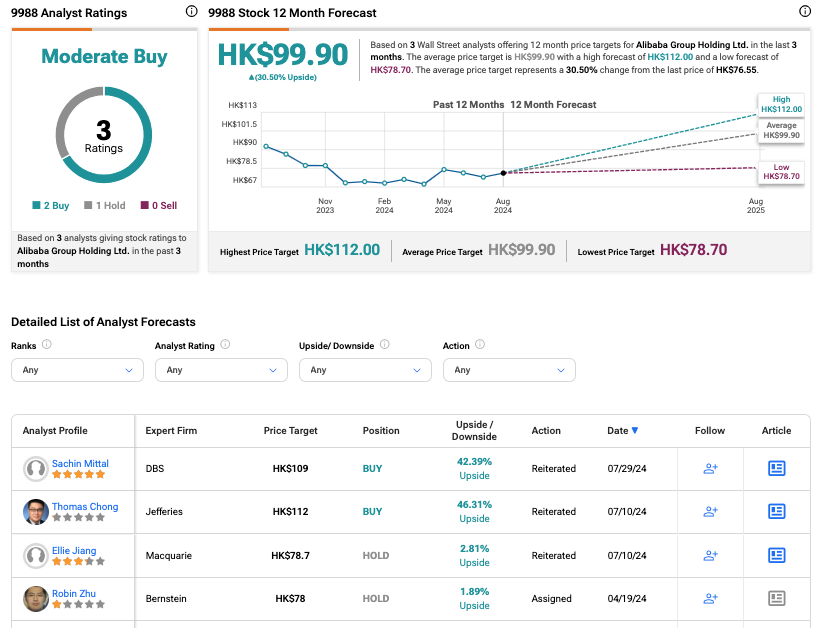

Investor sentiment remains buoyant regarding the future prospects of Alibaba Group Holding Limited, listed on the Hong Kong Stock Exchange as HK:9988. Analysts foresee a continual upward trajectory for this tech behemoth. In July, Alibaba’s stock garnered three noteworthy recommendations, notably two Buy ratings from financial heavyweights DBS and Jefferies. The analyst community exudes positivity towards the stock, lauding its formidable standing in the e-commerce sphere and multifaceted business model.

Alibaba, a Chinese technology titan celebrated for its expansive online marketplace, has significantly diversified its offerings over the years. Beyond e-commerce, the conglomerate now boasts a robust presence in cloud computing, digital entertainment, logistics, and financial services.

Let’s delve into these recent ratings and delve into the insights proffered by analysts on the trajectory of Alibaba’s stock.

DBS Upbeat on Alibaba’s Future Potential

In a recent development, DBS analyst Sachin Mittal reiterated a Buy rating, projecting an impressive upside potential of 42.4%. DBS envisions a Compound Annual Growth Rate (CAGR) of 5% from Fiscal Year 2024 to Fiscal Year 2027 for Alibaba’s primary marketplaces, Taobao, and Tmall.

During the fourth quarter of Fiscal Year 2024, Alibaba’s Taobao and Tmall segments witnessed a moderate 4% year-on-year revenue uptick to ¥93.2 billion. Notwithstanding this growth, the company faces mounting competition in the e-commerce domain from rivals like PDD Holdings (PDD), owners of platforms like Pinduoduo and Temu.

Moreover, DBS expresses a sanguine outlook for Alibaba’s cloud computing division. The financial institution anticipates a consistent 6% yearly growth in the Cloud sector, driven by burgeoning demand for public cloud services and AI-driven products.

Mittal also underscored Alibaba’s Customer Management Revenue (CMR) as a pivotal factor influencing the stock price, foreseeing a gradual rebound in CMR during Fiscal Year 2025 attributable to heightened merchant engagement and escalating consumer demand.

Alibaba is slated to unveil its first-quarter results for Fiscal Year 2025 on August 15. Despite potential short-term challenges posed by cut-throat competition and a decelerating Chinese economy, analysts remain bullish on the enduring promise of Alibaba’s shares.

Other Notable Analyst Ratings

Thomas Chong, an analyst at Jefferies, also maintained a Buy rating on the stock, envisaging a substantial 46.3% upside.

Conversely, Macquarie analyst Ellie Jiang reiterated a Hold rating, forecasting a modest 2.8% upside for Alibaba’s stock.

Is Now the Right Time to Invest in Alibaba Stock?

As per TipRanks, the 9988 stock has garnered a Moderate Buy rating based on two Buy and one Hold recommendations. The Alibaba share price target stands at HK$99.90, translating to a promising 30.5% potential upside from the existing trading price.

Year-to-date, Alibaba’s stock has surged by 4.2%.

For further insights into 9988 analyst ratings, click here.