As Amazon’s (NASDAQ: AMZN) stock hovers at an inflection point, a notable shift in strategy under CEO Andy Jassy’s leadership from founder Jeff Bezos has sparked profound changes. The company now prioritizes profitability and cloud computing, marking a significant transformation for the tech juggernaut.

What was once a landscape of reckless expansion has now evolved into a realm of accelerated growth and unprecedented profitability. Despite the current market’s oversight, Amazon finds itself on the brink of a generational shift, inviting keen investors to seize the opportunity before it becomes mainstream knowledge.

The Multifaceted Success of Amazon’s Operations

While Amazon’s e-commerce store remains a cornerstone of its operation, it serves merely as the tip of the iceberg. Investors stand to gain substantial insights by shifting focus to the peripheral businesses thriving in Amazon’s ecosystem.

Among these subsectors, the third-party seller services emerge as a standout player. By empowering external sellers to utilize Amazon’s platform, propelling them with access to Amazon’s distribution network and swift delivery services, Amazon navigates a profitable route. By edging sellers to shoulder inventory risks and align with consumer demands, Amazon not only fosters efficient commerce but also fosters collaboration with smaller enterprises, fortifying its position against potential antitrust scrutiny.

Also in the spotlight is Amazon’s advertising arm, the fastest-growing segment in recent times. From premium search placements to featured product advertisements on Prime Video, this division has become a revenue powerhouse.

However, the crown jewel remains Amazon Web Services (AWS), the groundbreaking cloud computing division. Initially pioneering the cloud services domain, AWS witnessed a surge in rivals like Microsoft’s Azure and Alphabet’s Google Cloud capturing market share. Although facing stiffer competition, AWS’ revenue upsurge by 17% in the first quarter signals a renaissance in this crucial segment.

Valuation and Growth Dynamics

Amazon’s financial disclosure categories—North American, International, and AWS—offer a glimpse into the company’s robust performance across the board. The numbers speak for themselves, illustrating Amazon’s thriving trajectory.

| Segment | Revenue | YOY Revenue Growth | Operating Income | YOY Operating Income Growth |

|---|---|---|---|---|

| North American | $86.3 billion | 12% | $5 billion | 455% |

| International | $31.9 billion | 10% | $903 million | N/A |

| AWS | $25 billion | 17% | $9.4 billion | 84% |

Data source: Amazon. YOY = Year over year. Note: International was unprofitable last year.

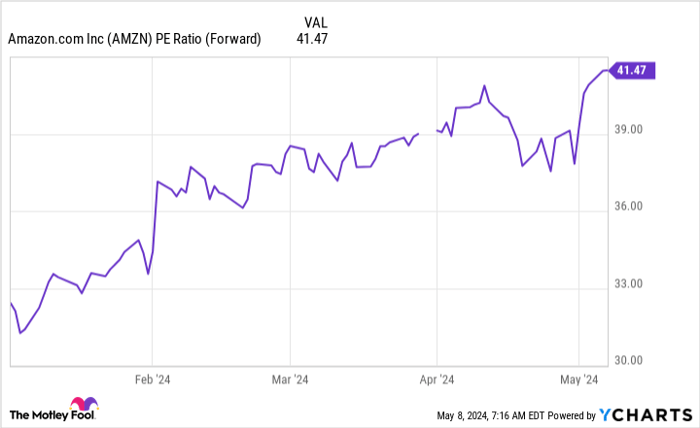

Although Amazon’s stock may seem pricey, its robust growth substantiates the valuation. With all three segments churning profits at admirable rates, Amazon emerges as a promising growth stock. However, prospective investors need to brace for a premium valuation, with Amazon trading at more than 40 times earnings.

The forward price-to-earnings ratio, although skewed by Amazon’s burgeoning profitability and enduring growth prospects, warrants a cautious evaluation before diving into Amazon stock.

The bedrock of Amazon’s current fortune lies in the escalating profitability across its various business arms. This upsurge in profits outpacing revenue growth promises to normalize the stock’s valuation in forthcoming quarters, urging investors to position themselves strategically for potential upsides.

Unlocking the Potential: Should You Invest in Amazon?

Prior to embarking on an Amazon investment journey, pause and ponder:

The Motley Fool Stock Advisor research team recently unveiled their top picks for investors, projecting monumental returns from ten select stocks—Amazon notably absent from the list. These highlighted gems carry the potential to yield extraordinary gains over the coming years.

Reflect on the transformative power of investments, akin to Nvidia’s ascension when it graced the list on April 15, 2005. A mere $1,000 allocation at that juncture would have blossomed into a staggering $543,758 return!*

Stock Advisor facilitates a roadmap to success, offering a blueprint for portfolio construction, insights from seasoned analysts, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 index fourfold.*

*Stock Advisor returns as of May 6, 2024