Advanced Micro Devices (AMD) shares have surged by 10%, outpacing the Computer & Technology sector’s return of 9.7%.

The stellar performance of AMD’s Data Center segment has been a key driver of this growth. In the second quarter of 2024, Data Center revenues saw a remarkable 114.5% year-over-year increase, reaching $2.83 billion and representing nearly half of the total revenues. Moreover, Sequentially, revenues climbed by 21%.

As of the end of the second quarter in 2024, AMD had over 900 public cloud instances available, with major players like Netflix and Uber opting for fourth-gen EPYC public cloud instances. In the domain of data center AI, quarterly revenues from the MI300 surpassed $1 billion for the first time.

The pipeline of Enterprise and Cloud AI customers remains strong, with AMD collaborating with industry giants such as Microsoft, Oracle, DELL, HPE, Lenovo, and Supermicro.

AMD Stock Outperforms Sector

AMD’s strategic acquisitions are aimed at narrowing the technological gap with NVIDIA in the competitive AI landscape. The company has been on an acquisition spree to bolster its AI ecosystem.

Over the past year, AMD has allocated $125 million towards a series of acquisitions, including Nod.ai and Mipsology. Notably, the recent acquisition of Helsinki-based Silo AI and the impending acquisition of ZT Systems for approximately $4.9 billion in cash and stock are pivotal moves for AMD’s data center AI initiatives.

AMD Stock Rides on Strong Data Center Demand

Both AMD and NVIDIA have garnered significant investor interest, driven by the surge in AI applications that necessitate GPU chips. The outlook for the AI segment remains robust, with heightened investments from major cloud computing providers like Microsoft and Alphabet.

AMD’s product expansion efforts position it well to challenge NVIDIA in both the data center and consumer PC markets. New offerings such as the Instinct MI325X accelerator and Ryzen AI processors are expanding AMD’s presence in the data center domain.

AMD’s Estimate Revision Shows Upward Trend

In the third quarter of 2024, AMD anticipates revenues of $6.7 billion (+/- $300 million), reflecting a robust 16% year-over-year growth rate and a substantial 15% sequential increase.

Analysts project the third-quarter 2024 revenues at $6.71 billion, showcasing a 15.71% year-over-year growth. Earnings estimates stand at 91 cents per share, indicating a 30% year-over-year rise.

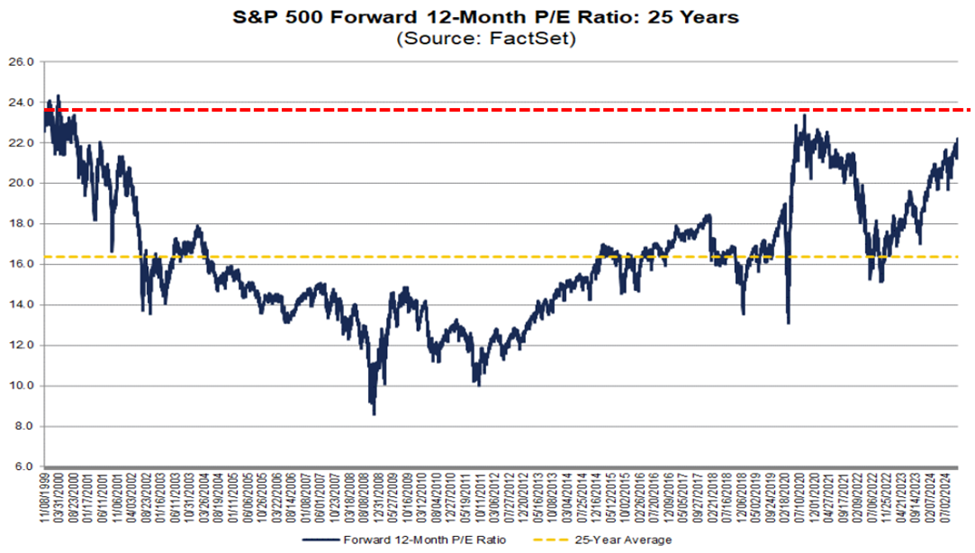

AMD Stock Overvalued

Despite its strong performance, AMD stock appears overvalued, with a Value Score of F suggesting stretched valuation levels.

The stock is trading at a premium with a forward 12-month Price/Sales ratio of 7.98X, compared to the sector’s 6.23X.

Conclusion

AMD’s strategic acquisitions, particularly Silo AI and ZT Systems, are expected to drive its revenue growth. While investors holding the stock may benefit from the company’s long-term prospects, short-term outlook remains muted due to challenges in the Gaming segment and intense competition from NVIDIA.

With a Growth Style Score of D and a Zacks Rank #3 (Hold), caution is advised, and it may be prudent to wait for a more favorable entry point into the stock.