Sinking Stocks and Social Media Buzz

Advanced Micro Devices, known as AMD, witnessed a dip in its stock year-to-date following a downturn on Wednesday, coinciding with the scrutiny of earnings reports from Tesla Inc and Alphabet.

CEO Meeting with Tesla

AMD CEO Lisa Su has recently met with Tesla, as evident from photos shared on social media platforms. Su’s visit to Tesla was marked by discussions on topics like artificial intelligence and leadership.

Su, who seemed to be a speaker at the event, shared insights from the gathering with Tesla, shining a light on collaboration between the two entities. The historical ties between AMD and Tesla are underscored by the former listing the electric vehicle giant as a partner on its website.

Strategic Collaborations and Technological Advancements

AMD’s partnership with Tesla extends to the integration of AMD Ryzen Embedded APU and RDNA2 based GPU in Tesla’s Model S and Model X vehicles, enhancing the infotainment experience.

Although Su’s appearance at the Tesla event may primarily revolve around thought leadership, it hints at potential future partnerships between the companies, reaffirming the existing ties.

Impact on Semiconductor Sector

The automotive industry represents a significant growth opportunity for semiconductor companies, with players like Qualcomm Inc witnessing robust year-over-year growth. While AMD doesn’t disclose specific automotive revenue figures, its investments in the automotive sector are indicative of its commitment to this segment.

Earlier comments by Tesla CEO Elon Musk about procuring chips from AMD for AI initiatives accentuate the importance of semiconductor companies in driving innovation within the automotive realm.

Stock Performance and Future Projections

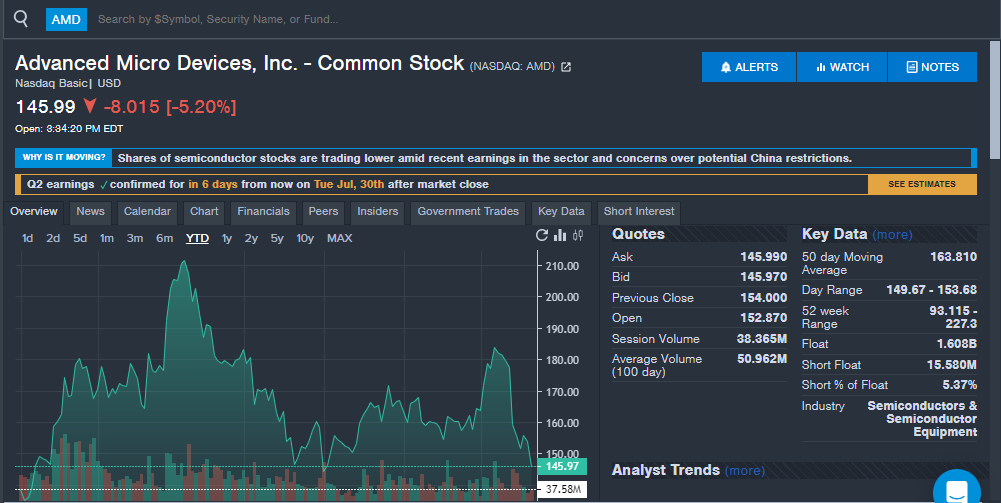

AMD shares concluded Wednesday with a 6.08% decrease, marking a shift in its year-to-date trajectory. Despite a 30% increase in the last year, the stock is now down 1.5% in 2024, reflecting evolving market dynamics.

The upcoming second-quarter results announcement slated for July 30 may shed further light on AMD’s financial performance. Analysts anticipate revenue of $5.73 billion and earnings per share of 68 cents, showcasing growth compared to the previous year.