The Rise of AI Technologies

The surge in artificial intelligence (AI) technologies has captivated investors since 2023, with ChatGPT’s mainstream launch heralding a new era of possibility. The AI market, projected to hit nearly $2 trillion by the end of the decade, has sparked a race among companies to dominate the field, driving up demand for high-end semiconductor chips like GPUs.

Current Market Performance

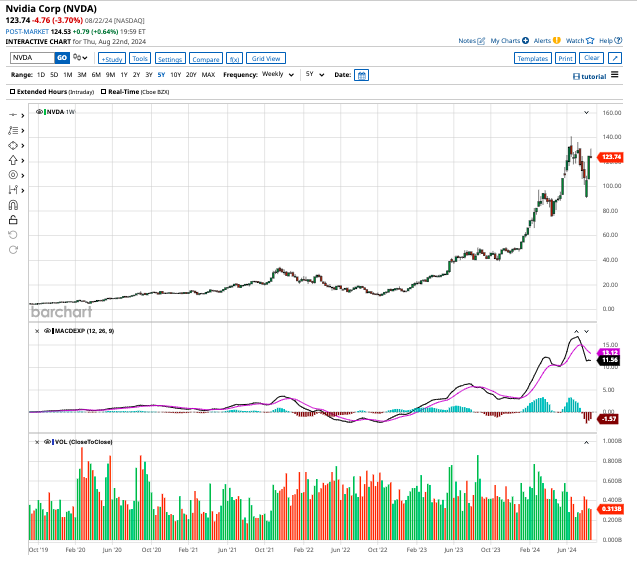

Nvidia has asserted its dominance in the AI chip market, boasting a staggering 90% market share that has propelled the stock to over 650% gain in the last two years. In contrast, AMD has seen a more modest 67.5% return in the same period.

With these performances in mind, investors are left to ponder which AI-based chip stock presents a better buying opportunity at current price levels.

The Strategic Move by AMD

Advanced Micro Devices recently unveiled its plan to acquire ZT Systems, a server company, for $4.9 billion in a bid to bolster its AI chip portfolio. This acquisition, funded mostly in cash, positions AMD to meet the escalating demand for powerful server systems that fuel AI platforms.

By leveraging ZT Systems’ $10 billion annual sales, AMD is poised to enhance its GPU rollout, cater to tech giants like Microsoft, and drive revenue growth significantly.

Analysts predict a sales surge for AMD in the coming years, with estimates indicating an increase to $22.95 billion in 2024 and $29.5 billion in 2025. Despite the optimistic outlook, the stock’s forward earnings valuation at 49.7 times paints a pricey picture.

Assessing Nvidia’s Position

Although Nvidia briefly held the title of the largest company by market cap, its stock trajectory saw a setback following reported delays in shipping its Blackwell chips. Despite this hiccup, Nvidia’s robust revenue growth driven by surging GPU demand has bolstered its financial performance.

Wall Street projects exponential growth for Nvidia, with sales forecasted to skyrocket from $55.7 billion in 2024 to $150.6 billion in 2026. Likewise, earnings are anticipated to see substantial improvement over the same period.

Investor sentiment remains largely optimistic on Nvidia, with analysts predominantly endorsing the stock. The average price target for NVDA suggests a potential upside of 9.5% from current levels.

Deciding Between the Titans

As Nvidia looks set to dominate the data center sales space, with an estimated $106 billion in revenue this year, compared to AMD’s more modest $4.5 billion AI chip sales projection, investors face a tough decision. Both stocks trade below consensus price targets, offering potential value.

In the battle of AMD vs. Nvidia, the nod seems to go towards Nvidia. Its leadership in the GPU market, rapid growth trajectory, and relatively lower valuation make it a compelling choice for investors eyeing the AI semiconductor sector.