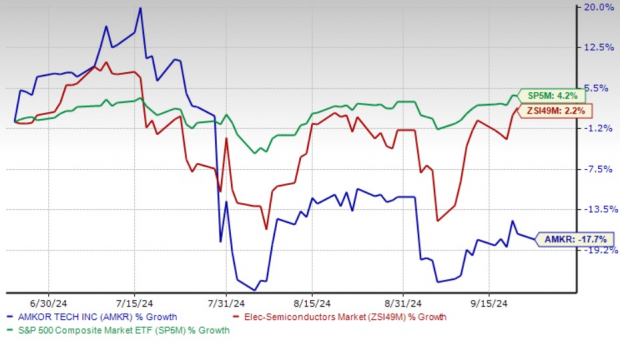

In the technological stock maelstrom, Amkor Technology (AMKR) has faced a tempestuous journey lately. Over the past three tumultuous months, its share value has plummeted by a staggering 17.7%. A sharp contrast to the soaring success stories of the Zacks Electronics – Semiconductors industry and the S&P 500 index, which recorded returns of 2.2% and 4.2% respectively over the same period. An unsightly underperformance that has inevitably rattled investors and forecasters alike within financial circles.

The Storm Clouds Hovering Over Amkor

Amkor’s challenges do not reside in an isolated vacuum but are deeply interconnected with global volatility and internal woes. Political frictions have resulted in severe supply chain disruptions, exacerbating the existing macroeconomic quagmire. Factors such as soaring inflation rates and interest rates have placed significant strains on the company’s operations, leaving it navigating financial turbulences.

The resurgence of Amkor’s automotive and industrial sectors has been disappointingly sluggish, mirroring the lackluster demand from traditional data center clients. Moreover, multiple factories are functioning below optimum capacity, impeding the revenue streams and hindering the company’s growth trajectory.

Facing the Giants in the OSAT Arena

Amidst the chaos, Amkor is engaged in a fierce battle within the outsourced semiconductor packaging and test services (OSAT) market. Standing tall as a formidable player, the company’s reputation for cutting-edge packaging and test technologies is undisputed. With a global presence spanning across Asia and Europe, Amkor has fostered crucial alliances with industry behemoths such as Apple, Qualcomm, Intel, Broadcomm, and AMD, among others.

However, the road ahead is laden with formidable challengers. Competitors like Taiwan Semiconductor Manufacturing Company (TSM) and ASE Technology Holding (ASX) loom large on the horizon, posing a substantial threat to Amkor’s market supremacy. Both TSM and ASX are industry stalwarts equipped with advanced fabrication facilities, creating a competitive landscape that Amkor must navigate skillfully to secure its foothold.

The Future Forecast for Amkor

As the dust settles, Amkor braces itself for the upcoming quarter with a projected revenue range of $1.785-$1.885 billion. A pivotal moment where the company’s performance will be scrutinized against the Zacks Consensus Estimate of $1.84 billion. Looking further ahead, fiscal 2024 revenues are estimated to reach $6.51 billion, signaling a marginal improvement of 0.15% year over year.

In Closing

Amkor Technology finds itself at a crossroads, beset by formidable challenges ranging from macroeconomic headwinds to intense competition and tepid market growth. Currently clinging onto a Zacks Rank #5 (Strong Sell) recommendation, Amkor seems to be stuck in turbulent waters. As the storm clouds gather ominously overhead, perhaps it is time for investors to consider setting sail to calmer horizons.