If you believe its hype, artificial intelligence (AI) is one of the most profound advances in technology ever. This may be hyperbole — time will tell — but it’s clear already that the technology has commercial power. Its impact in the market has been enormous, with its champion, Nvidia, joining Apple and Microsoft as among the biggest companies in the world.

Nvidia’s rise led to the company splitting its stock 10-for-1, opening the door to more investors who were priced out. Now another company working in AI is splitting its stock, too. Broadcom, which designs, manufactures, and sells hardware and network infrastructure that allows AI programs to run, will split its stock later this summer.

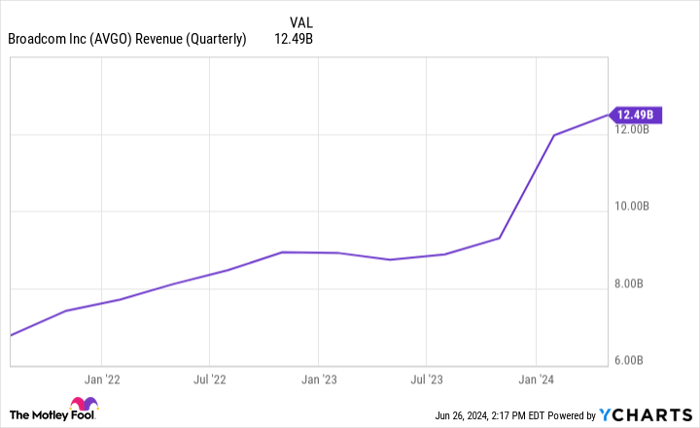

Assessing Broadcom’s Revenue Growth Post Acquisition

Broadcom is in growth mode, having raised Q1 revenue by 34% from the year before and Q2 revenue by 43% from Q2 2023.

Notice the massive recent increase? That late-2023 inflection point is important. This growth isn’t really organic — much of it is coming from an acquisition. The company bought VMware, a highly successful cloud software company, in November 2023 for $69 billion, adding its revenue to Broadcom’s.

Valuation & Future Earnings Outlook

12% organic growth reflects Broadcom’s growing AI-focused business. Communication within the AI server farms that power platforms like ChatGPT is a crucial aspect and is where Broadcom shines. Its PCIe and Ethernet technology is some of the best on the market.

Hock Tan, Broadcom president and CEO, stated in the company’s latest earnings release that “revenue from our AI products was a record $3.1 billion during the quarter.” The combo of a growing AI business and a solid acquisition means that the company expects to continue delivering record revenues.

Broadcom vs. Nvidia: A Comparative Analysis

Broadcom’s growth prospects, while promising, just aren’t comparable to Nvidia’s. Nvidia is growing revenue at a pace that far outstrips Broadcom and doing it organically, not relying on costly acquisitions.

Aside from the numbers, Nvidia demonstrated immense vision as a pioneer in AI. While difficult to quantify, visionary leadership is a factor that can’t be underestimated. As the industry matures and competition heats up, Nvidia’s leadership may help it maintain its top position.

At the end of the day, however, Broadcom is still a good investment with a solid track record and optimistic prospects. Is it the next Nvidia? I don’t think so, but it doesn’t need to be.

Final Considerations: Investment in Broadcom

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.