Somewhere between the lines of Apple’s (AAPL) latest quarterly results lies a tale of promise and potential. While the masses eagerly await the unveiling of Apple Intelligence and the heralded iPhone 16, there are other undercurrents at play. Updates on Apple Vision Pro and forthcoming spatial content may well hold the key to unlocking momentum sooner than expected. Despite the stock’s relatively modest post-earnings performance, there is ample reason for optimism in the Cupertino giant’s trajectory.

Apple Steady Following Impressive Third Quarter

Apple’s third-quarter performance, while not strikingly surprising, outstripped expectations. Revenue saw a 5% uptick year-over-year, with earnings per share settling comfortably above estimates at $1.40 compared to the projected $1.34. Notably, iPhone sales maintained a robust position at $39.2 billion. The tech giant is on the precipice of a potentially groundbreaking iPhone supercycle, with Apple Intelligence poised to redefine the landscape.

Despite the imminent integration of Apple Intelligence into the iPhone 15 Pro, excitement swirls around the next iteration. Anticipation for the next-gen A-series chip and prospective design overhauls is palpable among consumers. Speculations of an AI-driven iPhone supercycle have been fuelled by bullish narratives, echoing the excitement that precedes a watershed moment in tech evolution.

While CEO Tim Cook’s enthusiasm for Apple Intelligence shone through during the earnings call, recent delays haven’t dampened spirits. Drawing a comparison to Google’s AI misstep with Gemini, Apple’s meticulous approach to innovation is commendable. In a field rife with launch pitfalls, Apple’s cautious strides could prove more valuable in the long run.

Despite a marginal 0.7% post-earnings uptick in AAPL stock, the true potential of Apple Intelligence may have eluded many amid the quarterly disclosure. The conference call, however, hinted at nuanced insights that could shape the company’s transformative narrative.

Positive Outlook on Apple Vision Pro

While Vision Pro’s current revenue contribution may be nominal, its developmental trajectory merits attention for long-term stakeholders. Apple’s foray into mixed reality garnered initial fanfare but subsequently waned in enthusiasm. Insights shared during the Q3 2024 call shed light on promising advancements that could fortify Apple’s long-term standing.

Tim Cook highlighted the international expansion of Vision Pro, upgrades in visionOS 2 enhancing workspace personalization and entertainment immersion, and an enticing lineup of Vision Pro-exclusive content. The key lies in content aggregation – a critical linchpin in driving customer engagement for Apple TV+ subscriptions and Vision Pro adoption.

Apple’s recent pledge to introduce 150 3D films and series to Vision Pro, alongside immersive concert experiences and NBA content, signals a concerted push towards enhancing user engagement. As Apple delves deeper into spatial content curation, potential Hollywood collaborations may well cast the company as a metaverse and AI powerhouse.

While Apple Intelligence and the allure of an iPhone supercycle have underpinned recent stock movements, Vision Pro emerges as a wildcard with the potential to validate the stock’s forward P/E multiple of 29.90.

Analyst Perspectives on AAPL Stock

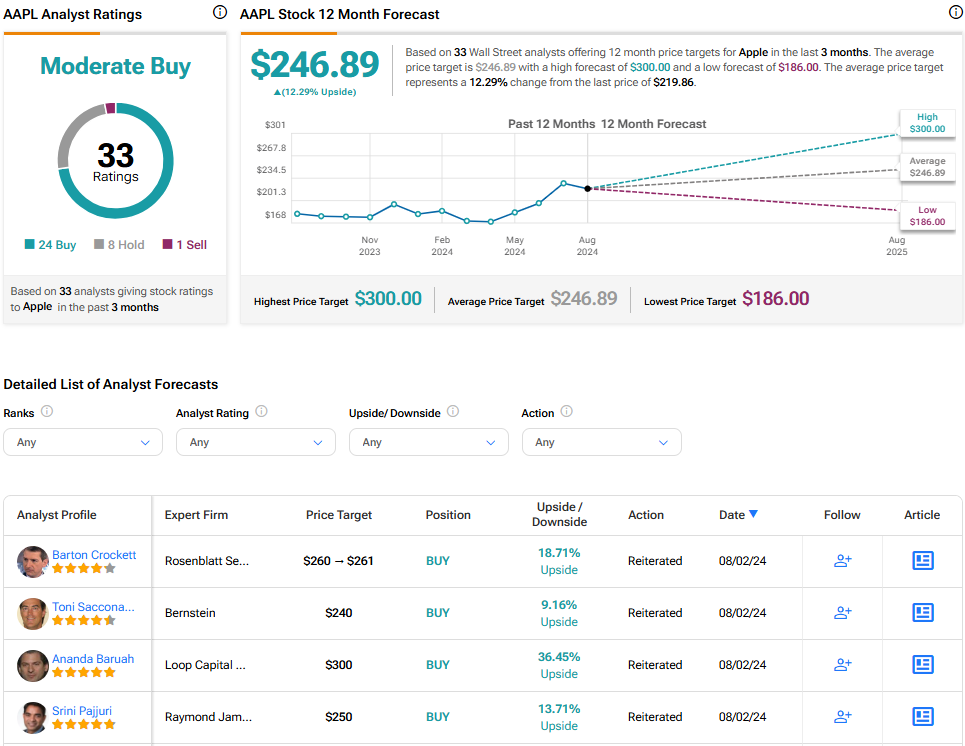

Analysts view AAPL stock as a Moderate Buy on TipRanks, with 24 Buy ratings, eight Holds, and one Sell recommendation. The average price target for AAPL stock stands at $246.89, projecting a 12.3% upside potential. Price targets range from $180.00 to $300.00, reflecting a spectrum of opinions within the financial community.

Explore more AAPL analyst ratings

Concluding Thoughts on Apple

Apple’s Q3 showing was commendable, yet failed to spark a significant market reaction. Against a backdrop of sectoral headwinds, AAPL stock could present an enticing investment opportunity post-earnings. The impending debut of iPhone 16 and Apple Intelligence looms large, but it’s the overlooked Vision Pro content pipeline that might hold the ace. As tech corrections loom ahead in August, Apple’s stock appears tantalizingly poised for a potential upswing.