The recent buzz surrounding Apple stock, ticker symbol AAPL, is not for the faint-hearted investor. An uptick in trading volume for out-of-the-money (OTM) put options, set to close this Friday, has caught the attention of market participants today. While this surge may be attributed to mixed sentiments, one thing remains certain – Apple stock is still navigating turbulent waters, albeit from a seemingly undervalued standpoint.

Apple Stock: The Undervalued Gem

Over the past month, AAPL shares have soared a jaw-dropping 32% since settling at $165.00 on April 19. This upward trajectory commenced after the company unveiled its quarterly results on May 2. As highlighted in a recent Barchart article, Apple’s robust free cash flow (FCF), FCF margins, and strategic stock buybacks argue for a stock price of at least $241.38 per share. Despite the recent rally, the market sentiment suggests potential upside in the near future.

Investors seem to breathe a sigh of relief as Apple hints at revamping its product lineup with the incorporation of AI capabilities.

The Surge in Put Options Volume

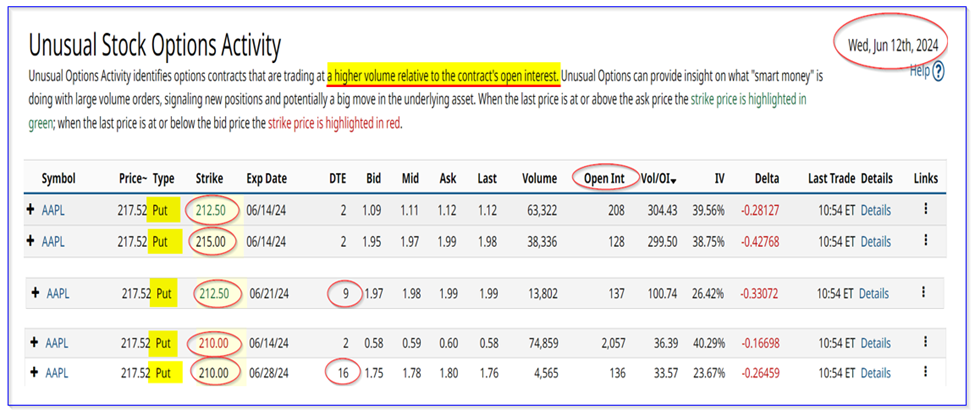

Today’s flurry of put options activity, as evidenced in the Barchart Unusual Stock Options Report for Wednesday, June 12, raises eyebrows. Five significant put options tranches, all expiring this Friday, with strike prices below the current stock price, paint a vivid picture of market expectations.

The top basket of put options activity centers around the $212.50 strike price put expiring on Friday. Priced $5 below today’s $217.52, it rests at 2.29% OTM. These movements hint at a diverse array of sentiments in the market – from bearish views anticipating a stock plunge to short seller tactics aiming to capitalize on the status quo.

Leveraging Puts for Profit

The short seller’s game is a precarious yet lucrative one, evident in the $212.50 strike put scenario. With a coveted premium of $1.11, the short seller can harvest a 0.52% yield in just two days until expiration. This affords protection for a downside, offering a breakeven price of $211.39, ensuring minimal risk amidst volatility.

Furthermore, the allure of options as decaying assets plays into the hands of smart investors. As put premiums dwindle towards Friday closure, short sellers are positioned to capitalize on the market’s fickleness.

On the flip side, put buyers might perceive Apple stock as having ramped up too hastily, hence turning to puts as a hedging mechanism. This two-sided anticipation reflects the multifaceted dynamics at play in the current AAPL stock landscape.

In the game of high stakes, Apple stock remains a tempting prospect. Today’s surge in put options volumes represents a renewed fervor in the AAPL stock forecast, beckoning both seasoned players and speculative observers alike. buckle up as the rollercoaster ride is far from over!