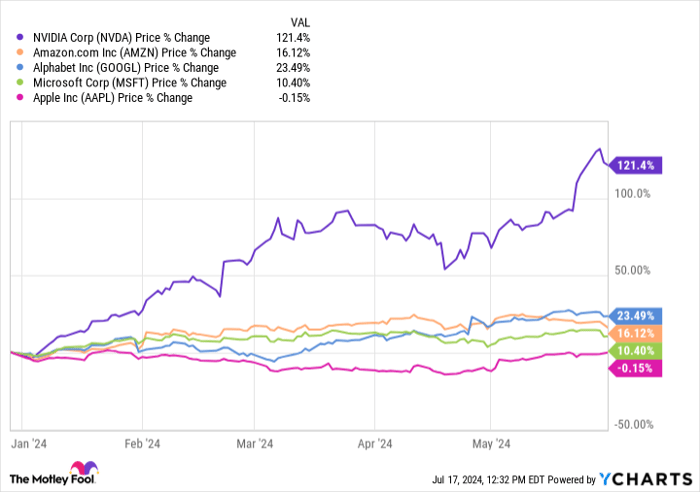

Shares in Apple (NASDAQ: AAPL) have surged 8% in the past month, reaching an all-time high of $237 per share in mid-July. Surpassing key players in artificial intelligence (AI) like Microsoft, Alphabet, and Nvidia, Apple’s recent growth marks a significant turnaround following a sluggish performance earlier this year.

This upward trajectory comes in the wake of Apple’s introduction of Apple Intelligence, a software update aimed at integrating AI features across its entire product range. While competition had previously outpaced Apple with AI advancements, the company’s strategic pivot on June 10 has set the stage for a resurgence.

The impending launch of its AI-focused iPhone in September has piqued investors’ interest, fueling optimism on Wall Street as Apple appears to be catching up in the AI race.

Apple Enters the AI Arena with Room for Growth

OpenAI’s ChatGPT release in late 2022 initiated an AI rally that has dominated the tech landscape, propelling the Nasdaq-100 Technology Sector index up by 31% over the past year. Noteworthy gains by tech giants such as Nvidia and Alphabet have upstaged Apple’s more gradual uptick in stock value, positioning the company for considerable expansion as it ramps up its AI initiatives.

By strategically restricting AI capabilities to its latest product range, Apple is set to entice consumers into upgrading to unlock Apple Intelligence features, setting the stage for a potential surge in demand with the upcoming iPhone 16 release.

Despite recent incremental growth, Apple’s shares present an enticing opportunity for investors, as the company gears up to leverage AI for sustained expansion.

Optimal Valuation Signals Favorable Outlook for Apple

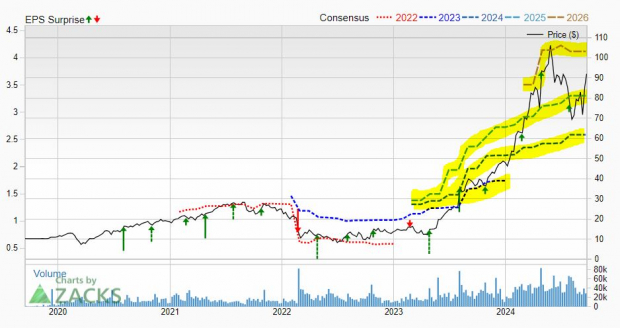

An analysis of Apple’s price/earnings-to-growth (PEG) ratio reveals a 98% drop over the past year, currently standing at approximately 4. This reduction indicates that while Apple’s stock price has climbed, its intrinsic value has appreciated, reflecting an attractive buying position for investors.

In conjunction with its AI endeavors, Apple’s flourishing services segment, anchored by revenue from the App Store and subscription-based services like Apple TV+ and Music, promises further growth potential. The segment outstripped all other divisions in growth in the second quarter of 2024, boasting a profit margin double that of Apple’s product sales.

With a resurgence in sight, Apple’s stock presents a compelling investment opportunity for those eyeing long-term growth.

Considerations for Prospective Apple Investors

While Apple’s recent surge has sparked interest, prudent investors should weigh all factors before diving in. A thorough evaluation of potential returns and market dynamics is crucial to informed decision-making. And remember, not all top stocks are created equal; seeking expert advice and diversifying your portfolio can help maximize returns over time.

With historical examples like Nvidia‘s meteoric rise following expert recommendations, the adage “knowledge is power” holds true in the fast-paced world of investments. And the Motley Fool Stock Advisor offers a wealth of insights and guidance to optimize your investment strategy for future success.

*Stock Advisor returns as of July 15, 2024