In the realm of tech giants, where innovation is a prized currency, Apple (NASDAQ: AAPL) finds itself recalibrating its trajectory. The highly anticipated Vision Pro, purportedly a game-changer in the realm of spatial computing, hasn’t yielded the market response expected. Instead of riding high on investor optimism, Apple faces regulatory hurdles reminiscent of its industry behemoths.

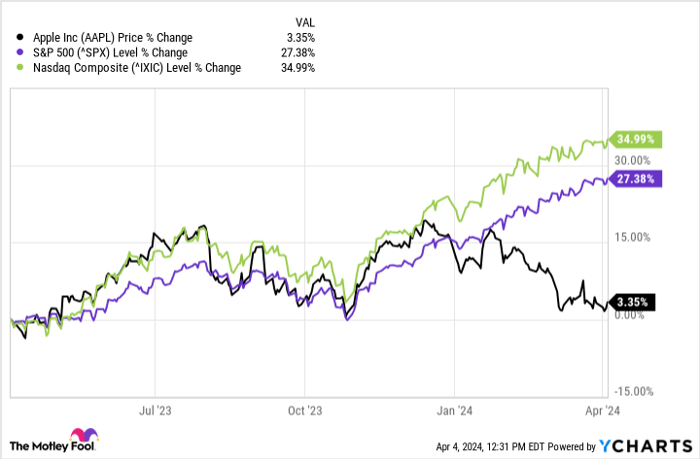

The European Commission’s hefty $2 billion fine and ongoing antitrust probes have cast a shadow over Apple. With financial performance trailing market benchmarks in the past year, the spotlight shifts to the tech titan’s strategic maneuvers in response to evolving challenges.

The Unveiling of a Strategic Shift

One area Apple is maneuvering in is research and development (R&D). A realm known for its secrecy was the recent focus of scrutiny as Apple began scaling down undisclosed expenses. This shift closely mirrors a surprising trend observed in tech peer Meta Platforms (NASDAQ: META), which has uncharacteristically provided transparent insights into its R&D operations.

Leaked internal communications signal the termination of two significant R&D ventures at Apple. The long-hyped Project Titan, a venture into self-driving electric cars, and sustained work on microLED technology stand among the casualties of this strategic pivot.

While the fate of Apple’s 5G modem endeavor remains ambiguous, recent multiyear agreements concerning 5G chip supply underscore a potential sunset for this project as well.

Navigating Financial Efficiency

Apple’s expenditure patterns offer a glimpse into its strategic evolution. After a prolonged period of ascending R&D investments post-iPhone era, a paradigm shift towards fiscal prudence appears to be underway. Contrary to Apple’s trajectory, Meta has embraced operational efficiency under CEO Mark Zuckerberg’s leadership, although R&D outlay continues to climb.

In contrast to Apple’s discreet approach, Meta’s strategic clarity is reinforced by renaming its core identity in 2021. The pivot from Facebook to Meta underscored the significance of Reality Labs (RL) in its financial framework. With substantial R&D disbursements, particularly in VR technology, Meta’s operational landscape pivots around a blend of data centers, AI, and hardware technology such as Nvidia.

Apple’s strategic realignment hints at a renewed focus on profitability. The decision to curtail certain expenditures in favor of bolstering profit margins signifies a pivotal juncture in the tech giant’s trajectory, possibly paving the way for forthcoming developments under CEO Tim Cook’s stewardship.

Focusing on Apple’s Resilience

As conjecture abounds regarding Apple’s venture reallocations, Meta’s transparent disclosures offer a contrasting narrative. The confluence of cost optimization and product diversification heralds a new chapter for Apple, echoing a narrative of adaptive resilience amid a dynamic market landscape.

Examining Apple’s robust history of innovative leaps and successful product commercialization underscores the strategic possibilities arising from redirected R&D investments. With a staggering Return on Invested Capital (ROIC) exceeding 50%, Apple’s track record of innovation underpins investor optimism for potential future growth avenues.

While historical success is no guarantee of perpetual prosperity, Apple’s expansive global user base positions it favorably for unveiling innovative products and services. The unfolding landscape of 2024 casts Apple’s strategic recalibration against the backdrop of traditional earnings growth, reminiscent of Meta’s revival in recent years.

Strategic Considerations for Investors

For prospective investors contemplating Apple’s trajectory, fundamental considerations emerge. Beyond the regulatory intricacies and operational shifts unfolding, assessments of Apple’s future pivot points demand attention. An assessment of the tech landscape underscores the importance of strategic resilience and operational agility in navigating evolving market dynamics.

As Apple charts a new course and Meta’s resurgence plays out, astute investors weigh these strategic nuances in a landscape of evolving technological frontiers.