Apple’s AAPL fourth-quarter fiscal 2024 results, to be reported on Oct. 31, are expected to bear the brunt of a sluggish PC market. However, steady growth in the Services business is expected to offset this headwind.

The PC segment declined in the third quarter of calendar 2024. Per IDC’s latest report, 68.8 million PCs were shipped, down 2.4% from the year-ago period. In contrast, Gartner estimates shipment of 62.997 million units, down 1.3% year over year.

In IDC’s list, Apple is the worst-performing PC vendor, with Mac shipments declining a whopping 24.2% year over year. However, Gartner estimates Mac shipments to increase 3.5% year over year, trailing only Acer Group.

Click here to learn how Apple’s overall fiscal fourth-quarter earnings results are likely to be.

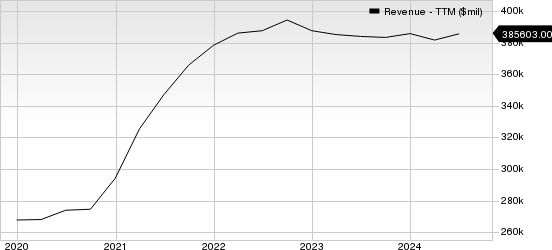

Apple Inc. Revenue (TTM)

Apple Inc. revenue-ttm | Apple Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Apple & Traditional PC-Makers Suffer From Weak Demand

Shipments of traditional PC makers like Lenovo LNVGY, HP HPQ and Dell Technologies DELL remain weak.

IDC anticipates Lenovo and HP’s shipments to grow 3% and 0.4% year over year, respectively, while Dell’s is expected to decline 4%. IDC places ASUS at #1 position with 10% shipment growth.

Gartner puts Acer Group at #1 position with 4.4% shipment growth. While HP’s shipment is expected to grow 0.3%, Dell’s is expected to decline 3.9%.

The Zacks Consensus Estimate for fiscal fourth-quarter Mac net sales is pegged at $7.43 billion, suggesting 2.4% year-over-year decline.

Steady Services Growth to Aid Apple’s Top Line

Apple’s Services business is expected to benefit from increasing users of the App Store and growing viewership of Apple TV+. The growing adoption of Apple Music, Apple Arcade, Apple News+ and Apple Card has been noteworthy.

Although Apple’s business primarily revolves around its flagship iPhone, the Services portfolio has emerged as the company’s new cash cow. It accounted for 28.2% of sales in third-quarter fiscal 2024.

Apple had more than 1 billion paid subscribers across its Services portfolio at the end of the fiscal third quarter. This is expected to have increased in the to-be-reported quarter, thanks to the growing installed base of Apple’s devices, as well as the popularity of apps like Apple TV+.

The Zacks Consensus Estimate for fiscal fourth-quarter Services net sales is pegged at $25.759 billion, suggesting 15.4% year-over-year growth.

Apple’s iPad Sales to Increase Y/Y

iPad accounted for roughly 8.3% of fiscal third-quarter net sales. Strong demand for iPad Pro and launch of 11-inch and 13-inch iPad Air benefited sales, which increased 23.7% year over year to $7.16 billion. The momentum is expected to have continued in the to-be-reported quarter.

The Zacks Consensus Estimate for fiscal fourth-quarter iPad net sales is pegged at $6.984 billion, suggesting 8.4% year-over-year growth.

Zacks Rank

Apple currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Apple Inc. (AAPL) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY) : Free Stock Analysis Report