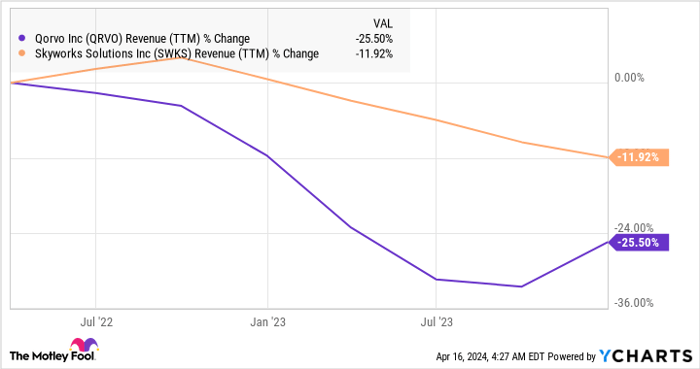

As semiconductor stocks bask in their 2023 success, achieving a notable 12% gain on the PHLX Semiconductor Sector index, a tale of two chipmakers emerges. While the market flourishes, Skyworks Solutions and Qorvo, known for their contributions to Apple, falter in 2024. Skyworks plunges nearly 11%, and Qorvo sags 2%.

The decline follows weak smartphone market performance, a core revenue source for both manufacturers. Despite the gloom, a silver lining looms on the horizon — artificial intelligence (AI). This burgeoning technology holds the promise of revitalizing these companies.

Boost from Rising Smartphone Sales

Global smartphone shipments endured an 11.3% slump in 2022 and a further 3% dip in 2023. Yet, fortunes shift as the market rebounds, with a robust 8% year-over-year growth noted in the first quarter of 2024 according to IDC. Surpassing expectations, smartphone shipments are projected to jump by 4% in 2024, hinting at imminent growth. Canalys forecasts an AI-infused smartphone surge, expecting a market share spike to 5% this year from a mere 1% in 2023.

This translates to an estimated 59 million AI smartphones in 2024 alone. Forecasts extend this trend, with AI-capable phones potentially dominating 45% of the global market by 2027. Notably, industry expert Samik Chatterjee predicts an AI-inspired smartphone upgrade cycle analogous to the 5G boom, a phenomenon that once fueled Skyworks’ and Qorvo’s robust performance.

AI Adoption and Future Growth

The intersection of AI and smartphones signals a winds of change, evident in Apple’s strategic acquisitions and rumored product enhancements. Reports suggest revolutionary AI applications in the upcoming iPhone, leveraging advanced neural engines and partnerships with tech giants like OpenAI and Google. With Apple being the primary patron for both Skyworks and Qorvo, the dawn of AI capabilities in iPhones could resonate with over 240 million users awaiting upgrades.

Furthermore, Skyworks and Qorvo’s foray isn’t confined to Apple alone. They cater to a broad spectrum of smartphone brands, including Samsung, Xiaomi, and Vivo. This diversification augurs well for these firms to exploit the burgeoning AI smartphone trend.

Potential Upsurge in Chips Stocks

Despite forecasted ordinary performance in the current fiscal year, a silver lining peeks through for Skyworks and Qorvo. Skyworks anticipates a revenue dip in fiscal 2024, rebounding with a 7.4% surge to $4.78 billion by fiscal 2025. Similarly, Qorvo projects a 10% revenue ascent in 2025, bolstered by a 27% earnings leap to $7.61 per share. Investors eyeing these chip stocks are presented with a bargain, with both companies trading at modest price-to-sales ratios and forward earnings multiples lower than the sector average.

Anticipating a bullish market in the wake of AI innovation, investing in Skyworks Solutions and Qorvo could bear fruitful returns as a revitalization looms on the horizon.

References

Chauhan, Harsh. “Artificial Intelligence (AI) Is Lifting the Smartphone Market.” The Motley Fool, 2024.