Insight Into Cannabis Credit Markets: A Surge Across Credit Spectrum

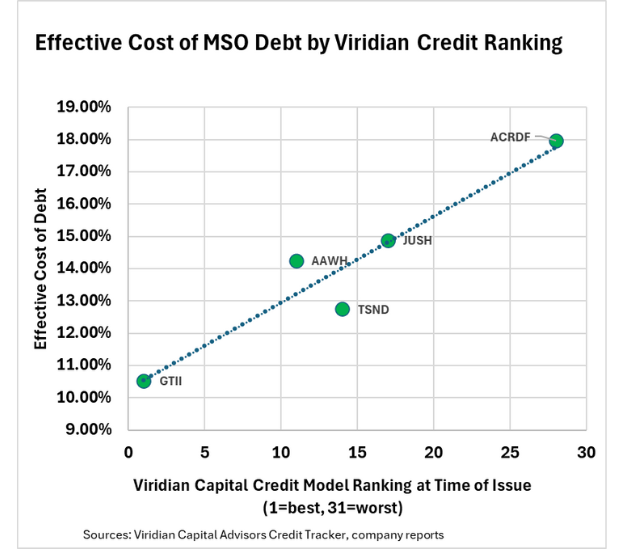

The Rise of Cannabis Debt The cannabis debt market is ablaze! The five recent issues showcased on the chart sizzled in the third quarter of 2024, collectively netting a whopping $632 million in proceeds. This fervor surpasses any quarter’s performance since the tail end of 2021, painting a vivid picture of the scorching hot nature ...