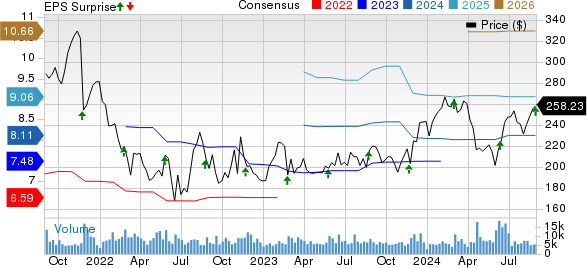

Autodesk ADSK recently revealed its second-quarter fiscal 2025 results, leaving investors pleasantly surprised with non-GAAP earnings per share soaring to $2.15. This impressive figure not only surpassed the Zacks Consensus Estimate by a notable 7.5% but also marked a robust 12.6% improvement over the previous year.

Revenue-wise, Autodesk reported a total of $1.5 billion, exceeding market expectations by 1.54%. The company demonstrated a commendable 11.9% year-over-year growth trajectory, characterized by a well-rounded performance across various products and regions in Architecture, Engineering, and Construction (AEC) and manufacturing sectors. However, challenges in the media and entertainment segment persisted due to the residual impact of the Hollywood strike.

Breaking Down the Numbers

In terms of revenue composition, Autodesk’s subscription revenues witnessed a healthy 10.9% year-over-year increase, accounting for 93.6% of total revenues at $1.4 billion. However, maintenance revenues saw a 21.4% decline from the previous year, settling at $11 million. Notably, other revenues climbed by an impressive 41% to reach $86 million during the quarter.

Recurring revenues dominated Autodesk’s revenue stream, contributing 97% to the overall second-quarter fiscal 2025 revenues. The company also maintained a healthy net revenue retention rate within the targeted range of 100-110%, driven by steady performance.

Region-wise, the Americas marked a revenue increase of 12.4%, reaching $662 million, closely followed by the Europe, Middle East, and Africa (EMEA) region with a 12.6% growth to $570 million. The Asia-Pacific region also showed promise, increasing its revenues by 9.2% to $273 million.

The quarter’s billings stood at $1.24 billion, reflecting a strong 13% surge year over year.

Product Portfolio Performance

Autodesk’s four core product families – Architecture, Engineering, and Construction; AutoCAD and AutoCAD LT; Manufacturing; and Media and Entertainment (M&E) – each contributed significantly to the company’s revenue streams. Notably, AEC, AutoCAD and AutoCAD LT, and Manufacturing posted impressive revenue growth rates of 13.7%, 6.9%, and 15.6%, respectively.

The company’s adaptability across diverse product segments underscores a strategic strength in catering to varied customer needs.

Financial Outlook and Growth Projections

Looking ahead, Autodesk’s fiscal 2025 guidance signals a promising trajectory, with revenue estimates ranging between $6.08 billion and $6.13 billion, indicating an approximate 11% growth momentum. Billings are projected to fall within the $5.88-$5.98 billion range, representing a robust 13-15% year-over-year increase.

Furthermore, the company anticipates non-GAAP earnings per share to hover around $8.18 to $8.31, with an expected strong operating margin between 35% and 36%. Free cash flow is also poised to register healthy figures within the $1.45-$1.5 billion band.

Autodesk’s optimistic outlook sets a tone of optimism and resilience in an ever-evolving market landscape, reassuring investors of the company’s steadfast growth trajectory.

Analyst Insights and Market Comparisons

Autodesk’s current Zacks Rank #3 (Hold) status reflects a balanced sentiment in the market, keeping investors attentive to the evolving landscape. While ADSK shares have shown a moderate 6.1% return year to date, other contenders in the Computer and Technology sector like Arista Networks, Badger Meter, and Audioeye stand out as strong picks, each boasting a Zacks Rank #1 (Strong Buy) at present.

These comparative insights provide investors with a broader perspective on market trends and potential opportunities, allowing for informed decision-making in a dynamic investment environment.