AutoZone Inc. (AZO) reported earnings of $36.69 per share for the third quarter of fiscal year 2024, showcasing a 7.5% increase compared to the previous year. The earnings exceeded the Zacks Consensus Estimate of $35.72 per share. Despite this triumph, net sales experienced a slight setback, growing 3.5% year over year to $4,235.5 million, falling short of the Zacks Consensus Estimate of $4,292 million.

In this quarter, domestic commercial sales rose from $1.11 billion to $1.14 billion in the year-over-year comparison. Meanwhile, the domestic same-store sales indicated a flat trend.

The gross profit surged to $2.26 billion from $2.14 billion in comparison to the previous year. Operating profit also witnessed an uplift, rising by 4.8% year over year to $900 million.

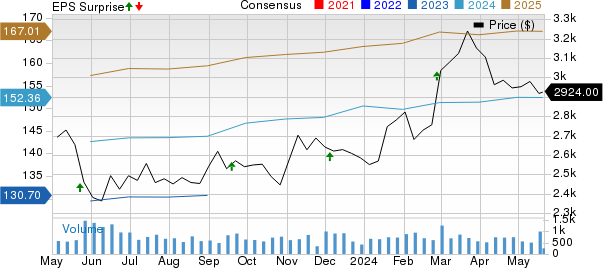

AutoZone, Inc. Price, Consensus and EPS Surprise

Throughout the quarter, AutoZone inaugurated 32 new stores in the United States, 12 in Mexico, and one in Brazil, leading to a total of 7,236 stores as of May 4, 2024. Simultaneously, inventory saw an 8% year-over-year increase, with each store’s inventory totaling $851,000, up from $810,000 a year ago.

Financials and Share Repurchases

As of May 4, 2024, AutoZone flaunted cash and cash equivalents of $275.4 million, down from $277.1 million since August 26, 2023. The company’s total debt stood at $8.5 billion as of May 4, 2024, contrasting with $7.67 billion as of August 26, 2023.

In a move indicative of confidence in the company’s performance, AutoZone repurchased 242,000 shares of its common stock for $737.7 million during the fiscal third quarter, averaging at $3,036 per share. The company still has $1.4 billion remaining under its current share repurchase authorization.

Zacks Rank & Key Picks

Presently holding a Zacks Rank #3 (Hold), AutoZone is joined by other notable players in the auto sector like Blue Bird Corp. (BLBD), Oshkosh Corp (OSK), and Ford (F).

The Zacks Consensus Estimate for BLBD predicts significant year-over-year growth, with fiscal 2024 earnings and sales showing a 155% and 17.3% increment, respectively. Blue Bird Corp currently boasts a Zacks Rank #1 (Strong Buy).

Oshkosh Corp, another contender, projects an 11% and 10% increase in earnings and sales for 2024, respectively. With a Zacks Rank #1, the company appears to be in a promising position. As for Ford, the Zacks Consensus Estimate anticipates a 3% growth in 2024 sales. With a Zacks Rank #2 (Buy), Ford is seen as a legacy automaker with a positive trajectory.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report