A recent report by Reuters has shed light on Amazon’s AWS and Microsoft’s Azure for offering artificial intelligence (AI) services to China. The report unveiled insights from around 50 tender documents over the past year, indicating that approximately 11 Chinese entities tapped into U.S. chips and AI software through cloud services.

Navigating the Loopholes

Amid strict restrictions imposed by the U.S. on exporting high-end chips and AI tech to China, concerns over potential military applications have spurred these regulations. Despite this, Chinese companies have managed to side-step the bans by utilizing cloud services as an indirect pathway to acquire advanced technologies from the U.S.

Surprisingly, several tenders explicitly identified AWS as the primary cloud service provider. In response, AWS emphasized compliance with all U.S. trade laws, seeking to reassure stakeholders of its commitment to regulatory standards.

Expert Maneuvers in the Tech Battlefield

The ban on exporting Nvidia’s high-performance chips, crucial for fueling large language models like OpenAI’s ChatGPT, has prompted creative maneuvers in the tech ecosystem. For instance, Shenzhen University secured access to Nvidia’s A100 and H100 chips by paying for an AWS account through an intermediary firm. Similarly, Sichuan University procured 40 million Microsoft Azure OpenAI tokens to develop a generative AI platform.

Chinese companies are turning to American cloud providers due to the limitations in domestic computing capabilities, especially when it comes to running advanced generative AI models. With China standing as a tech hotbed, companies are fiercely competing to capture a sizeable portion of its burgeoning demand. According to IDC, AWS ranks as the sixth-largest cloud computing service provider in China.

The U.S. government, cognizant of the cloud services loophole, is actively considering ways to fortify regulations that would restrict access to AI models. Proposals like the bill introduced in April to bar chip access through cloud services indicate a potential tightening of oversight. A crackdown on such practices could significantly impact AWS and Azure in the industry landscape.

Selecting Between Titans: MSFT or AMZN

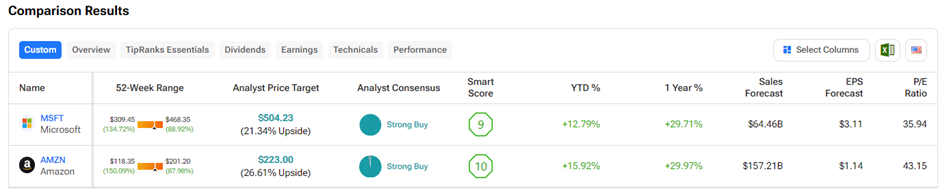

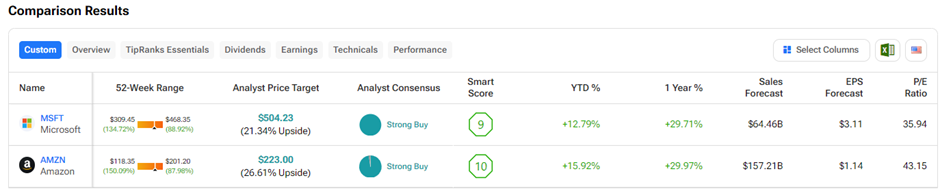

Utilizing the TipRanks Stock Comparison tool, we evaluated Amazon.com and Microsoft to discern the better investment choice. Both firms boast a “Strong Buy” consensus rating from Wall Street, indicating a strong market sentiment. With stellar scores exceeding eight, these tech giants are poised to surpass market expectations.

Embark on the journey to sustainable investing.