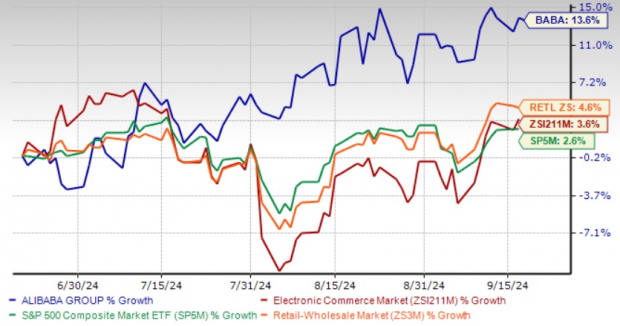

Alibaba BABA has demonstrated an impressive gain of 13.6% over the last three months, outshining the Zacks Internet-Commerce industry’s modest 3.6% return, the Retail-Wholesale sector’s 4.6% rise, and the S&P 500’s 2.6% rally.

The driving force behind this surge lies in the Alibaba International Digital Commerce Group (AIDC), encompassing Lazada, AliExpress, Trendyol, Alibaba.com, and several other ventures in international retail and wholesale markets.

BABA’s growth trajectory is being significantly shaped by strategic investments and a dedicated focus on product and service innovations bolstered by the might of AI.

Alibaba’s Performance Over Three Months

Image Source: Zacks Investment Research

Despite these remarkable gains, concerns loom large in the form of global uncertainties, shifting consumption habits, recession threats, market volatility, and the challenging backdrop of China’s economy.

The escalating tensions between the United States and China cast a shadow of worry. Although this geopolitical tech tussle may not have a direct linkage to the e-commerce sphere, its lingering effects pose challenges for Alibaba and peers.

Despite being a dominant player in China, Alibaba faces stiff global competition from giants like Amazon AMZN and eBay EBAY.

Amid this landscape of risks and rewards, investors must carefully assess Alibaba’s growth potential against the hurdles it confronts.

The Driving Force Behind Alibaba’s Growth: AIDC Strength

The robust performance of AliExpress, Trendyol, and Alibaba.com in the overseas e-commerce realm has been a game-changer. Increased investments in pivotal markets are ramping up brand recognition for AliExpress and Trendyol.

Alibaba’s expansive cross-border retail and logistic operations are serving as major growth catalysts.

The supremacy of AliExpress Choice is fuelling business expansion. By transitioning to a supply-chain-driven platform marketplace model, Alibaba is enhancing its supply chain services, offering semi-consignment and full-consignment services.

Alibaba has broadened its supplier network on the AliExpress platform to include local merchants, enriching product variety to aptly meet the demands of local consumers. The partnership with Brazil’s leading retailer, Magazine Luiza, to run operations on AliExpress signifies a notable collaboration.

Alibaba’s unwavering focus on delivering customized user experiences globally is commendable. Leveraging AI and advanced technologies, the enterprise is boosting efficiency in cross-platform product listings, product details, multilingual searches, and tailored recommendations.

The rising trend of small and medium-sized enterprises (SMEs) harnessing Alibaba’s AI services is a testament to its services’ value. The introduction of Alibaba Guaranteed for global SMEs simplifies B2B cross-border trade by ensuring supply chain reliability.

Debuting the Logistics Marketplace – an economical logistics solution for U.S.-based SMEs – is a significant stride forward.

With these strategic initiatives in play, the AIDC business flaunts substantial upward potential, emerging as the pivotal growth driver for Alibaba.

Bright Future: Growing Estimates for BABA

The horizon looks promising for Alibaba, driven by its robust international commerce operations and robust AI integrations.

Projections for fiscal 2025 foresee revenues hitting $139.56 billion, reflecting a 7% year-over-year upsurge.

Earnings for fiscal 2025 are estimated at $8.68 per share, indicating a 1% year-over-year climb. Noteworthy is the 5.9% upward revision in estimates over the past 60 days.

Image Source: Zacks Investment Research

Solid Financial Footing: BABA’s Shareholder-Friendly Approach

Alibaba boasts a robust balance sheet and strong cash-generating capabilities. As of June 30, 2024, the company held a solid net cash reserve of RMB 405.75 billion or $55.8 billion. Free cash flow stood at RMB 17.4 billion or $2.4 billion. Armed with healthy cash flow, Alibaba is committed to rewarding shareholders through share repurchases and dividends.

In the quarter concluding on June 30, 2024, Alibaba repurchased 613 million ordinary shares (equivalent to 77 million ADSs) worth $5.8 billion across U.S. and Hong Kong markets under its repurchase program.

Attractive Valuation: A Beacon of Hope for BABA

Alibaba presently trades at a discount, sporting a forward 12-month Price/Earnings of 9.69X. This figure is lower than the industry’s 24.51X and the median of 9.89X, offering a lucrative proposition for investors.

Notably, it holds a Value Score of A, an enticing characteristic for prospective investors.

Image Source: Zacks Investment Research

Final Thoughts

Alibaba’s dominant position in international commerce and within China’s e-commerce arena, coupled with optimistic estimates, appealing valuation, and sound financial health, paint a compelling investment scenario.

Nonetheless, prevailing macroeconomic uncertainties, China’s slowdown, and fierce global e-commerce competition cast shadows on BABA’s future.

Thus, investors eyeing Alibaba should exercise patience for an opportune entry, given uncertainties surrounding its trajectory. Notably, BABA currently holds a Growth Score of C, indicating caution.

Existing shareholders of this Zacks Rank #3 (Hold) stock, however, may choose to retain their positions, given the company’s promising long-term outlook.

Unveiling the Cream of the Crop: A Look at Elite Stock Picks

Elite Stock Selections for the Next 30 Days

Recently revealed: Industry professionals have meticulously curated 7 premier stocks from the current roster of 220 Zacks Rank #1 Strong Buys. These specific stocks are marked as the “Most Likely for Early Price Pops.”

Going back to 1988, this exclusive list has outperformed the market by a staggering margin, racking up an average annual gain of +23.7%. These 7 carefully selected stocks demand your immediate attention.

Would you like to stay updated and receive the most recent recommendations from Zacks Investment Research? As of today, you can access a report on 5 Stocks Set to Double. Click to download this complimentary report.

Consider Amazon.com, Inc. (AMZN) for a Free Stock Analysis Report.

Explore a Free Stock Analysis Report on eBay Inc. (EBAY).

Educate yourself with a Free Stock Analysis Report on Alibaba Group Holding Limited (BABA).

Want to delve deeper into the impressive 13.6% gains from Alibaba Group Holding Limited (BABA) in just 3 months? Learn more about the crucial factors driving the strength of this stock.

For more detailed insights, read the complete article on Zacks.com by clicking here.

Visit Zacks Investment Research for additional information.