Is Palantir Technologies’ (PLTR) streak coming to an end? While the AI sector has been experiencing a surge, one notable AI company, Palantir, might be in for a rough ride ahead. Despite a year of impressive growth, Wall Street has heard thunder in the distance, with a bearish forecast predicting the stock to lose over a quarter of its value in the next 12 months.

About Palantir

Born in 2003 with ex-PayPal (PYPL) founder Peter Thiel in its founding team, Palantir is a seasoned player in the big data analytics and fusion platforms market. Its flagship platform, Foundry, empowers users to integrate, analyze, and visualize extensive data sets, particularly for security purposes. Despite its impressive rally, Palantir stock is now trading at lofty valuations, standing well above the median readings for tech sector stocks, suggesting that PLTR might be overvalued.

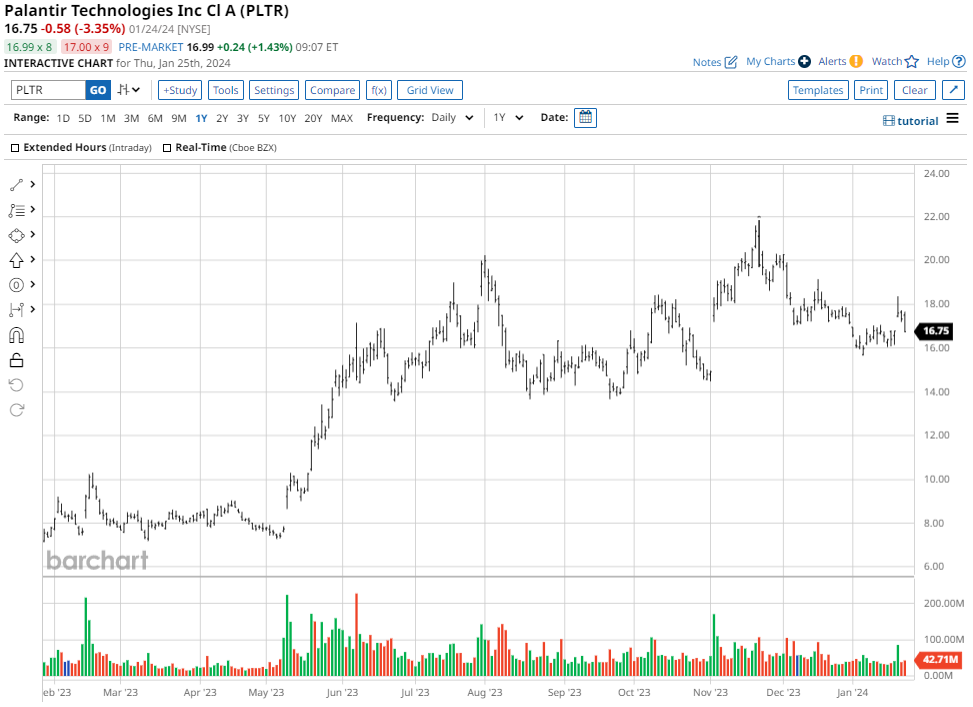

Palantir’s Recent Performance

Palantir’s latest quarterly results showcased a 17% increase in revenues from the previous year to $558 million, with commercial revenue growing by 23% to $251 million. The company also witnessed substantial improvements in net cash from operating activities, free cash flow, and FCF margin, reflecting positively on its financial health.

Concerns and Challenges

Despite its rise in customer count and the impressive growth of commercial customers, analysts have expressed concerns about the uncertainty surrounding government contracts, specifically citing the U.S. Army and UK’s NHS. Additionally, CEO Alex Karp’s emphasis on market share over a clear monetization strategy has raised eyebrows, given the fierce competition within the AI space.

Analyst Projections

Deutsche Bank recently raised its price target on PLTR to $12, indicating an anticipated downside of more than 26% from current levels and reaffirming a “Sell” rating on the stock. The consensus among analysts is marginally less grim, with an overall “Hold” rating and a mean target price of $14.35, signaling an expected downside of about 12% from current levels. Out of 14 analysts covering PLTR stock, opinions vary widely, with some even advocating a “Strong Sell” rating.