Delving into the realm of financial investments, let’s explore three standout stocks with exceptional income potential that investors may find enticing as of the 25th of October this year. Each of these companies brings its own unique value proposition to the table:

The Financial Maestro: Virtu Financial, Inc. (VIRT)

Virtu Financial, Inc. VIRT stands tall as a financial services juggernaut, witnessing a 4.7% increase in the Zacks Consensus Estimate for its current year earnings in the past 60 days. This behemoth, tagged with a stellar Zacks Rank #1, flaunts a generous dividend yield of 3%, overshadowing the industry average of 0.0%.

Virtu Financial, Inc. Earnings Surge

Virtu Financial, Inc. price-consensus-chart | Virtu Financial, Inc. Quote

Virtu Financial, Inc. Yielding Dividends

Virtu Financial, Inc. dividend-yield-ttm | Virtu Financial, Inc. Quote

Unearthing Gold: Kinross Gold Corporation (KGC)

Kinross Gold Corporation KGC, a prominent gold exploration and development entity, has experienced an 8.6% uptick in the Zacks Consensus Estimate for its current year earnings over the last 60 days. With a commendable Zacks Rank #1, Kinross Gold reveals a dividend yield of 1.1%, surpassing the industry average of 0.0%.

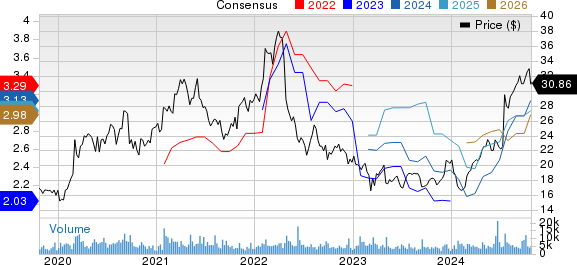

Kinross Gold Corporation Stock Momentum

Kinross Gold Corporation price-consensus-chart | Kinross Gold Corporation Quote

Kinross Gold Corporation Dividend Earnings

Kinross Gold Corporation dividend-yield-ttm | Kinross Gold Corporation Quote

Tax-time Marvel: H&R Block, Inc. (HRB)

H&R Block, Inc. HRB, a leading provider of DIY tax return preparation services, has observed a 2.8% elevation in the Zacks Consensus Estimate for its current year earnings in the recent 60-day span. This top-tier Zacks Rank #1 contender offers a juicy dividend yield of 2.5%, leaving the industry average of 0.0% in the dust.

H&R Block, Inc. Financial Prosperity

H&R Block, Inc. price-consensus-chart | H&R Block, Inc. Quote

H&R Block, Inc. Yielding Returns

H&R Block, Inc. dividend-yield-ttm | H&R Block, Inc. Quote

Curious about other top-ranked stocks? Explore the full list here.

Discover more high-potential income stocks by utilizing premium screening services.

The Creme de la Creme in the Next 30 Days

Breaking news alert: Our experts have meticulously selected 7 top-notch stocks from the current cohort of 220 Zacks Rank #1 Strong Buys. These gems are touted as the “Most Likely for Early Price Pops.”

Since the illustrious year of 1988, this elite list has outshone the market by more than 2 times over, boasting an average annual gain of +23.7%. Make sure you focus your attention on these meticulously handpicked wonders.

Check out the Free Stock Analysis Report on Kinross Gold Corporation (KGC)

Get in-depth insights with the Free Stock Analysis Report on H&R Block, Inc. (HRB)

Access the Free Stock Analysis Report on Virtu Financial, Inc. (VIRT)