As 2023 comes to a close, the realm of artificial intelligence (AI) has ignited the collective intrigue of investors. The unveiling of OpenAI’s ChatGPT in November 2022 served as a catalyst for the surging interest in AI, and the potential for this technology to revolutionize numerous domains like cloud computing, healthcare, education, and productivity software has captivated the market. According to Grand View Research, the AI market is predicted to experience a staggering compound annual growth rate of 37% through 2030, surpassing $1 trillion by the end of the decade.

Amid this landscape, two behemoths, Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT), are standing on the precipice of immense gains in the AI market. These tech giants have entrenched themselves in the AI sector through their formidable prowess and fortified positions, making their stocks compelling considerations as investors ponder the promising year ahead. Consequently, the question reverberates: which is the superior AI investment for 2024 — Nvidia or Microsoft?

The Dominance of Nvidia

Nvidia, a leading chipmaker, stands as the vanguard in providing the essential hardware for both the training and execution of AI models. The company has reaped substantial rewards from the upsurge in demand for graphics processing units (GPUs), fueling a remarkable 237% surge in its stock value this year. In the third quarter of its fiscal 2024 (culminating in October 2023), Nvidia achieved momentous growth, with revenue escalating by an astounding 206% year over year and an eye-watering 1,600% surge in operating income. This meteoric rise was predominantly ascribed to a seismic 279% upsurge in its data center segment, emblematic of a significant spike in AI GPU sales.

Nvidia has long been the unrivaled champion of the GPU market, while its competitors such as Advanced Micro Devices and Intel have predominantly fixated on central processing units (CPUs). Consequently, Nvidia found itself ideally positioned to capitalize on the burgeoning AI landscape, securing an estimated 90% stranglehold over the AI chip market since the outset of 2023, while its contemporaries are yet to make meaningful inroads in this domain.

Despite numerous chipmakers’ plans to unveil novel AI GPUs in 2024, the market is expanding at a blistering pace, with heightened competition improbable to elicit a significant dent in Nvidia’s projected growth trajectory.

The Microsoft Arsenal

Similarly, Microsoft had made early forays into the realm of AI. Back in 2019, the company invested a staggering $1 billion in OpenAI, subsequently augmenting this investment to secure a 49% stake in the startup. This partnership has accorded Microsoft exclusive access to some of the most sophisticated AI technologies, which the tech juggernaut has adroitly woven into its product portfolio.

Over the past year, Microsoft has enshrined new AI tools into its Azure cloud platform, integrated ChatGPT-like capabilities into its Bing search engine, and imbibed AI upgrades into its suite of Office productivity services.

Microsoft has begun the process of monetizing its foray into AI. In March, Microsoft 365 unveiled Copilot, an AI assistant, available to members for an additional $30 atop their standard subscription. The company’s dominion over the productivity and cloud markets confers upon it an immense potential for earnings in AI, poised to propel its revenue to soaring heights in the forthcoming year and beyond.

Nvidia or Microsoft: The Superior AI Investment for 2024?

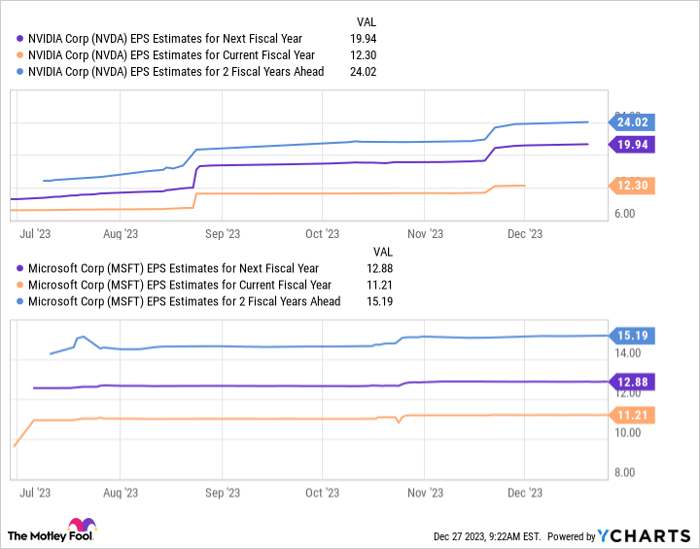

Data by YCharts

Nvidia and Microsoft hold commanding positions in the realm of artificial intelligence, with one exerting its dominance through hardware while the other has cornered the market with software tools. Both present enticing prospects for investment in the approaching year. Nonetheless, prudently scrutinizing the charts suggests that Nvidia may offer more enticing prospects for stockholders.

Estimations propose that Nvidia’s earnings could soar to $24 per share over the next two fiscal years, while Microsoft may potentially reach $15 per share. Multiplying these figures by their respective forward price-to-earnings ratios — Nvidia’s 40 and Microsoft’s 33 — yields a stock price of $960 for Nvidia and $495 for Microsoft.

Given their current standing, these figures imply that Nvidia’s stock may surge by 95% over the next two fiscal years, while Microsoft’s stock could potentially witness a 32% increase. Consequently, Nvidia emerges as the more promising AI investment for 2024 and beyond.

Should you invest $1,000 in Nvidia right now?

Before jumping into the Nvidia bandwagon, it’s pivotal to weigh your options:

The analyst squad at Motley Fool Stock Advisor recently identified what they deem are the 10 best stocks for investors to bet on at the moment… and Nvidia wasn’t among them. These 10 stocks that garnered their approval could potentially yield monumental returns in the years to come.

Stock Advisor equips investors with a user-friendly blueprint for success, providing guidance on crafting a portfolio, regular updates from analysts, as well as introducing two fresh stock picks every month. Since 2002*, the Stock Advisor service has outperformed the return of S&P 500 more than threefold.

*Stock Advisor returns as of December 18, 2023

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.