The semiconductor industry is buzzing with excitement as the demand for artificial intelligence (AI) technology skyrockets across various sectors. The PHLX Semiconductor Sector index has surged by a remarkable 20% in 2024, propelled by the widespread adoption of AI in data centers, smartphones, and personal computers.

Nvidia (NASDAQ: NVDA) stands out as a star performer in the AI chip market, witnessing a staggering 135% surge in its stock price this year. The company commands an impressive 94% market share in AI graphics processing units (GPUs), consolidating its position as a frontrunner in the industry.

Nvidia’s Strong Foothold

Nvidia’s stranglehold on the AI chip market is evident from its record revenue of $26.3 billion in the data center business, registering a phenomenal 154% year-over-year growth. In stark contrast, its rival Advanced Micro Devices (NASDAQ: AMD) reported data center revenue of $2.8 billion, reflecting a comparatively modest growth rate of 115%.

While Intel, another major player in the AI chip arena, faced a 3% decline in data center and AI revenue, Nvidia continued to dominate with an over 80% share of the market. The strong revenue growth in Nvidia’s data center segment underscores the robust demand for its chips, with customers eagerly anticipating the release of the upcoming Blackwell processors, set to replace the popular Hopper AI GPUs.

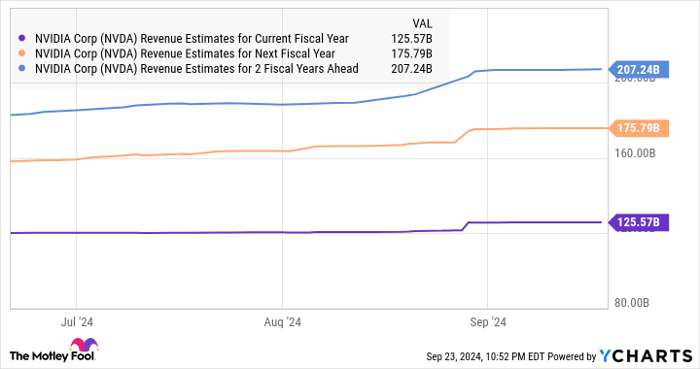

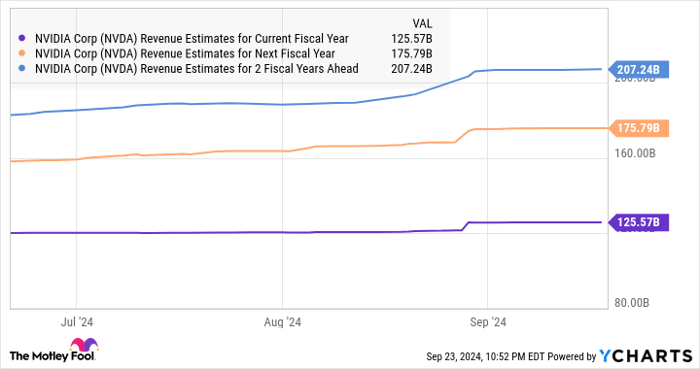

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The promising outlook for Nvidia’s data center business hints at a potential revenue milestone of $200 billion by 2025, surpassing the estimated consensus of $140 billion. The company’s projected revenue growth is poised to accelerate further with the launch of Blackwell chips, with analysts forecasting a revenue spike to $204 billion in the next fiscal year, outpacing expectations.

Potential Growth Prospects for AMD

Conversely, despite trailing Nvidia in the AI data center GPU market, AMD remains optimistic about its growth trajectory. With an estimated data center GPU revenue target of $4.5 billion in 2024, AMD is gearing up to leverage AI opportunities beyond GPUs.

The rise of AI applications across multiple domains presents a bright prospect for AMD, with its client segment revenue witnessing a robust 49% increase propelled by the success of Zen 5 Ryzen processors tailored for AI tasks on PCs. Notably, these processors are equipped with AI-specific chips to enhance the performance of AI workloads on personal computing devices.

Market projections indicate a substantial uptick in AI-capable laptops by 2027, with a surge in the AI PC market growth rate up to 44% through 2028. AMD’s strategic positioning in the client CPU market, where it commands over a third share, positions it favorably to capitalize on this burgeoning trend.

Furthermore, the expanding demand for general-purpose server CPUs in AI model development and inferencing activities presents a ripe opportunity for AMD’s data center business to thrive. Intel’s forecast of $24 billion in annual revenue from general compute chips by 2027 underscores the vast potential for growth in this segment.

The Ongoing Saga of AMD and Nvidia in the Tech Market

AMD’s Steadfast Climb in the Server CPU Market

AMD continues its ascent, steadily gaining more share of the server CPU market from Intel. The behemoth’s dominance has been a staple in the industry for years; think of it like a Goliath facing an emerging David.

The Data Center GPU Market Beckons

On the flip side, AMD eyes growth in the data center GPU market. It may not steal the limelight from Nvidia, but a significant portion isn’t bad for the underdog either.

Forecasted Growth: The Duel of Titans

The crystal ball predicts accelerated growth for AMD in the looming years. However, Nvidia, the reigning champ, is expected to outpace AMD’s progress with a forecasted compound annual growth rate of 52% compared to AMD’s 33%. It’s like a race where one contender has a head start!

Investors seeking to dive into the AI chip market frenzy may find Nvidia more economical and promising as it basks in its dominant position, primed for robust growth. Buying AMD might be like choosing a reliable sedan whereas Nvidia could be akin to a sleek sports car, the ultimate choice for speed and excitement.

To Invest or Not to Invest: The Nvidia Dilemma

Before taking the plunge into Nvidia stocks, ponder over this gem: The Motley Fool Stock Advisor team has unearthed the 10 best stocks for prospective investors, yet Nvidia didn’t make the cut. Those 10 chosen ones could potentially yield monstrous returns in the foreseeable future.

Reflect on the historical feat of Nvidia making it to the esteemed list back in April 2005—a $1,000 investment back then would have blossomed into a jaw-dropping $760,130. Imagine being a part of that financial fairytale!

The Stock Advisor service isn’t merely a financial guide; it’s a beacon of hope for investors. It has substantially outpaced the S&P 500’s returns since 2002, almost like a mentor guiding a protege to financial enlightenment through stormy seas.

*Stock Advisor returns as of September 23, 2024