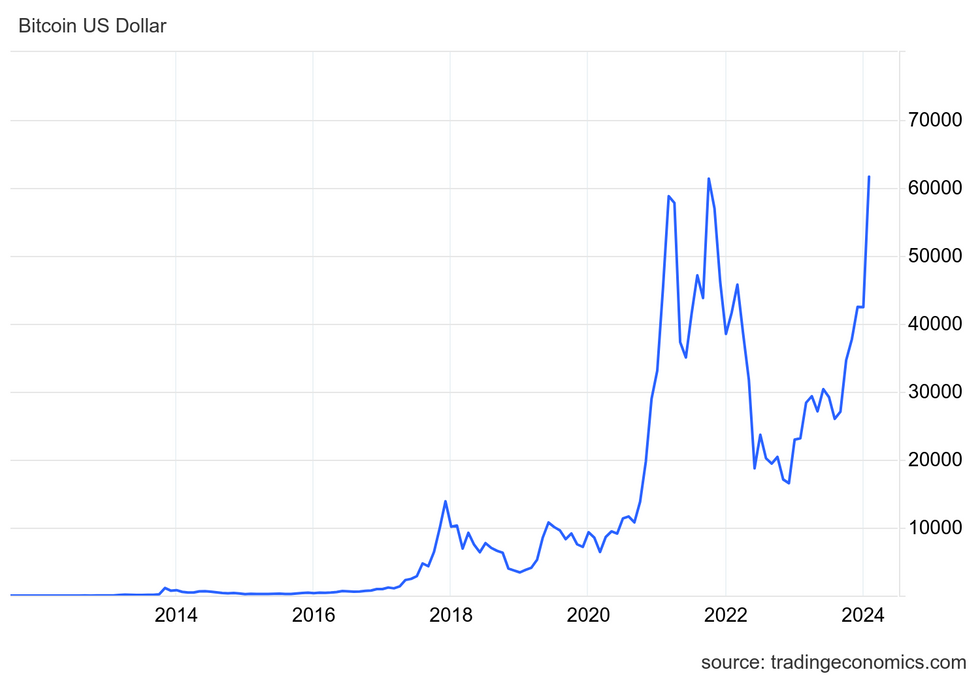

Bitcoin has captivated a devoted following and soared to incredible heights in just over a decade. Riding the choppy waves of the financial world, it stands on the cusp of shattering its all-time high in 2024.

Bitcoin, the pioneer of cryptocurrencies, reached its peak at US$68,649.05 on November 10, 2021, amidst abundant liquidity in the market and increasing investor interest. Between March 2020 and November 2021, Bitcoin skyrocketed over 1,200 percent before hitting a speed bump in 2022.

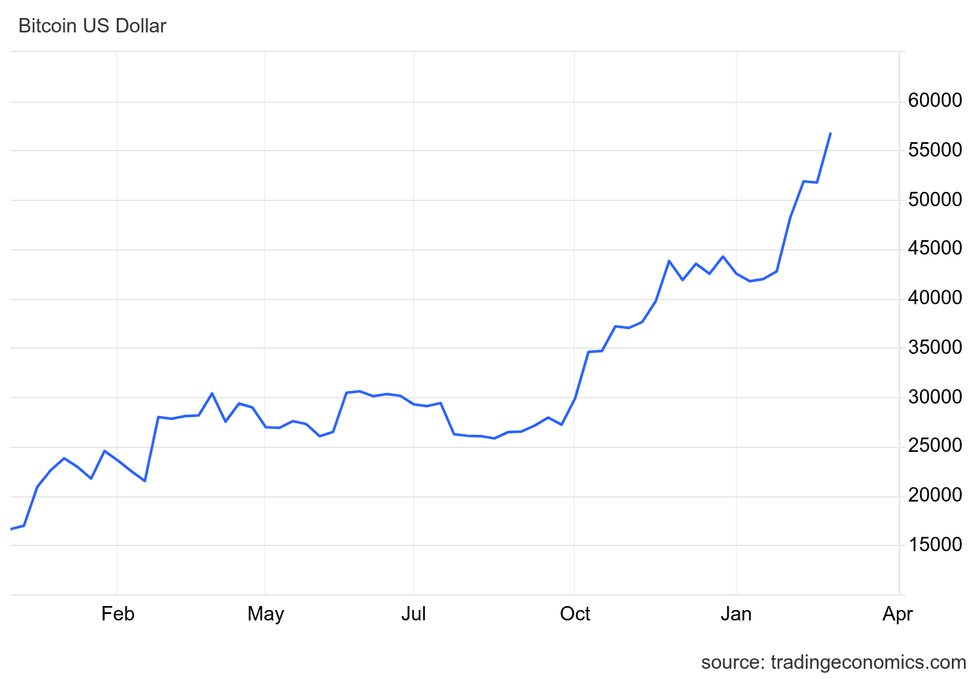

In 2024, Bitcoin kicked off the year just above US$44,000, swiftly climbing to trade at US$61,113 by February 29, 2024.

What fuels the roller-coaster of Bitcoin’s price swings in recent times, and why is it surging now? Let’s delve into the details.

The Genesis of Bitcoin

Emerging in response to the 2008 financial crisis, Bitcoin weathered extreme volatility, peaking at US$19,650 in 2017, but then stagnating below US$10,000 for years. Introduced in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the enigmatic Satoshi Nakamoto, this cryptocurrency aimed to disrupt the conventional monetary system.

Cryptographically secured, Bitcoin leveraged blockchain technology to create a transparent, censorship-resistant payment system—a revolutionary idea that appealed to its early adopters seeking to democratize financial power.

The aftermath of the 2008 financial debacle, which wiped out US$7.4 billion from the US stock market and shrunk the global economy by an estimated US$2 trillion, underscored the urgency for an alternative financial model.

Unveiling the Bitcoin Numbers Game

In stark contrast to traditional currencies, Bitcoin boasts a finite supply of 21 million coins. Currently, over 19 million Bitcoins are in circulation, with less than 2 million left to be mined.

This scarcity, inherent in Bitcoin’s algorithm, acts as a bulwark against inflation, setting it apart from fiat currencies that can endlessly print money.

Bitcoin mining, where new coins are created by verifying transactions on the blockchain, presently yields approximately 900 Bitcoins daily. Every 210,000 blocks, the system halves the number of new coins issued, thus reducing inflation—a phenomenon known as “halving.”

The upcoming halving in April 2024 will diminish miner rewards from 6.25 to 3.125 Bitcoin per completed block over the subsequent four years, sustaining the currency’s value.

Surviving the COVID Storm

Bitcoin’s price surge commenced in 2016, reaching US$959 by year-end from US$433 at the start—a 121 percent gain. In 2017, the mainstream adoption of Bitcoin catapulted its value from US$1,035.24 in January to US$18,940.57 in December, marking a phenomenal 1,729 percent surge.

However, Bitcoin’s volatility later eroded its peak value, settling above US$3,190, a threshold it hasn’t revisited since. Despite skeptics questioning its resilience, 2020 saw Bitcoin weather the COVID storm, rebounding from a 30 percent drop to conclude the year at US$29,402.64—a 323 percent annual increase.

Comparatively, gold, a traditional safe haven, appreciated by 38 percent in 2020, hitting an all-time high of US$2,060 per ounce.

Chasing the All-Time High

In 2021, Bitcoin smashed records, peaking at US$68,649.05 in November—almost doubling from January—before consolidating at US$47,897.16 by year-end, demonstrating a 62 percent annual rise.

The surge was fueled by a confluence of factors, including growing risk appetite among investors and Tesla’s monumental investment of US$1.5 billion in Bitcoin. Tesla’s subsequent plan to accept Bitcoin as payment for its electric vehicles further stoked activity in the crypto world.

The Rollercoaster Ride of Bitcoin and NFTs

Reemergence of Bitcoin Amidst Environmental Concerns

In response to mounting criticism from investors and environmentalists, the electric car maker announced in 2021 that it would be conducting due diligence on the amount of renewable energy used to mine the cryptocurrency before allowing customers to buy cars with it. However, in September of 2023, Elon Musk declared that the level of renewable energy use in the crypto industry had reached an appropriate threshold, potentially opening the door for Bitcoin transactions once again.

The NFT Boom and Bust

While increased money printing during the pandemic boosted Bitcoin’s appeal as investors sought portfolio diversification, the rise of the world’s first cryptocurrency in 2020 and 2021 catalyzed interest and investment in alternative digital assets. The emergence of non-fungible tokens (NFTs) in 2021, unique crypto assets traded exclusively using cryptocurrencies, saw the NFT market skyrocket to over US$40 billion. Although the NFT market value plummeted to US$7.39 billion by November 2023, it soared to a staggering US$58.71 billion by February 28, 2024.

The Wild Ride of Bitcoin Prices

Amidst Bitcoin’s mainstream adoption as a payment method by more businesses, volatility remains a primary concern. The cryptocurrency’s prices plummeted below US$20,000 in the second quarter of 2022 and sank further to below US$17,500 by the year’s end. However, Bitcoin’s resilience was evident as it rallied to US$28,211 in March 2023 and maintained stability above US$25,000 despite SEC lawsuits and regulatory hurdles.

Chart via TradingEconomics.com.

Bitcoin price in US dollars, January 1, 2023 to February 29, 2024.

Heading into the final months of the year, Bitcoin’s price surged on increased institutional investment expectations, reaching US$42,228 per BTC by the end of 2023. Following the approval of 11 spot Bitcoin ETFs by the SEC, Bitcoin’s value soared to US$61,113 per BTC by the end of February 2024.

Insights into Blockchain and Investing in Bitcoin

What is a blockchain?

A blockchain serves as a digitized and decentralized public ledger for all cryptocurrency transactions. As blocks are continually added in chronological order, blockchain technology’s widespread adoption in various industries such as banking, cybersecurity, and supply chain management has made it a lucrative investment space.

How to buy Bitcoin?

Bitcoin can be acquired through diverse crypto exchange platforms and peer-to-peer crypto trading apps, with a digital wallet acting as the repository for purchased coins. Notable platforms for purchasing Bitcoin include Coinbase Global, CoinSmart Financial, BlockFi, Binance, and Gemini.

What is Coinbase?

Coinbase Global stands as a secure online cryptocurrency exchange facilitating the buying, selling, transferring, and storing of cryptocurrencies, offering investors easy access to the crypto market.

The Dynamic Dance: Bitcoin and the Banking Ballet

Fueling Change in the Banking Industry

Cryptocurrencies have emerged as a disruptive force, captivating a younger demographic seeking alternatives beyond traditional banking realms. With 53% of crypto holders falling between 18 and 34 years old, the appeal of decentralized digital assets is unmistakable.

Privacy, augmented by detachment from central bank oversight, allures cryptocurrency enthusiasts in a landscape characterized by swift transactions and reduced fees compared to conventional banking systems. The growing prominence of cryptocurrencies like Bitcoin has prompted banks to delve into investments within the sector, recognizing the shifting financial currents.

Bitcoin’s Resilience Amidst Banking Turmoil

The recent banking upheaval, triggered by events such as the Silicon Valley Bank’s collapse followed by Signature Bank’s demise, spurred anxious investors towards Bitcoin as a haven. Despite a transient retreat from the limelight, the reverberations of the crisis continue to unsettle the regional banking domain, portending further convulsions.

Formed in the aftermath of the 2008 financial crisis, Bitcoin operates as an antidote to traditional banking fragility. While past Bitcoin valuations ebbed and flowed based on narrative and sentiment, today’s labyrinth of regulations and historical volatilities casts uncertainty on the cryptocurrency’s trajectory amidst the continuing financial turmoil.

The Genesis of Bitcoin’s Valuation

In a notable historical transaction dating back to late 2009, the initial recorded exchange involving Bitcoin saw 5,050 coins traded for a paltry sum of US$5.02 via PayPal, pegging the value of one Bitcoin at roughly US$0.001 — a fraction of a cent.

Deciphering Bitcoin’s Investment Viability

While Bitcoin’s upward trajectory in 2024 tantalizes investors, its inherent volatility remains a salient feature. Adventurous investors, comfortable with risk-taking, may be enticed by the cryptocurrency’s potential rewards despite the entwined risks. However, risk-averse investors seeking steadier waters may opt for alternative investment avenues.

For a deeper dive into Bitcoin investment insights, exploring the article “Is Now a Good Time to Buy Bitcoin” could offer valuable perspectives for interested parties.

Cathie Wood’s Stratospheric Bitcoin Prognosis

Renowned for her staunch advocacy of Bitcoin, Cathie Wood from ARK Invest charts an audacious course for the cryptocurrency’s future. Wood boldly envisions a baseline price target of US$600,000 by 2030, with an even more bullish projection eclipsing a million US dollars.

The Enigmatic Figures in Bitcoin’s Realm

Satoshi Nakamoto, the enigmatic Bitcoin progenitor, purportedly commands the largest slice of the digital currency pie, with analyses of early Bitcoin wallets hinting at Nakamoto’s ownership of over 1 million of the nearly 19.5 million Bitcoins in circulation.

Bitcoin’s Celebrity Connections: Unraveling Musk’s Crypto Contours

Elon Musk, the maverick at the helm of Tesla and Twitter, boasts a storied association with Bitcoin and the whimsical Dogecoin currency, exerting influence through both social media missives and corporate maneuvers. While the precise extent of his Bitcoin holdings remains veiled, Musk has confirmed personal stakes in Bitcoin, Dogecoin, and Ether, with Tesla once delving into the Bitcoin market before divesting a significant portion thereafter.

Warren Buffett’s Cryptocurrency Conundrum

In stark contrast to Musk’s digital dalliances, Warren Buffett stands aloof from Bitcoin, having voiced disdain towards cryptocurrencies on various occasions. Resolute in his skepticism, Buffett dismissed Bitcoin as a mere “gambling token,” devoid of intrinsic value, underscoring his steadfast aversion to the digital asset realm.

This article, originally penned by the Investing News Network in 2021, sheds light on the dynamic interplay between Bitcoin and the traditional banking sphere, navigating the tumultuous waters of financial evolution.