A sense of excitement and trepidation mounts as the next Bitcoin halving looms on the horizon. This pre-programmed event, designed to halve the number of Bitcoin rewarded for successful block mining, holds profound implications for savvy investors navigating the complex cryptocurrency terrain. Delving into the historical reverberations of previous halvings and dissecting current market trends is essential to brace oneself for the impending halving and to strategically position within the dynamic cryptocurrency landscape.

Teaming up with acclaimed crypto expert Peter Eberle, the Investing News Network (INN) embarks on an insightful journey to unravel the nuances of the halving process and candidly dissect the potential tumult that might ensue in the wake of this pivotal event.

Exploring the Essence of Bitcoin Halving

Bitcoin’s genesis lies in the process of mining, wherein miners engage in cutthroat competition to crack algorithmic puzzles. Upon successful decryption, a new block is appended to the blockchain, with the victorious miner being rewarded with a fixed amount of freshly minted Bitcoin. In the nascent days of Bitcoin’s inception in 2009, miners relished a reward rate of 50 Bitcoins per mined block.

The Bitcoin halving unfolds roughly every four years or post the mining of 210,000 blocks; a temporal spectacle governed not by the ticking clock but rather by the ebb and flow of mining complexity and network hash rate. This year’s much-anticipated halving is slotted tentatively for April 20, 2024. Marking the fourth historic halving after the milestones of 2012, 2016, and 2020, the reward rate presently stands at 6.25 Bitcoins, poised to plummet further to a meager 3.125 Bitcoins per block in the imminent halving.

Embedded into Bitcoin’s very core, the halving galvanizes a denouement where block rewards dwindle, orchestrating a cinematic slowdown in the creation of new Bitcoins. This orchestrated scarcity, a countermeasure against inflation, pulsates through Bitcoin’s veins sustained to prop its enduring value. As the halving epochs unfurl, the deluge of fresh coins recedes gradually towards a crescendo where the 21 millionth Bitcoin shall ceremoniously circulate.

Unraveling the Ripples on Bitcoin Miners

The Bitcoin halving’s seismic tremors quake profoundly through the cryptocurrency’s mining domain, imperiously dictating the tempo and tone of mining operations and supply allocution.

The relentless heartbeat of Bitcoin mining, known colloquially as block time, ticks to a cadence of approximately 10 minutes. To sustain this metronomic pulse, the Bitcoin network orchestrates elegant ballets of mining complexity in tandem with hash rate, a barometer for the cumulative computational might expended in mining and transaction processing endeavors. Echoing historical echoes, hash rate crescendos in the lead-up to halvings, only to modulate into solemn lulls as the post-halving cull purges inefficiency.

“In this flux,” shares Eberle, “inefficient miners, clasped by antiquated rigs and prodigious energy appetites, face obsolescence as the mining reward shrinks.” A swan song of sorts for the unprepared.

New dawn breaks with fervor as behemoth mining conglomerates adulate “record-high” hash rates, fostering a symbiotic ecosystem wherein archaic machinations commune with state-of-the-art processors. The avant-garde maneuvering that commenced in 2024 witnessed Bitcoin miner Riot Platforms fortifying its arsenal with fresh miners, syncopated with CleanSpark’s coronation in acquiring Mississippi’s data troves, amplifying the anticipation for the halving crescendo.

For investors, this harmonious ballet of efficiency translates into a boon. Miners, in their capricious dance of selling Bitcoins to appease production exigencies, pirouette towards profit margins as operational costs dip below sales revenues. CoinShares, in its 2024 Crypto Outlook eulogizes an age where miners saunter with reduced debt burdens and a solace of expanded equity rallying calls. Bitcoin’s meteoric rise, escorted by spot Bitcoin ETF approvals and the Federal Reserve’s dalliance with a dovish monetary policy, bestows an ethereal glow upon investor vistas.

Anticipating a ‘dual cycle year,’ CoinShares prognosticates a tempestuous terrain of rebalancing harmonies enthroned upon the halving pedestal. As the Bitcoin price gallops, outstripping miners’ hastened deployment of hash rates, the report forecasts a mining merriment where 1 Bitcoin shall court a princely sum of US$37,856 post-halving.

“The canvas unfurls,” muses Eberle, “and the halving, a herald of change, serves evictions to the laggards. In the crucible of evolution, miners embody the alchemy of adaptation or fade into oblivion beneath the halving’s steely guillotine.” Investors, observe keenly, for within lies a tale of survival of the fittest.

Deciphering the Symphony of Bitcoin’s Worth

Bitcoin’s valor often scales vertiginous heights in the pulsating prelude to the halving, though with merely three halvings etched in history’s annals, the conundrum of discerning definitive price patterns remains beguiling.

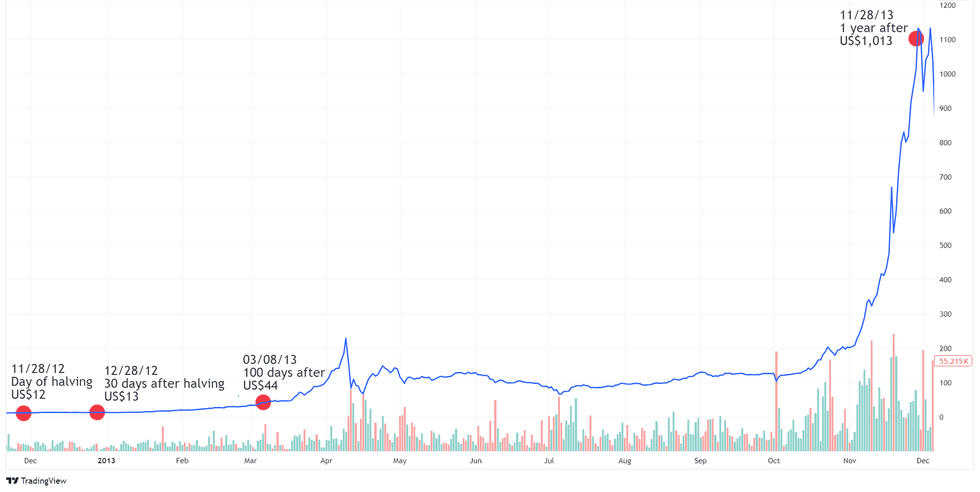

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

Tracing back to the inaugural Bitcoin halving on November 28, 2012, where the bounty tapered from 50 to 25 Bitcoins, the nascent Bitcoin basked in a rarefied glow kindled by a whiff of mainstream intrigue. Embroiled in economic tumult echoing across Europe, Bitcoin’s ascent from the meadows of US$5.50 bore the seeds of eminence.

The Ever-Evolving Landscape of Bitcoin Halvings

In January 2012, Bitcoin’s price sat at approximately US$12 before the first halving in November of that year. This event marked a gradual rise in interest and adoption. Over the subsequent months, Bitcoin gained significant traction, reaching a value of US$1,013 a year post-halving. This surge set the stage for Bitcoin’s emergence as a contender in the alternative asset class arena. alas, the glory was short-lived, as its value plummeted back to under US$300 by mid-2015.

Bitcoin’s Rise Post First Halving

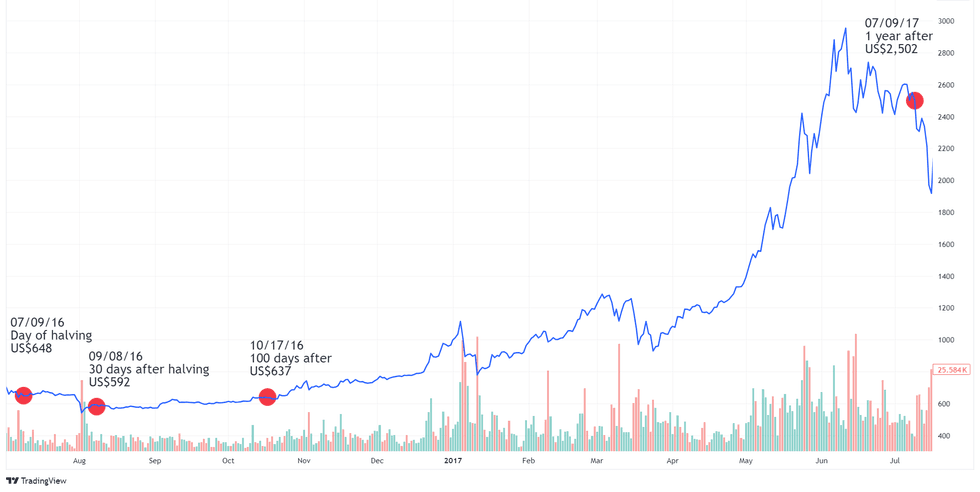

Chart via TradingView

By the time of the second halving on July 9, 2016, Bitcoin surged to US$648. Over the ensuing year, driven by escalating excitement and optimism, the fear of missing out (FOMO) gripped the market, propelling the price above US$2,500 by June 3, 2017.

Increased recognition of blockchain technology’s potential by major financial institutions further fueled Bitcoin’s meteoric rise, culminating in a record high of US$19,783.21 in December 2017.

Bitcoin’s Rollercoaster Ride

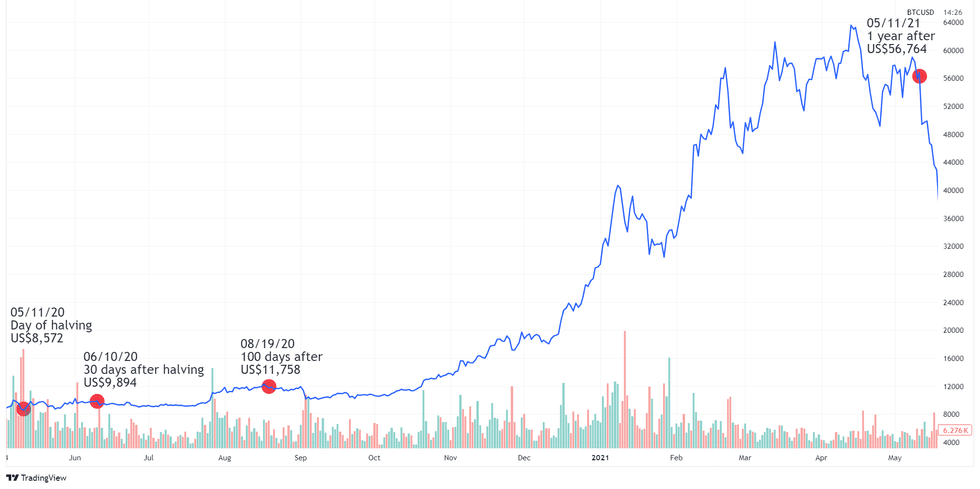

Chart via TradingView

The most recent halving occurred on May 11, 2020, reducing block rewards to 6.125 Bitcoin. Despite initial anticlimactic sentiments, various factors in 2020, such as the COVID-19 economic fallout and the rise of decentralized finance, propelled Bitcoin to new heights.

By late 2020, PayPal and Square made significant moves into the crypto space, contributing to Bitcoin’s climb to over US$28,000 by year-end and US$56,000 in the following year post-2020 halving. Though facing fluctuations, Bitcoin reached a then all-time high of US$68,000 in November 2021.

Insights on the Next Bitcoin Halving

In light of the recent surge in market activity following the approval of spot Bitcoin ETFs, the upcoming 2024 halving stands out as highly anticipated. These ETFs offer a simplified entry point for risk-averse investors seeking exposure to Bitcoin’s price movements without direct ownership.

2023 witnessed a revitalization of the crypto industry, with legal victories and the promise of spot Bitcoin ETFs reigniting institutional interest. Following the US SEC’s ruling, Bitcoin prices surged, hitting levels unseen since 2021. Bitcoin ETFs set a new volume record of US$7.6 billion on February 28, driven by the upcoming halving and amplified demand for crypto.

Unveiling the Bitcoin Halving: A Gateway to Investing Opportunities

The world of cryptocurrency is abuzz with anticipation as the countdown to the Bitcoin halving event draws nearer at the end of February.

The Impact of ETFs on Bitcoin Demand and Supply

In a recent discussion, industry experts shed light on the interplay between Exchange-Traded Funds (ETFs) and Bitcoin’s supply and demand dynamics ahead of the halving event. Analysts mentioned a historical trend where miners upgrade their equipment before halvings, leading to sell pressure on the market. However, this time around, the extra supply from miners seems to be absorbed by ETFs, hinting at potential future gains in the market post-halving.

Navigating Bitcoin Markets Pre-Halving

Renowned analyst Peter Brandt raised eyebrows with a bullish prediction, stating that Bitcoin’s price could surge to US$200,000 by September, a substantial jump from his previous estimate. Additionally, experts foresee the ease of purchasing ETFs driving retail FOMO and potentially pushing the price to remarkable levels. Although price estimates vary, optimism reigns, with targets ranging from US$75,000 to US$150,000 in the coming months.

Strategic Investment Advice for Bitcoin

If you’re considering Bitcoin as part of your investment portfolio, industry veteran Eberle shared valuable insights. He suggested balancing a standard 60/40 equity-bond portfolio by leveraging Bitcoin’s volatility. Studies have shown that allocating 3 to 5 percent of Bitcoin in such a portfolio can reduce overall volatility and boost expected returns. Additionally, Eberle emphasized the importance of managing allocation size to mitigate investment-related anxieties.