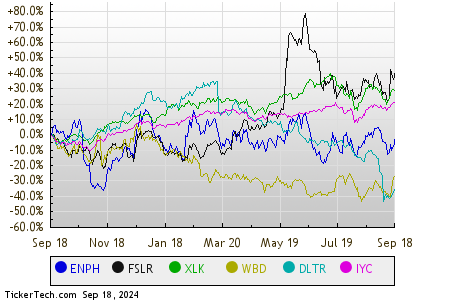

Box, Inc. shares have taken investors on a wild ride, surging an impressive 29.1% year to date. This meteoric rise easily outpaces the Computer and Technology sector’s 14.5% growth and the Zacks Internet Software industry’s 11% return. It’s akin to watching a horse break free from the starting gate and gallop ahead with unwavering determination.

The driving force behind this remarkable performance is Box’s robust top-line growth, a rapidly expanding client base, and a diverse partner network that’s akin to a well-orchestrated symphony.

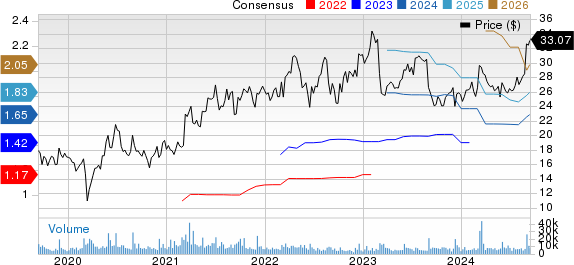

In the second quarter of fiscal 2025, BOX reported revenues of $270 million, showing a 3% year-over-year increase. Not stopping there, their non-GAAP earnings of 44 cents per share not only beat the Zacks Consensus Estimate but soared 22.3% from the prior year, leaving investors cheering from the sidelines.

BOX Raises Guidance on Strong Clientele

BOX isn’t just stopping to smell the roses. With over 1,800 customers shelling out at least $100,000 yearly, their reach is expanding like vines in a flourishing garden. The prominence of Box AI in the market has been a true gamechanger, leading the charge towards innovation.

A whopping 87% of BOX’s deals above the $100,000 mark consisted of suites, showcasing an upward trajectory from the previous year. It’s a bit like watching a skilled artist add layer upon layer to a masterpiece, each stroke bringing more depth and richness to the canvas. Enterprise Plus continues to dominate, accounting for over 95% of these high-profile deals.

With raised guidance for fiscal 2025, BOX anticipates revenues in the $1.086-$1.09 billion range, hinting at a 5% annual surge, setting sail towards new horizons.

BOX Shares Overvalued

While BOX shares are currently held in high regard by investors, their Value Score of C bears a warning sign that the stock may be overvalued. A forward 12-month Price/Sales of 4.21X compared to the industry’s 2.5X indicates premium pricing, urging caution to those ready to dive in headfirst.

Will Investors Find BOX Shares a Worthy Buy?

Despite the stretched valuation, BOX’s solid portfolio, extensive partner network, and growing clientele present an enticing package for investors. Their Zacks Rank #2 (Buy) and Growth Score of B paint a picture of promise, akin to spotting a flourishing garden amid a concrete jungle.

Infrastructure Stock Boom to Sweep America

The imminent wave of infrastructure investments in the U.S. is the talk of the town, a bipartisan effort set to transform cities and livelihoods alike. Companies poised to benefit from this boom stand at the cusp of greatness, waiting for the golden opportunity to capitalize on this monumental shift. Think of it as a race to secure a front-row ticket to the most significant transformation of our generation.