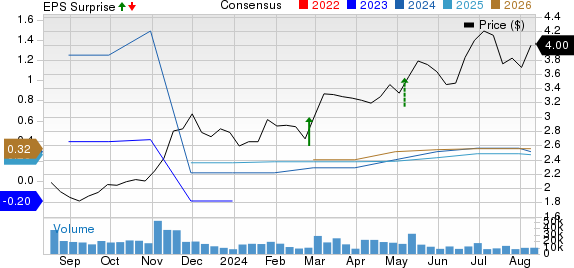

BRF S.A. BRFS is poised to demonstrate growth in its bottom-line figures in the upcoming report on second-quarter 2024 earnings slated for Aug 14. The Zacks Consensus Estimate for quarterly earnings has held steady over the last 30 days at 7 cents per share, marking an improvement from a loss of 10 cents in the same quarter last year.

Expectations hint towards a year-over-year decrease in the company’s revenue. The consensus estimate for quarterly revenues stands at $2.6 billion, reflecting a 2.6% decline from the corresponding figure of the previous year. BRF, a global giant in the food industry, surprised with a 50% earnings overachievement in the last reported quarter.

Factors to Keep in Mind

BRF has been reaping the fruits of its ongoing BRF+ program, emphasizing enhanced commercial execution, cost efficiency, and operational performance. The company’s commitment to value-added and innovative products is fortifying market resilience through competitive pricing. Stable feed costs in the near future are expected to facilitate effective cost management and drive profitability. The continuance of these factors likely propelled the company’s performance in the to-be-revealed quarter.

Insights from Zacks Model

Our proven model does not definitively forecast an earnings beat for BRF this time around. A favorable combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) typically enhances the odds of an earnings beat, which is not evidenced in this case.

With a Zacks Rank #3 and an Earnings ESP of 0.00%, BRF’s outlook remains uncertain.

Highlighted Stocks with Favorable Metrics

Three companies stand out with potential for positive earnings outcomes:

Ollie’s Bargain currently possesses an Earnings ESP of +2.38% and a Zacks Rank of 3. The company is expected to see a rise in bottom-line figures in its upcoming second-quarter fiscal 2024 results. The Zacks Consensus Estimate projects quarterly earnings per share to reach 78 cents, reflecting a 16.4% increase from the previous year.

Costco Wholesale Corporation is forecasted to achieve top and bottom-line growth in its fourth-quarter fiscal 2024 reports, backed by an Earnings ESP of +0.67% and a Zacks Rank of 3. The company is estimated to reach quarterly revenues of $80.1 billion, a 1.4% increase from the previous year.

Another notable mention is Coty, which is anticipated to witness revenue and earnings growth in its fourth-quarter fiscal 2024 results. With an Earnings ESP of +22.73% and a Zacks Rank of 3, the company is expected to report quarterly earnings of 5 cents, signifying a remarkable 400% surge from the corresponding quarter last year.