Investors eyeing Broadcom Inc (AVGO) are in for a treat as the semiconductor design company’s strong free cash flow (FCF) sets the stage for potential undervaluation. Trading statistics suggest that AVGO could ascend, boasting a significant uptick of up to 21% from its closing price of $1,325.41 on March 28, to potentially reach $1,607.72 per share.

For shareholders, this forecast spells potential through a dual strategy: long-term holding of AVGO shares coupled with shorting out-of-the-money (OTM) put options in nearby expiry periods. Such a move not only secures additional income but also complements the current low 1.58% dividend yield.

An earlier analysis detailed in a Barchart piece released on March 10, outlined the upward trajectory forecast for February. The iteration pinpointed the stock price at $1,308.72, just following Broadcom’s fiscal Q1 earnings announcement on March 7. The suggestion to short the $1,270 strike price put options for March 28 proved lucrative, with the expiration resulting in a $36.30 premium income, amounting to an immediate 2.85% yield in just three weeks.

Given this successful venture, it’s ripe for investors to replicate the strategy and delve into the reasons amplifying AVGO’s worth by over 21%. The insights garnered not only benefit existing shareholders but open avenues for intensified stock appreciation.

The Foundation: Broadcom’s Resilient Free Cash Flow and FCF Margins

Revisiting Broadcom’s standing reveals a robust 34% year-on-year revenue increase to $11.96 billion, with free cash flow (FCF) soaring by 19.2% to $4.693 billion. Leading to a noteworthy FCF margin of 39.2% ($4.693 billion out of $11.96 billion). This, although slightly underneath last year’s fiscal Q1 FCF margin of 44.1%, remains steadfastly impressive.

The accelerated revenues and steady FCF stem from the burgeoning demand for AI-driven servers and AI application-specific integrated circuits (ASICs), akin to the success witnessed in other semiconductor design spheres, such as Nvidia (NVDA).

Optimism prevailed in management’s foresight as they envisioned a remarkable revenue surge of 39.5% for the current fiscal year, surpassing the $35.8 billion preceding fiscal period. Meanwhile, analysts project a prospective revenue spike to $57.08 billion in the upcoming fiscal year.

Extrapolating a 39.2% FCF margin against this premonition (mirroring the latest quarterly FCF margin), Broadcom’s FCF could escalate to $22.375 billion, consequently shaping the stock’s valuation.

Setting the Stage: Price Target for AVGO Stock

Painting a picture, a hypothetical scenario where Broadcom disburses 100% of the FCF as dividends (bearing in mind the current 52% payout norm), might unlatch a 3.0% dividend yield. This figure nearly doubles the existing 1.57% dividend yield.

By calculation, for AVGO to present a 3.0% dividend yield, envisaging a market cap pegged at $745 billion is essential. This math involves dividing the anticipated $22.375 billion FCF of the impending year by 3.0% ($22.375 billion divided by 0.03 equates to $745 billion), encapsulating the enigmatic FCF yield metric.

Therefore, with Broadcom’s prevailing market cap at $614.2 billion, the envisioned $745 billion market cap prediction signifies a prudent 21.3% increment. Such projections hint that AVGO stock could appreciate to $1,607.72 per share.

Close convergence with Susquehanna analyst Christopher Roland’s $1,650 price target, as ordained by CNBC, fuels confidence. On the flip side, insights from AnaChart, a novel sell-side analyst supervision entity, indicate an average buy-side analyst price forecast at $1,447.25 per share, radiating a 9.75% surge.

Mr. Roland’s stellar predictive record in Broadcom’s stock valuation with a solid performance score stands tall at 5.67 within the analyst panorama covering AVGO stock. The impending fruition of his price target looms large.

Existing stakeholders can efficiently capitalize on this paradigm by preserving their shareholdings in tandem with vending short OTM puts for supplementary income.

Maximizing Returns: Shorting OTM Puts for Income

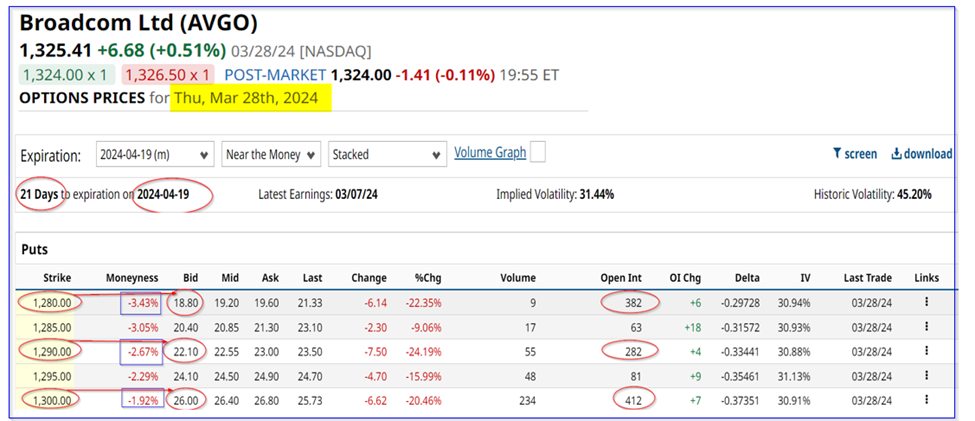

A snapshot of the AVGO put option chain close to the April 19 expiration date showcases substantial interest in three key tranches: $1,280, $1,290, and $1,300. These strike prices hover approximately 3.43%, 2.67%, and 1.92% beneath the March 28 closing price, qualifying them as near out-of-the-money (OTM) levels.

Lucrative income prospects emerge from these OTM put options, illuminated in the premium levels. For instance, the $1,300 strike price put options sealed at $26.00 at the bid end, offering a lucrative 2.0% immediate yield over the brief 3-week span ($26 divided by $1,300). Conversely, the less risky $1,290 and $1,280 strike prices present yields of 1.71% ($22.10 divided by $1,290) and 1.469% ($18.80 divided by $1,280) respectively.

Of import, the $1,280 strike price presents a robust safety net. The calculated breakeven price point rests at $1,261.20, reflecting a 4.844% descent from the March 28 closure of $1,325.41.

With the 3-week 1.469% yield closely shadowing the annual 1.58% dividend yield, a prudent move would be to perpetuate this trade every 3 weeks for a quarter, unraveling an expected return (ER) of 5.876% (derived from 1.469% multiplied by 4). Heightened risk aversion here is justifiable, given the enticingly elevated ER.

Ultimately, current investors stand to benefit from substantial additional income by engaging in shorting OTM puts set to expire in forthcoming expiration periods.