Before you place your bets on investing in Jabil (JBL), it’s crucial to look beyond the average brokerage recommendation (ABR) and do your own analysis. While the ABR might suggest a Strong Buy, relying solely on this information can be precarious. Diving into the historical context enables investors to make informed decisions and maximize the potential for profit.

The Merits of Brokerage Recommendations

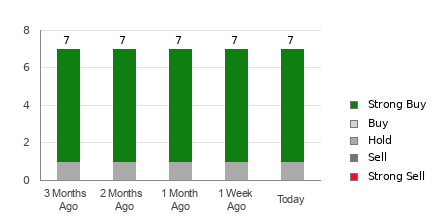

Wall Street analysts historically hold significant sway over investor sentiment through their stock recommendations. The current ABR for Jabil stands at 1.29, indicating a penchant towards a favorable outlook. However, it’s important to be cautious about placing undue reliance on these recommendations. Past evidence suggests that brokerage recommendations often lack the precision of predicting stock price appreciation, potentially skewing the odds against retail investors.

Validating Through Zacks Rank

For a more strategic approach, it’s essential to validate the ABR through tools such as the Zacks Rank, which relies on a quantitative model driven by earnings estimate revisions. Unlike the ABR, the Zacks Rank holds a proven track record of correlating with future stock price movements, making it an effective indicator for investment decisions.

Understanding the Distinctions

A striking difference between ABR and Zacks Rank lies in their underlying methodologies. While ABR reflects brokerage recommendations, subject to potential biases, the Zacks Rank leverages earnings estimate revisions, yielding a more balanced and timely prediction of future stock prices. It’s prudent for investors to juxtapose these distinctive measures for a comprehensive assessment.

Cautious Outlook for Jabil

The Zacks Consensus Estimate for Jabil has remained unchanged at $9.11 over the past month, leading to a Zacks Rank #3 (Hold). Despite steady earnings prospects, the relatively static consensus estimate suggests a conservative stance on the stock. This warrants a thoughtful approach to the seemingly bullish ABR, urging investors to exercise prudence.

Ultimately, the decision to invest in Jabil (JBL) demands a comprehensive evaluation beyond the apparent recommendations. Uncovering the underlying dynamics and critically appraising the contradiction between the ABR and Zacks Rank will equip investors with a more nuanced perspective, indispensable for navigating the financial markets.