The Resurgence of Hybrid Vehicles

Automakers worldwide are adapting to the shifting landscape by focusing on hybrid technologies amid consumer hesitancy towards fully electric vehicles. The competition from Chinese EV manufacturers has spurred a renewed interest in hybrids, known for their profitable margins compared to EVs.

One standout is Toyota Motor, demonstrating the impact of hybrid technologies on global markets with a staggering 78% increase in operating profit to $7 billion in the first quarter. Despite expectations for the EV surge, Toyota recently introduced a new lineup of internal combustion engine vehicles, anticipating a slower transition to electric vehicles globally.

The United States, historically slow in hybrid adoption, is seeing a significant shift, with hybrid sales surging by 35% year on year in 2024. Europe mirrors this trend with a 21% rise in hybrid sales, outpacing EV growth by a substantial margin, as reported by BNP Paribas.

Forecasts from S&P Global Mobility suggest hybrid sales are poised to triple in the next five years, constituting 24% of new car sales by 2028 in the U.S. Ford CEO Jim Farley is even more optimistic, predicting a quadrupling of hybrid sales for the company over the same period.

Platinum: Benefitting from the Hybrid Boom

Investors keen on commodities are leveraging the hybrid vehicle resurgence by investing in platinum, essential for both hybrid and traditional engine vehicles to reduce emissions. The increased demand stems from the belief that hybrids will dominate the market for a considerable time, requiring more catalytic converters and platinum.

Hybrid vehicles, known for higher temperature variability, need 10-15% more platinum in catalytic converters compared to gasoline and diesel engines. This has driven a surge in automotive demand for platinum, comprising 40% of yearly platinum demand.

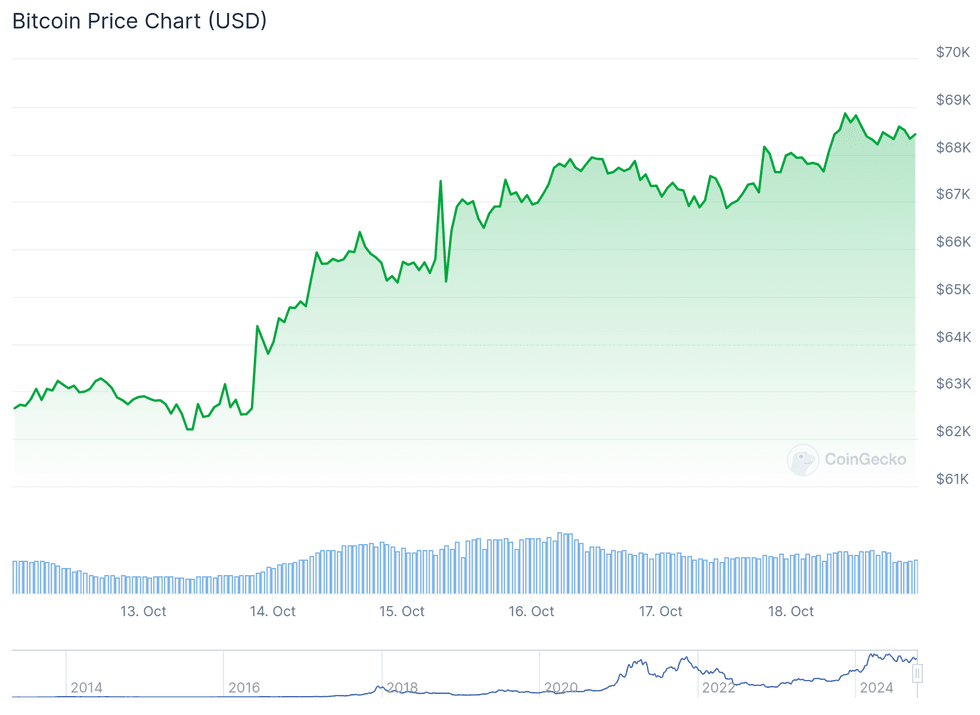

Investors cheered as Bitcoin skyrocketed, buoyed by China’s stimulus plan. The cryptocurrency broke through the US$62,640 mark on Sunday evening and soared past US$66,400 by Monday morning, igniting a frenzy in the market. Liquidated short positions exceeded US$100 million, indicating a significant shake-up in the crypto landscape.

An all-time high in open interest for Bitcoin futures signifies robust institutional involvement, fueling hopes for a prolonged bullish trend. With daily ETF inflows exceeding US$250 million, traders are rife with excitement, anticipating further gains in the sector. Analyst Omkar Godbole hints at a substantial upward trajectory, with eyes now set on the US$70,000 milestone for Bitcoin and a $2,770 hurdle for Ether.

Chart via CoinGecko.

Bitcoin concluded the week at US$68,362, while Ether settled at US$2,663. Political speculations surrounding the US election also lent momentum to Bitcoin's trajectory.

Vice President Kamala Harris' voiced support for crafting a regulatory framework for cryptocurrencies on Monday, though lacking specifics, stirred the industry. Ripple Labs co-founder Chris Larsen made headlines by generously donating US$1 million in XRP tokens to Future Forward, a super PAC backing Harris’ endeavors.

Chip Stocks Tumble on Export Cap ReportsThe tech industry was rocked by a wave of uncertainty as chip stocks nosedived due to export restriction murmurs. Market volatility reigned, creating uneasiness among investors.

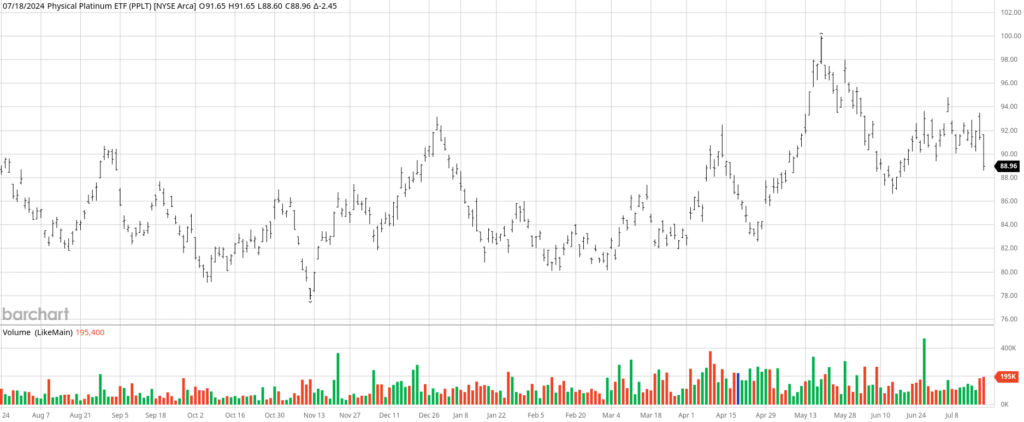

Financial News Article US Considers Limiting AI Chip Sales Amidst National Security ConcernsETF holdings backed by physical platinum soared by 444,000 ounces in the second quarter of 2024, equating to 6% of annual demand. This influx boosted platinum prices by 20% in a month, indicating strong investor interest in the metal. Despite a slight retracement, platinum remains a pivotal asset in the hybrid vehicle era.

Platinum’s Versatile Applications

Beyond automotive use, platinum demand is rising in AI and data storage, particularly in hard disk drives (HDDs) due to their enhanced thermal and magnetic stability. The HDD market is experiencing growth, driven by AI advancements necessitating expanded data storage capacity.

The advent of heat-assisted magnetic recording (HAMR) technology in HDDs is spurring a resurgence after a period of decline, attracting data center firms keen on optimizing energy efficiency and storage capacities.

Potentially, fuel cell vehicles could further bolster platinum demand, given its critical role as a catalyst in fuel cells. Platinum’s unique properties make it ideal for fuel cell applications, potentially opening up a new avenue for demand in the future.

Investing in PPLT Shares

Given the sustained demand for platinum amid the hybrid wave, a strategic investment approach involves purchasing shares in physical platinum ETFs like the abrdn Physical Platinum Shares ETF (PPLT). This fund holds actual physical platinum bars secured in London vaults, offering investors exposure to the metal market.

Despite lingering market concerns, such as demand for catalytic converters, that have impacted PPLT’s performance, the fund presents an opportunity with a modest 0.60% expense ratio and current favorable pricing in the mid- to upper $80s range, positioning investors to benefit from the ongoing hybrid revolution.