Market Standouts: NVIDIA and Advanced Micro Devices

NVIDIA and Advanced Micro Devices (AMD) currently offer investors enticing opportunities. While both companies are trading at attractive levels, NVIDIA remains the top choice in the field. Even with its remarkable price surge, NVIDIA boasts a remarkably modest valuation at 34 times forward earnings.

Powerful Performance Indicators

NVIDIA’s products are experiencing soaring demand, leading to frequent upward revisions in sales and earnings estimates, and securing a coveted Zacks Rank #1 (Strong Buy) rating for the company.

On the other hand, AMD, positioned as a premier semiconductor manufacturer, also holds a advantageous position. With a Zacks Rank #2 (Buy) rating, AMD is forecasted to achieve an annual EPS growth of 25% over the next 3-5 years. Despite a recent stock decline exceeding -30% from its peaks, AMD’s future prospects remain promising.

Financial Outlook and Recommendations

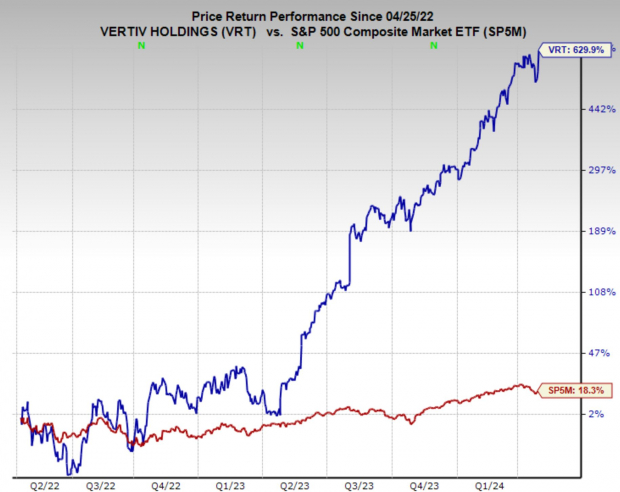

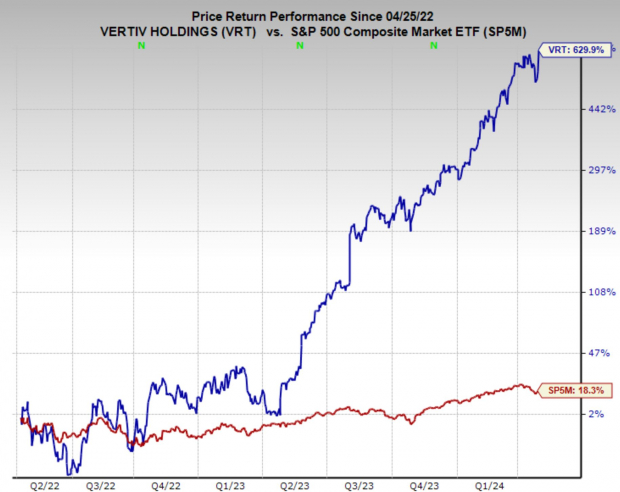

For investors seeking exposure to the artificial intelligence and technology sectors, Vertiv, Advanced Micro Devices, and NVIDIA emerge as worthy investment candidates. Following a recent market downturn, both AMD and NVIDIA are trading below their recent highs, with Vertiv soaring to new all-time highs post-earnings report.

Promising Returns in Cryptocurrency

Bitcoin has outperformed all other asset classes by a significant margin. Despite its volatility, historical data shows impressive returns during the last three presidential election years: +272.4% in 2012, +161.1% in 2016, and +302.8% in 2020. Anticipations of another substantial surge in the near future further contribute to the allure of Bitcoin investments.

Enjoy these insights. Click here for a free report.

Access the Free Stock Analysis Report for Advanced Micro Devices, Inc. (AMD).

Check out the Free Stock Analysis Report for NVIDIA Corporation (NVDA).

Gain insights with the Free Stock Analysis Report for Vertiv Holdings Co. (VRT).

Visit Zacks Investment Research.