Microsoft (NASDAQ:MSFT) and other leading companies, known as the Magnificent Seven, have had a slow start in 2024. Some have even dubbed them the “Lag 7,” an unwarranted name, given the short duration of trading. While a tepid start isn’t a strong predictor for the rest of the year, it sets the stage for potential gains in the coming months.

Despite the group’s slow start, compared to fellow “Mag 7” member Apple (NASDAQ:AAPL), Microsoft is hardly the worst performer thus far due to Apple’s unfortunate downgrades from prominent Wall Street analysts. Although some might fear that Apple, being the world’s largest company, would drag down the market, I believe that companies proficient in artificial intelligence, such as Microsoft, are well-equipped to weather downturns and uphold their magnificence in this mildly bearish beginning of the year. Hence, my continued optimism for MSFT stock.

Microsoft: AI Continues to Drive Progress in 2024

Throughout 2023, Microsoft made substantial strides in AI, earning accolades from investors. Microsoft Copilot, the company’s AI assistant, has proven its worth. With new Windows PCs set to feature the “Copilot” key, users now have seamless access to a powerful generative AI. This year, I anticipate that Microsoft and other tech firms will strive to further integrate their generative AI platforms, reducing barriers to their usage compared to traditional search engines.

Breaking the habit of relying solely on search engines for questions will be no easy feat. It remains to be seen if physical buttons on new devices and the inclusion of Copilot on Windows operating systems can accomplish this. Yet, I see the new Copilot button proving as indispensable as the Netflix (NASDAQ:NFLX) button on modern-day television remote controls. Regardless, we should expect Microsoft to steadfastly push forward with AI advancements.

Microsoft Stock: What About Its Valuation?

While the narrative around AI has been priced in for some time, I believe there is still room for Microsoft to surprise, particularly in terms of financial performance. This year will provide insights into how much AI can bolster the company’s bottom line and possibly offer long-term guidance. The overarching question remains: can Microsoft justify its lofty valuation with its impressive suite of AI technology and talent? Many analysts are of the opinion that it can.

Currently, MSFT shares trade at just under 36 times trailing price-to-earnings (P/E), representing a nearly 15% premium compared to the stock’s five-year historical average P/E of around 31.6 times. Given Microsoft’s AI prowess, a premium seems justified. In my estimation, a premium exceeding 25% is not unreasonable, considering AI’s sustained impact on the company’s profitability.

Analyst Brent Thill from Jefferies foresees Microsoft’s continued growth this year, with his price target of $450.00 indicating over 22% upside from Friday’s closing price. Thill confidently asserts that Microsoft possesses the “best AI lineup in software,” a sentiment with which I wholeheartedly concur. After all, Microsoft was at the vanguard of the AI surge a year ago, thanks to its involvement with OpenAI and the debut of Bing AI.

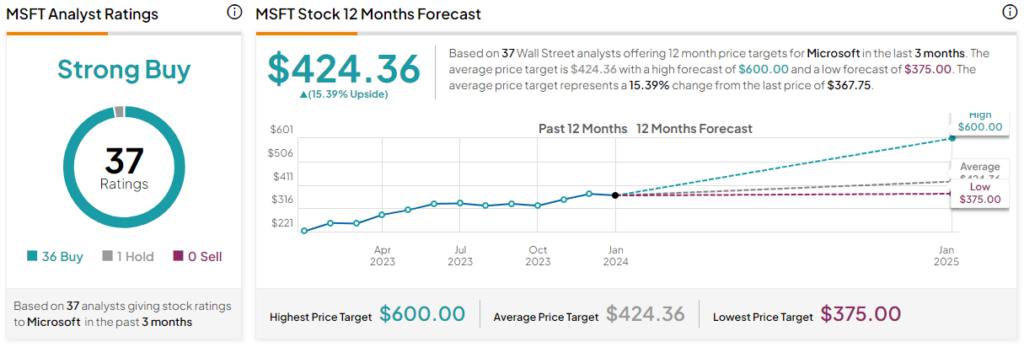

Is MSFT Stock a Buy, According to Analysts?

MSFT stock on TipRanks stands as a Strong Buy. Out of 37 analyst ratings, 36 recommend Buy and one suggests Hold. The average price target for MSFT stock is $424.36, translating to an upside potential of 15.4%. Analyst price targets span from a low of $375.00 per share to a high of $600.00 per share.

Notwithstanding last year’s resplendent gains (MSFT surged roughly 60%, outperforming the Nasdaq (NDX)), Microsoft seems poised for further growth. The loftiest price target of $600.00 (equating to more than a 63% increase from current levels) is courtesy of Truist Financial’s Joel Fishbein.

Fulfilling Fishbein’s lofty target in 2024 will necessitate the alignment of numerous positive factors. Yet, as analysts rush to revise their price targets for the year, I do not consider the highest target far-fetched in the least.

The Takeaway: MSFT Will Likely Stay Exemplary in 2024

As Microsoft builds upon its strengths from last year, it appears only a matter of time before the software giant wrests the title of “world’s largest company by market cap” from Apple’s grasp. Apple currently grapples with uncertainty regarding its AI strategy. For Microsoft, it seems to have the clearest AI roadmap among the Magnificent Seven. Therefore, I anticipate that it will maintain its exemplary status in 2024.