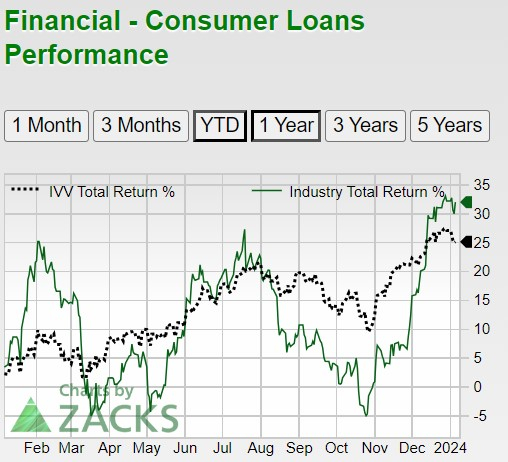

Easing inflation has made many consumer loan stocks more attractive with the Zacks Financial-Consumer Loans Industry producing a total return of +32% over the last year when including dividends.

Among the space, Capital One Financial and Discover Financial Services are two of the more prominent names and now may be a good time to gauge if investors should buy stock in either of these consumer loan titans for more upside.

Overview & Attractive Valuations

Capital One and Discover shares appeared to be vastly undervalued for most of 2023 after the collapse of Silicon Valley Bank and other regional banks led to fear and panic selling amongst the broader financial sector earlier in the year.

Still, they have a dominant presence as it relates to consumer lending via personal loans and credit offerings with Discover also offering home loans while Capital One has focused on auto loans after discontinuing its mortgage services in 2017.

Although Capital One and Discover shares have started to rebound they still trade at just 9.6X and 8.9X forward earnings respectively. Both trade well below the S&P 500’s 19.6X and closer to the Zacks Financial-Consumer Loans Industry average of 7.5X.

In terms of price to sales, Capital One’s P/S ratio of 1.3X and Discover’s 1.6X are below the optimum level of less than 2X, and the S&P 500’s 4.2X with their industry average at 0.9X.

Outlook Comparison

Capital One and Discover’s sales growth have remained very attractive even as high inflation slowed the post-pandemic boost they received on their bottom lines.

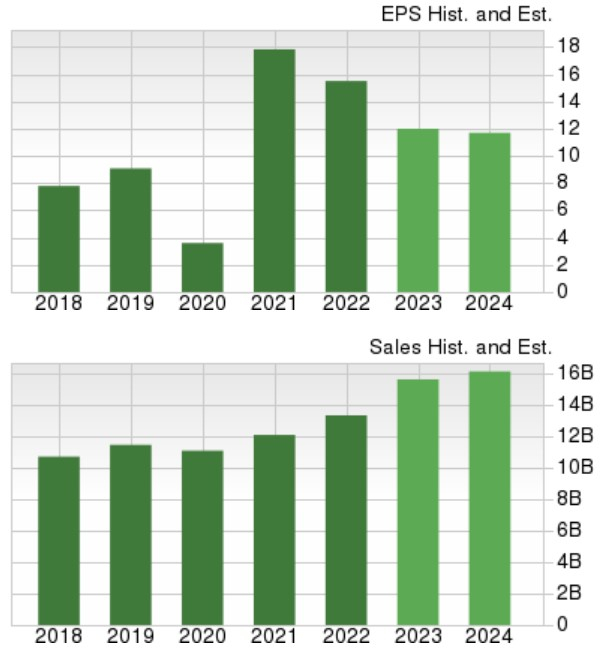

To that point, Capital One is now forecasted to round out its fiscal 2023 with earnings of $12.79 a share versus $17.71 per share in 2022.

With that being said, FY24 EPS is projected to rebound and rise 8% to $13.78 per share. Plus, total sales are projected to have risen 7% in FY23 and are expected to rise another 4% this year to $38.36 billion.

Pivoting to Discover, annual earnings for FY23 are anticipated at $12.27 a share compared to $15.50 per share in 2022. Fiscal 2024 earnings are expected to stabilize and rise over 1% to $12.47 per share.

Discover’s total sales are projected to have soared 18% in FY23 and are forecasted to rise another 6% in FY24 to $16.66 billion.

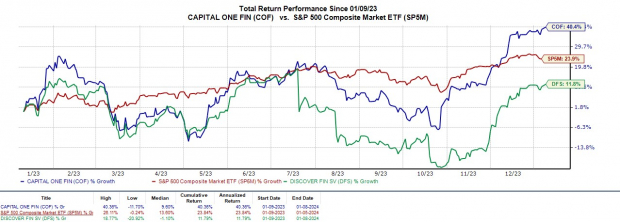

Recent Total Return Performance

Piggybacking on the strong performance and rebound of the Zacks Financial-Consumer Loans Industry over the last year, Capital One’s +40% total return has topped its Zacks Subindustry’s +32% and the benchmark’s +24% while Discover’s +12% has trailed.

Despite Discover’s price performance trailing the broader market its 2.5% annual dividend yield is noticeably above the S&P 500’s 1.4% and even tops its industry average of 2.2% with Capital One’s yield at a respectable 1.81%.

Takeaway

At the moment, Capital One Financial and Discover Financial Services’ stock both land a Zacks Rank #3 (Hold).