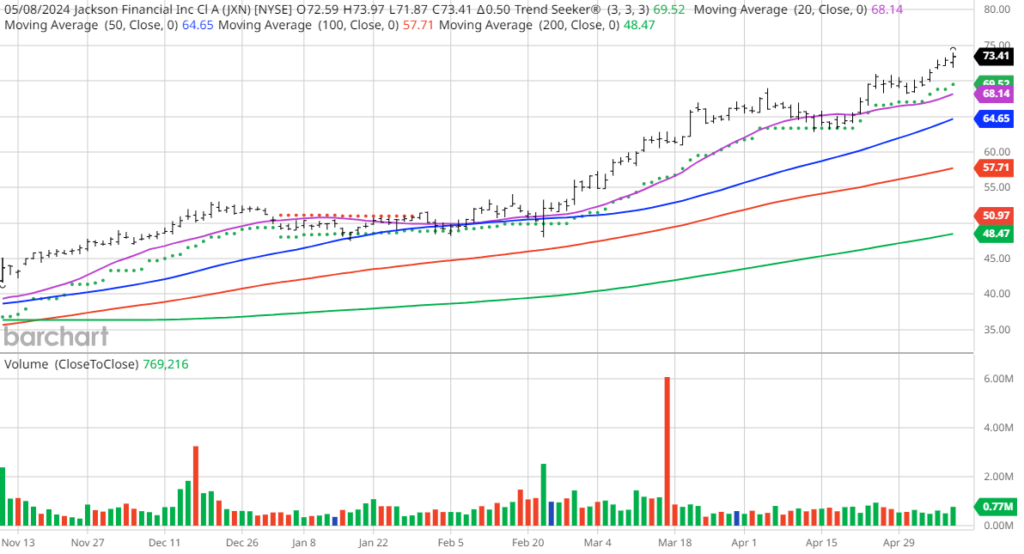

The story of Jackson Financial (JXN) is akin to a phoenix rising from the ashes, soaring high above the ordinary. Just like a skilled craftsman honing his masterpiece, utilizing the exquisite Barchart screening tools, a perfect find emerged – Jackson Financial, the epitome of excellence in the realm of annuities. Since the Trend Seeker illuminated the path on 1/30, the stock has ascended by an impressive 42.85%, painting a portrait of remarkable success.

Jackson Financial Inc., a titan among its peers, offers a dazzling array of annuities, sculpting a financial haven for retail investors across the expanse of the United States. Operating through three distinct segments – Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks – Jackson Financial stands as a beacon of reliability and innovation in the annuity landscape. From traditional guaranteed investment contracts to a myriad of protection products like whole life insurance and annuities, Jackson Financial leaves no stone unturned in catering to the diverse needs of its clientele. The company’s metamorphosis, formerly known as Brooke (Holdco1) Inc., into Jackson Financial Inc. in July 2020 marks a strategic evolution befitting its status as a powerhouse since its inception in 2006, with its headquarters nestled in the heart of Lansing, Michigan.

When we peek behind the curtain at Barchart’s Opinion Trading systems, a tapestry of technical prowess unfolds before our eyes with:

- 100% technical buy signals

- Weighted Alpha soaring beyond at 162.10+

- An awe-inspiring 107.49% gain in the last year

- Guidance from the Trend Seeker buy signal

- Majestically perched above its 20, 50, and 100 day moving averages

- Witnessing 9 new highs and an upward surge of 10.79% in the last month

- Exhibiting a Relative Strength Index standing tall at 73.68%

- A formidable technical support level established at $72.26

- Trading at $73.41 with a 50-day moving average standing at $34.65

Diving into the fundamentals, the cornerstone of any great entity, we unearth:

- A Market Cap of an impressive $5.64 billion

- A P/E that resonates at 5.64

- A bountiful Dividend yield of 3.51%

- An anticipated Revenue growth of 117.70% this year, with another 2.00% projected for the next

- Earnings estimated to scale new heights with a 25.90% increase this year and an additional 10.00% next year

The voices of analysts and investor sentiment sing in unison, offering a melodic chorus of insights:

- Wall Street echoes 1 buy and 3 hold recommendations on the stock

- Price targets enshrined between $55 to $75, shimmering with promise

- CFRA’s MarketScope stands steadfast with a hold rating

- MorningStar’s melodic hymn places a Fair Value crown at $90.93

- A devout following of 9,420 investors prayerfully watching over the stock on Seeking Alpha

In the world of investments, volatility and speculation often dance hand in hand. The Barchart Chart of the Day, while a tantalizing glimpse of current price appreciation, serves not as a direct buy recommendation but as a vivid showcase of the intricate dance of the market. Should investors choose to tango with one of these stocks, prudence dictates a dance routine carefully choreographed with diversified assets, accompanied by the rhythm of a moving stop loss discipline to protect against the capricious nature of the market’s ebbs and flows.