The Rise of Cannabis Debt

The cannabis debt market is ablaze! The five recent issues showcased on the chart sizzled in the third quarter of 2024, collectively netting a whopping $632 million in proceeds. This fervor surpasses any quarter’s performance since the tail end of 2021, painting a vivid picture of the scorching hot nature of cannabis credit markets.

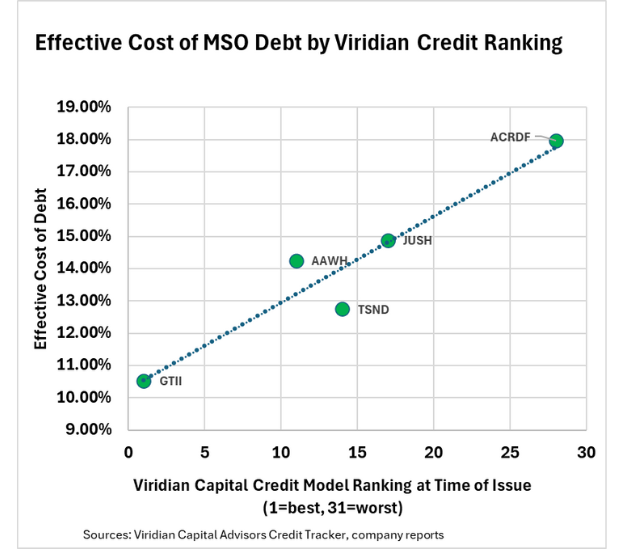

A Detailed Visual

The graphic portrays the effective transaction cost vertically against the Viridian Credit Ranking horizontally. The tight fit of the regression line, sporting an impressive R-squared of .91, indicates a finely tuned market that systematically factors in the credit risk of issuers when pricing new ventures.

Unveiling Outliers

A standout among the pack is the 12.75% transaction cost for TerrAscend, a figure higher than expected. The company’s less-than-stellar credit ranking, owing in part to liquidity pressures mitigated by the fresh financing, now finds itself perched three spots higher at #11.

Refinancings Galore

All the deals depicted on the chart represent refinancings of existing debt. Earlier in the year, additional refinancings totaling $114 million took place for AYR, PharmaCann, and Cannabist, underlining a robust trend in the cannabis credit market.

Diverse Debt Deals

Growth capital debt deals are not just the playground of public companies. Private players too have dipped their toes, with notable deals like the $40 million Sunburn transaction and the $20 million Nova deal making waves in cannabis credit circles.

Broad Investor Appetite

This week’s Acreage refinancing serves as a prime example of investors showing hunger for companies spanning the credit quality spectrum. Viridian currently ranks Acreage at #28/31 due to its substantial liabilities but anticipates an uptick in the company’s positioning post-transaction, reflecting dynamic market conditions.

A Reliable Capital Source

Amidst a sluggish and skeptical equity market, the debt arena emerges as a stalwart capital source for the cultivation and retail sector of the cannabis industry. Whether it’s rock-solid credits like Green Thumb or more challenging players like Jushi and Acreage, the debt landscape continues to provide much-needed financial fuel.

These insights drawn from the Viridian Capital Chart of the Week underscore crucial investment, valuation, and M&A trends sourced from the Viridian Cannabis Deal Tracker, an invaluable tool shaping strategic decisions in the cannabis landscape.