Financial Landscape Amidst Market Volatility

Amidst the chaos engulfing the cannabis sector, symbolized by the 15.24% plummet of the MSOS ETF after the DEA’s decision delay, the terrain remains unstable. With the U.S. elections looming and differing views on cannabis policy, uncertainty lingers like a heavy fog.

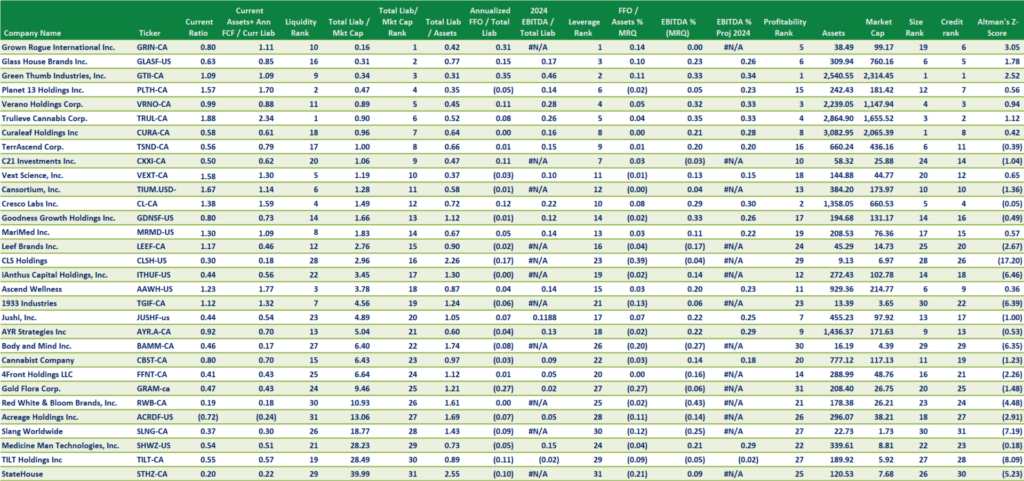

Sector’s Fiscal Health Overview

A glimpse into the world of cannabis finances, courtesy of the Viridian Capital Advisors, reveals a medley of conflicting debt-to-EBITDA ratios. The industry’s median stands at a manageable 2.98, a lifeline amidst the stormy seas of regulatory obstacles like the 280e tax code. Yet, the upper echelons speak of unsustainability, hinting at a sector still seeking financial solid ground.

The Financial Warriors

Among the ragtag group of resilient combatants, one finds companies dancing on the edge of volatility, showcasing deft financial maneuvers:

- Vext Science tumbled slightly to $0.16, a mere drop amidst stable trading waves. Despite an 8% revenue dip, Vext’s plans in Ohio and streamlined operations in Arizona signal a future dance of growth, with positive adjusted EBITDA in Q2 of 2024.

- C21 Investments saw its stock soar by 11.5295% to $0.2399, riding high on 10,025 shares’ worth of trading frenzy. With inflationary gusts blowing, a slight revenue move didn’t deter C21, maintaining a robust operational rhythm, showcasing a solid financial tango beneath the turbulent surface.

- iAnthus Capital Holdings, though witnessing an 8.7838% price plummet to $0.0135, flaunts improved credit armory. Despite raking in $43.0 million in revenue, with a significant net loss, iAnthus reveals signs of financial resuscitation, buoyed by a beefed-up cash reserve and working capital improvements, a faint glimmer of hope amidst dark clouds.

Credit Conundrum for Other Contenders

While some donned their financial armor adeptly, others like TerrAscend, AYR Strategies, and MariMed felt the credit lance point them downwards. The likes of Red White & Bloom, Acreage, and Slang Worldwide waved distress flags with staggering liabilities, shadowing their market cap.

Market News and Data brought to you by Benzinga APIs