The Call of the Whales on Coca-Cola

Wealthy investors are making bold moves, taking a bearish stance on the iconic brand that is Coca-Cola.

For regular retail traders, this market insight could prove invaluable.

These seismic shifts were unveiled through publicly available options data, meticulously scrutinized by vigilant eyes over at Benzinga.

Within these colossal transactions lie the whispers of potential foresight, hinting at future endeavors yet unseen.

But what tales do these transactions tell?

Today, Benzinga’s options scanner brought to light 10 unconventional options contracts tied to Coca-Cola.

An occurrence far from the norm, indeed.

The general sentiment from these high-rolling traders is a juxtaposition: 20% optimistic and 50% pessimistic.

Among the array of distinctive options unearthed, 5 are puts, totaling an impressive $318,061, while 5 are calls, summing up to $168,302.

Forecasting Future Prices

Factoring in the Volume and Open Interest within these agreements, it appears that the whales have set their sights on a price bracket between $52.5 and $70.0 for Coca-Cola over the past quarter.

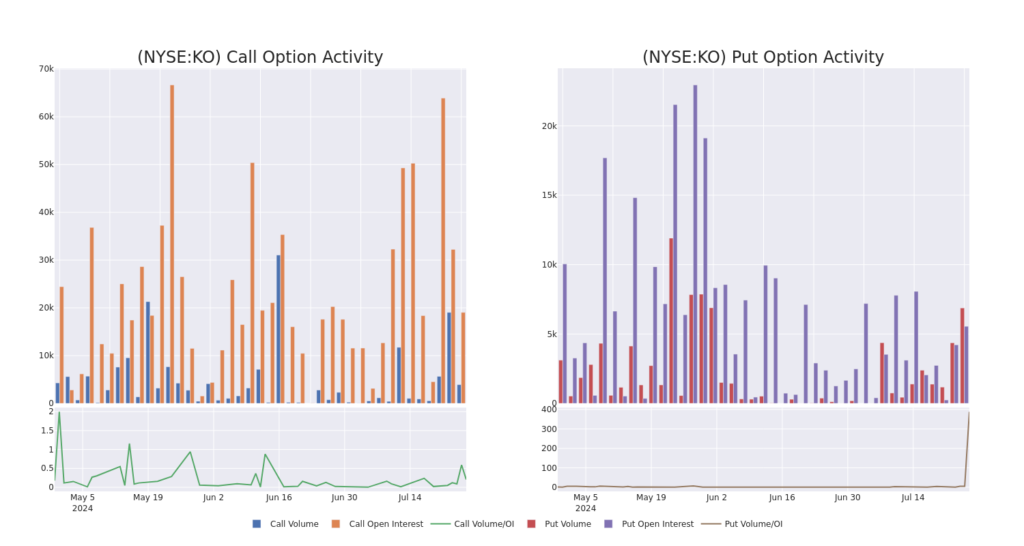

Delving into Volume & Open Interest

An examination of the volume and open interest unveils critical insights crucial to grasping the stock’s potential trajectory. This data serves as a barometer for liquidity and enthusiasm pertaining to Coca-Cola’s options within the strike price spectrum of $52.5 to $70.0 over the recent month.

Snapshot of Coca-Cola’s Options Performance Over Last 30 Days

Fascinating Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | PUT | TRADE | BEARISH | 07/26/24 | $2.25 | $1.99 | $2.19 | $69.00 | $109.5K | 8 | 500 |

| KO | PUT | SWEEP | BEARISH | 08/16/24 | $0.24 | $0.23 | $0.24 | $65.00 | $65.9K | 5.5K | 3.7K |

| KO | PUT | TRADE | BEARISH | 07/26/24 | $2.11 | $2.01 | $2.08 | $69.00 | $62.4K | 8 | 500 |

| KO | CALL | SWEEP | BEARISH | 01/17/25 | $4.35 | $4.25 | $4.25 | $65.00 | $44.2K | 10.0K | 285 |

| KO | PUT | TRADE | BULLISH | 07/26/24 | $2.14 | $2.05 | $2.07 | $69.00 | $41.3K | 8 | 1.5K |

Exploring Coca-Cola’s Legacy

Established in 1886, the Atlanta-based Coca-Cola reigns as the globe’s premier purveyor of nonalcoholic beverages. Their extensive lineup comprising 200 brands spans various categories, including sodas, water, sports, energy drinks, juices, and coffee. Collaborating with bottlers and distributors, the conglomerate disperses finished beverages under the Coca-Cola umbrella across 200+ countries. With a lion’s share of revenue sourced from international markets, particularly burgeoning regions like Latin America and Asia-Pacific, Coca-Cola’s reach knows no bounds.

The Market Impression of Coca-Cola

- With a trading volume of 13,317,693 trades, Coca-Cola’s shares have ascended by 1.48%, reaching $67.05.

- RSI metrics signal a potential overbought scenario for the stock.

- The eagerly anticipated earnings report is a mere 88 days away.

Expert Musings on Coca-Cola

A panel of 5 seasoned analysts has recently weighed in on Coca-Cola, collectively settling on an average price target of $72.0.

- JP Morgan’s analyst maintains an Overweight outlook on Coca-Cola, pegging a price target of $72.

- Citigroup’s analyst, unswayed, holds a Buy recommendation for Coca-Cola, aiming for a price threshold of $75.

- Barclays’ analyst is resolute in their Overweight rating on Coca-Cola, sustaining a target price of $70.

- Wells Fargo’s analyst stands by an Overweight stance on Coca-Cola, envisioning a price target of $73.

- TD Cowen’s analyst maintains a Hold perspective on Coca-Cola, setting a target price of $70.

The realm of options trading is rife with peril and potential. Astute traders navigate these turbulent waters through continuous learning, strategic adjustments, employing diverse indicators, and keeping a finger on the pulse of market dynamics. Stay abreast of Coca-Cola’s latest options moves with Benzinga Pro for timely alerts.