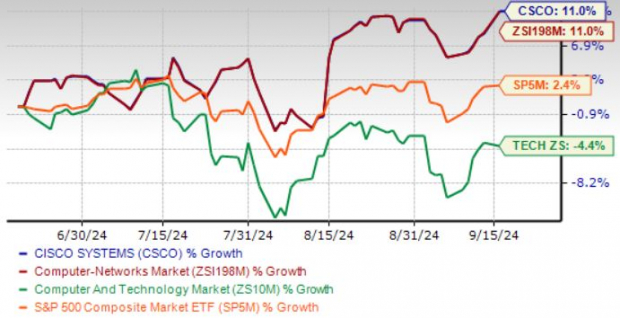

Cisco Systems (CSCO) shares have seen an upward surge of 11% in the last three months, albeit trailing behind the Computer & Technology sector’s decline of 4.4%. The recent rally mirrors the company’s bright prospects, driven by robust AI-related order growth.

Cisco’s Positive Trend and Revenue Outlook

Cisco’s shares are currently trading above both the 50-day and 200-day moving averages, signaling a bullish trajectory. Projections for fiscal 2025 estimate revenues to fall within the range of $55 billion to $56.2 billion, surpassing the $53.8 billion reported in fiscal 2024.

Cisco’s Price Performance in the Last 3 Months

The Zacks Consensus Estimate for fiscal 2025 revenues stands at $55.61 billion, reflecting a notable 3.36% year-over-year growth rate.

Cisco’s Earnings Disappointment

Despite impressive revenue forecasts, Cisco’s earnings outlook for fiscal 2025 is underwhelming. Non-GAAP earnings are predicted to range between $3.52 and $3.58 per share, down from $3.73 reported in fiscal 2024.

Cisco’s Ongoing Challenges and Future Resilience

The tech giant faces challenges, especially in the AI-driven networking arena, amidst heightened competition stemming partly from industry moves such as Hewlett Packard’s pending acquisition of Juniper. This begs the question – is Cisco’s current stock position a Buy, Sell, or Hold?

Cisco’s Innovations and Market Opportunities

Cisco’s strategic focus on AI, cloud, and cybersecurity is paving the way for future growth. The company’s investments in these areas, coupled with recent acquisitions like Splunk, are expected to bolster its competitive position in the evolving tech landscape.

Partner Collaborations and Technological Advancements

Collaborations with tech giants such as Microsoft, NVIDIA, Lenovo, and AT&T underscore Cisco’s commitment to innovation. Initiatives like the Cisco-NVIDIA partnership aim to revolutionize the tech infrastructure, gearing up for the demands of the digital era.

Evaluating Cisco’s Stock Value

Despite its promising growth prospects, Cisco’s stock valuation is currently stretched, indicating that investors might be paying a premium for its shares. The company’s forward 12-month Price/Sales Ratio compared to industry peers suggests cautious investment considerations.

The Decision: Buy, Sell, or Hold Cisco Shares

While Cisco’s expanding portfolio and strong industry foothold present compelling reasons to hold onto the stock, its current valuation may warrant a closer look. Investors considering Cisco should weigh the company’s long-term potential against its current market position before making investment decisions.

For now, Cisco holds a Zacks Rank #3 (Hold), indicating a neutral stance on the stock. Investors are advised to assess their entry points wisely and monitor the company’s performance amid the evolving market dynamics.