Large investors are taking a pessimistic stance on Core Scientific (CORZ), indicating a significant shift that shouldn’t be overlooked by market participants. Initial findings from public options data through Benzinga have brought to light this significant move today, implying a potentially impactful event on the horizon.

Today’s observation by Benzinga’s options scanner revealed 10 exceptional options activities for Core Scientific, an unusual level of engagement in the market.

The sentiment among these influential investors is split, with a 40% inclination towards bullish positions and 60% favoring bearish views. Noteworthy among these options are 8 puts, valued at $335,625, and 2 calls, totaling $531,044.

Revealing the Price Target

Based on an analysis of trading volumes and open interest data, it becomes apparent that major market players are eyeing a price range of $7.5 to $10.0 for Core Scientific over the past three months.

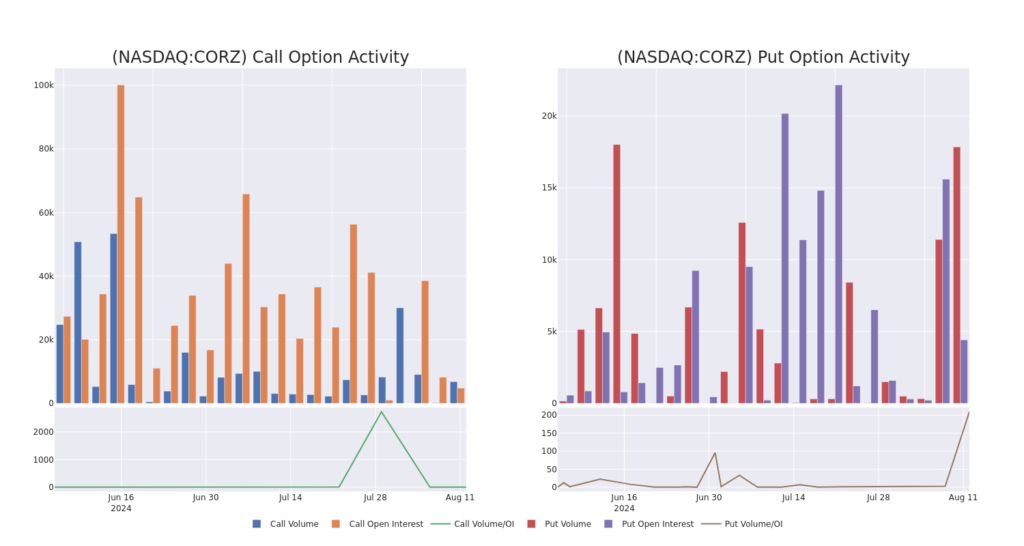

Trends in Volume & Open Interest

Examining volume and open interest data is a strategic move in options trading, offering insights into the liquidity and interest levels for Core Scientific’s options at various strike prices. The evolution of call and put volume and open interest for significant trades within the $7.5 to $10.0 strike price range in the last 30 days paints a revealing picture.

An Overview of Call and Put Volume for Core Scientific: Past 30 Days

Identifying Major Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CORZ | CALL | TRADE | BULLISH | 08/16/24 | $1.9 | $1.9 | $1.9 | $7.50 | $380.0K | 4.8K | 2.0K |

| CORZ | CALL | SWEEP | BEARISH | 08/16/24 | $2.9 | $1.95 | $1.96 | $7.50 | $151.0K | 4.8K | 4.8K |

| CORZ | PUT | SWEEP | BULLISH | 08/30/24 | $0.3 | $0.25 | $0.3 | $9.00 | $77.1K | 37 | 2.5K |

| CORZ | PUT | SWEEP | BEARISH | 08/16/24 | $0.6 | $0.55 | $0.6 | $10.00 | $46.9K | 3.3K | 2.0K |

| CORZ | PUT | TRADE | BULLISH | 08/16/24 | $0.7 | $0.65 | $0.65 | $10.00 | $46.8K | 3.3K | 3.5K |

Exploring Core Scientific

Core Scientific Inc specializes in Blockchain and AI Infrastructure, Digital Asset Self-Mining, Premium Hosting, and related services in Blockchain Technology and Artificial Intelligence. Operating across Equipment Sales and Hosting segments, the company engages in blockchain infrastructure, third-party hosting, and digital asset mining activities. Revenue is generated through consumption-based contracts, hosting services, and digital asset mining operations.

Given the recent options activity surrounding Core Scientific, it’s imperative to delve into the company’s current operational performance.

Current Position of Core Scientific

- Trading volume stands at 3,859,592, with CORZ’s price experiencing a -1.55% decline, settling at $9.55.

- RSI indicators suggest the stock is currently in a neutral position between overbought and oversold territories.

- An earnings announcement is anticipated in 93 days.

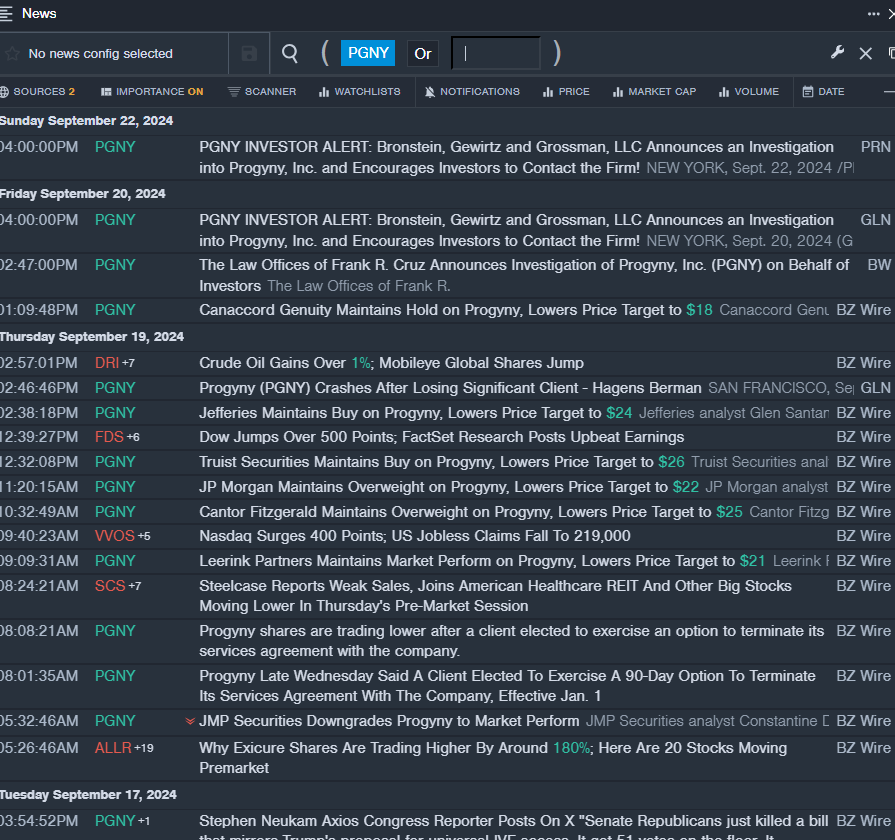

Analyst Assessments for Core Scientific

Over the past month, 3 analysts have provided ratings for the stock, with an average target price of $17.67. Recent updates include:

- B. Riley Securities raising its rating to Buy with a revised target price of $13, reflecting a positive outlook.

- Cantor Fitzgerald lowering its rating to Overweight and adjusting the target price to $20, indicating a shift in sentiment.

While options trading carries higher risk compared to stock trading, it also presents greater profit potential. Seasoned options traders mitigate this risk through continuous learning, strategic trade scaling, multifaceted indicator analysis, and vigilant market monitoring.

For real-time updates on the latest options trades concerning Core Scientific, consider utilizing Benzinga Pro for timely options trade alerts.