Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been the beneficiary of its formidable search engine, which has served as its primary revenue source for more than two decades. This robust foundation has enabled the firm to construct arguably the most exceptional infrastructure and product pipelines in the technology sector.

Based on this robust infrastructure, Alphabet is poised for further growth and increasing shareholder value, presenting a compelling case for its potential to lead you towards becoming a millionaire.

Elevating the Core Business and Capital Deployment

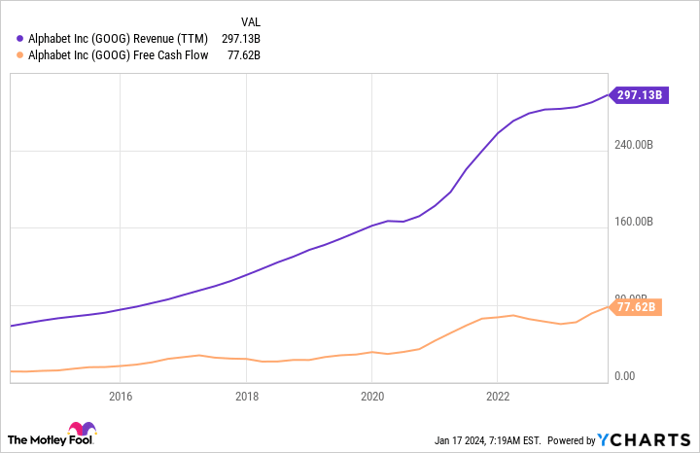

Alphabet’s revenue and free cash flow over the last decade, predominantly driven by search engine growth and substantial profits, are depicted in the chart below. This trend is indicative of its capacity to sustain as a lucrative cash-generating entity.

GOOG Revenue (TTM) data by YCharts

While the search business may evolve over time, there are strong indications that it will persist as a significant revenue-generating engine for Alphabet, given its colossal user base and extensive advertising network.

Anticipate a substantial shift in the coming decade with Alphabet’s increased focus on returning cash to its shareholders. With the company’s initiation of buybacks, this trend could accelerate as the core business transitions from expansion to extraction.

Cloud Services and Artificial Intelligence: The Future Growth Drivers

The cloud and artificial intelligence (AI) represent untapped potential for growth. Although Google Cloud has evolved into a $31.2 billion business, its $372 million operating income over the past year indicates room for enhanced bottom-line growth.

Beyond cloud services, Alphabet’s AI and its advanced chips and models mark a potential catalyst for the firm’s future growth trajectory, positioning it as a frontrunning entity alongside Nvidia. These developments could pave the way for a new phase in the company’s growth.

Marrying these two businesses creates promising opportunities for Alphabet. The refinement of its AI may result in product enhancements and additional use cases such as chatbots and superior virtual assistants. Furthermore, third-party companies might leverage Alphabet’s AI models, chips, and cloud services. Overall, Alphabet’s commanding presence in the AI arena could propel its growth for years to come.

Notably, Alphabet possesses a distinct advantage over its competitors with the potential to monetize the AI tools being developed. While OpenAI levies a monthly fee for ChatGPT, it is increasingly speculated that this could evolve into an advertising avenue for users seeking information through ChatGPT. Unlike OpenAI, Alphabet can seamlessly integrate these tools into one of the world’s largest advertising platforms today.

Waymo and Diverse Investments: Promising Path to the Future

In addition to the thriving core search business and the burgeoning cloud and AI segments, Alphabet’s foray into unconventional business endeavors offers substantial potential for the company. Categorized as “other bets,” these investments hold significant promise, with Waymo standing out as a prospective powerhouse. Boasting the most advanced autonomous driving technology in the industry and a meaningful partnership with Uber, Waymo has the potential to substantially elevate Alphabet’s value.

Alphabet’s diverse ventures, spanning from fiber optics to healthcare, harbor untapped value, which is not fully reflected in the current stock valuation. The realization of even a single successful venture among these could yield a substantial windfall for the company.

Prospects of Millionaire-Making

Over the past decade, Alphabet’s stock has catapulted by 452%, marking an astonishing return. Notably, an investment of $181,000 in early 2014 would have metamorphosed into $1 million over this period, accentuating the wealth-building potential of the stock.

While recreating the same returns over the next decade may be ambitious, an annual stock valuation appreciation of 15% is a reasonable expectation, potentially transforming a $250,000 investment into $1 million. At this rate, transforming a $10,000 investment into $1 million would require closer to 33 years.

Before investing in Alphabet’s stock, it is crucial to consider alternative viewpoints; however, the historical performance of the company’s stock makes it a compelling candidate for growth-focused investors.