Apple (NASDAQ: AAPL) encountered a stumbling block earlier this year with a 12% dip in shares by May. Factors like flagging product sales, challenging market conditions, and an uncertain footing in the AI realm prompted investor caution.

However, the tech behemoth executed a remarkable turnaround, with shares skyrocketing by 34% post-May 1. Apple won back the favor of Wall Street by surpassing Q3 2024 expectations and hinting at a promising AI future. In Q3 2024 (ending June 29), the company’s revenue surged by 5% year-over-year, exceeding analysts’ predictions by $1.4 billion. Noteworthy highlights included a 24% surge in iPad sales and a 14% uptick in services revenue.

Apple’s Strategic AI Pivot

Looking ahead, Apple is primed for a significant foray into AI, set to unveil its iPhone 16 in September and debut Apple Intelligence—an extensive OS overhaul. Apple’s stock has witnessed a remarkable 177,000% surge since going public in 1980, fueled by groundbreaking products like the inaugural iPhone. The company is now on the cusp of a pioneering AI-driven era that could potentially unlock substantial gains as its technology evolves.

In a striking revelation, Apple disclosed the date for its much-anticipated iPhone keynote in late August, scheduled for September 9, heralded by the slogan “It’s Glowtime,” likely alluding to its AI focus. The company’s deepening AI footprint includes the unveil of Apple Intelligence in June and the impending launch of the iPhone 16—a gadget engineered with AI at its core, backed by billions in R&D spend.

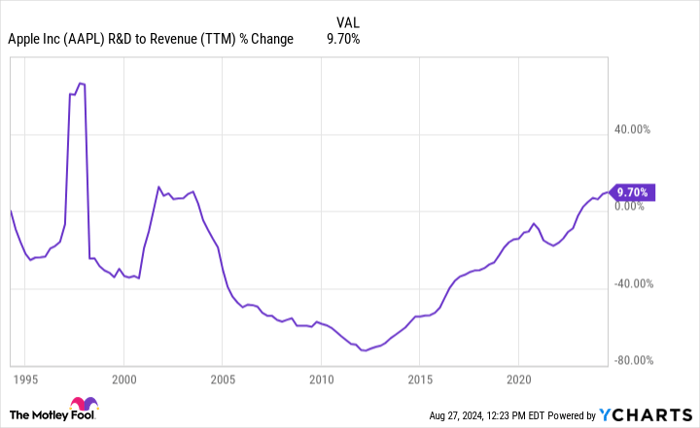

The surge in Apple’s R&D expenditure, reaching $8 billion in 2024 (a 10% increase from the previous year), underscores the company’s commitment to AI. Notably, the last time Apple’s R&D peaked to such levels was during the lead-up to the groundbreaking iPhone launch, underpinning a subsequent 60,000% stock rally.

While the hefty AI investments might raise eyebrows, they also beg the question: What groundbreaking innovation is Apple brewing? Renowned for its measured market approach, Apple traditionally enters a sector gradually, then swiftly ascends to dominance—snatching market share from incumbents, as witnessed with the iPhone, iPad, AirPods, and Apple Watch. With a robust free cash flow of $104 billion in 2024, Apple is well poised to sustain its AI drive and close the gap on competitors, making now an opportune moment for investment before a potential stock surge over the ensuing decade.

Monetization Opportunities in Apple’s AI Journey

While companies like Microsoft, Amazon, and Alphabet focus primarily on the business AI domain, Apple holds the key to consumer AI dominance. Leveraging the popularity of its product suite and the prospect of premium AI services supplementing its digital subscription arsenal positions Apple favorably to carve a lucrative niche in the industry.

Over the past five years, services revenue growth has eclipsed all other Apple segments, indicative of an upward trajectory. Forecasts suggest services could outstrip iPhone revenues, emerging as Apple’s top-earning sector. A strategic AI overhaul of its products could stimulate mass upgrades, while novel generative services stand to yield sustained revenue streams for Apple in the long run.

Projected earnings peg Apple at slightly exceeding $8 per share by fiscal 2026. Applying a forward P/E ratio of 34 translates to a $285 share price, marking a 25% stock growth over the forthcoming two fiscal years. Ergo, retaining Apple shares over a decade or more could catapult a substantial investment beyond the million-dollar threshold upon retirement.

Apple epitomizes substantial prospects and emerges as an enticing prospect for investors with a long-term horizon.

The Case for Investing in Apple Now

Before delving into Apple stock, contemplate this:

The Motley Fool Stock Advisor analyst squad recently pinpointed the supposed 10 best stocks for current investment opportunities… and Apple didn’t make the cut. These selected stocks are speculated to generate massive returns in the ensuing years.

Recall the notable inclusion of Nvidia in a similar list back on April 15, 2005. A $1,000 investment at the recommendation time would have burgeoned into a colossal $731,449!* Such transformative insights from Stock Advisor furnish investors with a roadmap for success, inclusive of portfolio structuring guidance, analyst updates, and bi-monthly stock picks.

*Stock Advisor returns as of August 26, 2024