Nvidia(NASDAQ: NVDA) is akin to the charismatic rockstar of the chip stock universe. The company’s meteoric rise, a whopping 2,000% ascent over five years, catapulted its market cap to a staggering $2.4 trillion. Nvidia, once lauded for its gaming GPUs, shifted gears as the artificial intelligence (AI) market burgeoned, propelling its high-end data center GPUs to the forefront of complex AI task processing.

Image source: Micron.

Is it plausible that Micron(NASDAQ: MU), a stalwart in DRAM and NAND memory chips, could be the next luminary to mirror Nvidia’s ascension? Let’s delve into the divergences between these two chip giants to discern if Micron harbors the potential to saunter in Nvidia’s illustrious footsteps.

Unveiling the Disparities Between Micron and Nvidia

Unlike Nvidia, Micron not only designs but also fabricates its memory chips in-house at its own foundries. This approach distinguishes Micron from Nvidia, which, while adept at chip design, outsources production to third-party foundries such as Samsung and Taiwan Semiconductor Manufacturing Company. Micron endures the operational rigor of this capital-intensive model at much slenderer margins than the luxury Nvidia relishes.

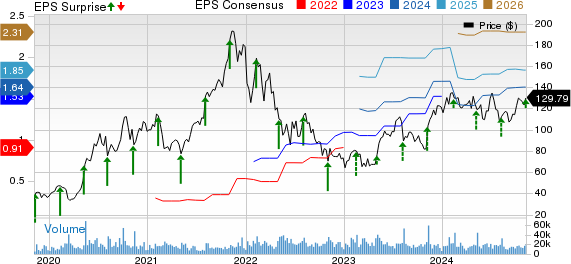

Data source: YCharts

Furthermore, Micron’s memory chips tout a moderate price tag relative to Nvidia’s GPUs, and it lacks the commanding dominance Nvidia wields in its niche markets. Standing as the third-largest purveyor of DRAM chips and fifth in the NAND chip realm, Micron pales before Nvidia’s towering presence. By JPR’s decree, Nvidia’s grip on the discrete GPU market stood unassailable at 80% by the closure of 2023, leaving a meager 19% morsel for AMD to savor.

While Micron operates within a more commoditized sphere compared to Nvidia, touting lesser sway against its competitors, it trudges through cyclic befalls endemic to the memory chip ecosystem. However, Micron’s realm boasts denser and more energy-efficient DRAM and NAND chips vis-a-vis its leviathan counterparts, Samsung and SK Hynix. This technological superiority emboldens Micron to entice discerning patrons of upscale PCs, mobile gadgets, and server suites.

The Unfolding Narrative of Micron’s Growth Trajectory

Embarked on a tumultuous detour over the past biennium, Micron grappled with a bruising slowdown as PC shipments dwindled post-pandemic, the 5G upgrade tempest abated, and macro headwinds encumbered its chip sales to enterprises and industrial patrons. Mired further by the Chinese government’s embargo on its memory chips, Micron’s galvanized growth in automotive and AI sectors couldn’t offset the ensuing storm.

Fiscal 2021 bore witness to a commendable 29% revenue uptick, while fiscal 2022 gingerly tiptoed with an 11% ascension, before plummeting by 49% in fiscal 2023. However, analysts project a vigorous 56% revenue escalation in fiscal 2024, followed by a 43% surge in fiscal 2025, undergirded by three discernible tailwinds. Firstly, stabilization looms for the PC and smartphone domains. Secondly, a lucrative deluge of chip sales beckons from the enterprise, industrial, and automotive alcoves as the macro ambience rekindles its warmth.

Crowning this crescendo, the generative AI realm unfolds as a luminous beacon, nudging data centers to ratchet up their memory chip fleet alongside Nvidia’s GPUs. Sanjay Mehrotra, the maestro orchestrating Micron’s symphony, professed during the recent conference call that the memory chip landscape waded in the nascent stages of a multiyear prosperity wave catalyzed by AI. These disruptive technologies solemnly vow to metamorphose every nook and cranny of commerce and society. Mehrotra foresaw a world where AI-infused phones would propound a 50% to 100% surge in DRAM content compared to their non-AI counterparts today.

Anticipating the Inevitable Reversal in Fortunes

While the horizon looms incandescent with promise, Micron’s new growth spiral inevitably draws a curtain on its splendor in a span of a few years. As industries inflate memory prices during fevered markets like smartphones, cloud data centers, and AI, manufacturers race to satiate this insatiable demand, often conducing to a surplus inventory backlash once the mania ebbs.

These ebbs and flows have steered Micron’s chip sales into decline in 2019 and 2022, painting a prelude to yet another impending retrenchment as the AI market matures.

While this impending growth cycle might wear a lengthier mantle than its predecessors, the inexorable denouement invariably spells a downturn. Nvidia, too, faces a comparable predicament. Yet, its sagas of decline have been markedly gentler across the last decade, owing to its supreme reign over the discrete GPU juncture, conferring it a vaster resilience against market vicissitudes vis-a-vis Micron, ensnared in the price machinations of its titanic adversaries.

Pondering Micron’s Voyager to Eminence

At a modest valuation of less than 4 times next year’s sales, Micron’s fortunes might ascend as it embarks on the next phase of its growth trajectory. Should its valuations perch stalwart and its revenue thrives at a CAGR of 30% over the subsequent five years, a nearly quadruple leap looms on the stock’s horizon. Undeniably a commendable feat, but not one fated to rival Nvidia’s laurels over the last quinquennium. In succinct terms, Micron adorns the mantle of a semiconductor bright spark—albeit, perched on the cusp of promise but a gulf away from Nvidia’s celestial heights.

Before venturing into the realms of Micron Technology’s stock domain, it’s prudent to mull over this nugget of wisdom:

The Motley Fool Stock Advisor team, seasoned maestros of market insights, recently unveiled their handpicked 10 best stocks poised to encapsulate investors’ dreams. And amidst these ten, Micron Technology didn’t clinch a spot. A cohort meticulously selected carrying the promise of behemoth returns in the twilight of impending years.

Stock Advisor unfurls a treasure trove of insights, a beacon illuminating the path to nefarious success with prudent counsel on portfolio curation and bimonthly stock revelations. Sealing its stature with an impressive tripling of S&P 500 returns since 2002*

*Stock Advisor returns as of March 25, 2024