Apple: A Steadfast Ship Amidst the Market Swell

Apple’s sail in the vast seas of the market has often led investors to treasure-laden shores, with some even amassing fortunes thanks to the Cupertino company’s stock performance. The tech titan’s consistent earnings growth, fueled by its iconic products like the iPhone and Mac, has propelled its shares to soar over 900% in the past ten years.

Yet, on the horizon of late, murky clouds in the form of weakening demand from China and a perceived lag in Artificial Intelligence (AI) investments have cast a shadow over Apple’s once bright prospects. Consequently, its stock price has remained stagnant this year, trailing behind the more nimble tech competitors in the race.

Weathering the Storm: A Mature Company’s Tale

Apple now stands as a mature growth company, unlikely to yield immediate explosive gains akin to its younger tech counterparts. However, within its storied walls lies a robust fortress—an economic moat of unparalleled brand strength. This stronghold ensures a steady stream of earnings over time, attracting both loyal customers and new converts to the Apple ecosystem.

Moreover, unlike many of its tech brethren, Apple offers investors a sweet dividend treat. This unique blend of growth and passive income makes it a sturdy vessel to navigate the volatile waters of the market.

Sailing Towards New Revenue Horizons

Peering through the spyglass reveals Apple’s formidable armada of over 2.2 billion active devices worldwide—each a potential revenue stream. The treasure trove lies not only in product sales but more significantly in services. Apple’s services revenue, steadily reaching new highs each quarter, contributes a significant 25% to its overall revenue mix.

The recent announcement of a mammoth $110 billion share buyback plan stands as a testament to Apple’s unwavering confidence in its future. This relentless pursuit of shareholder value bodes well for long-term investors eyeing the horizon.

Stoking the Furnace of Growth

Apple’s products, revered by a cult-like following, act as a bedrock for recurrent revenue through an array of services. Coupled with the dividend windfall, investors can ride the tide of passive income towards greater long-term gains.

However, it’s essential to remember that, like the caprices of the sea, no single stock, not even Apple, holds the key to instant millionaire status. Diversification remains the compass to navigate the treacherous waters of the market.

Adding Apple’s steady growth stock to your investment fleet, alongside other quality contenders, and setting sail for the long haul may pave the way towards the fabled shores of wealth in the years to come.

Leveraging Apple’s Strength in the Changing Tides

Before weighing anchor with Apple, heed this advice:

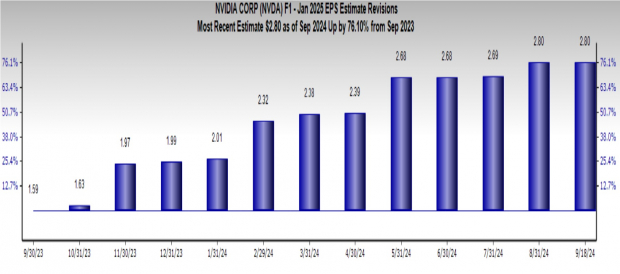

The esteemed analyst team at Motley Fool Stock Advisor has unearthed ten hidden treasures ripe for the taking, with Apple not in the vault. These gems hold the promise of monstrous returns in the evolving market landscape, reminiscent of past windfalls like Nvidia’s meteoric rise from the ashes.

Stock Advisor acts as the treasure map, guiding investors through the labyrinth of market complexities, offering the promise of riches that have outshone the broader market since 2002.

As the horizon beckons, consider the stars that align in your investment universe, each twinkling with the promise of wealth that Apple, like a wise navigator, can guide you towards.

*Stock Advisor returns as of May 13, 2024