Netflix (NFLX) stock is up 79% over the past 12 months and trading at a premium valuation. Does the streaming giant have another leg higher, or is the rally running out of steam? With the stock up significantly and shares trading at 38 times analysts’ December 2024 earnings estimates, it might seem that shares are running out of juice. However, the company has a secret weapon that it is ready to launch this month and expand as we head into 2025 – a new in-house ad server.

I’m bullish on Netflix because of its new in-house ad server, which should allow the company to capitalize on its growing ad-supported tier and make it a more valuable partner for advertisers, unlocking the next phase of the company’s growth.

Ad-Supported Memberships Are Growing

Things are going well for Netflix. The $324.6 billion company reported strong third-quarter results, growing revenue 15% year-over-year. Meanwhile, it increased operating income by a scorching 52% year-over-year to $2.9 billion, and its operating margin was 30%, up from 22% last year. In addition, ad-supported memberships are becoming a bigger part of the company’s business, as they grew a remarkable 35% quarter-over-quarter.

And Netflix’s new secret weapon is poised to make this ad-supported tier even more lucrative for the company in the months ahead. Netflix’s new ad server will launch in Canada this month and then in additional markets in 2025. Netflix previously relied on Microsoft’s (MSFT) ad server, but its new ad server will take advantage of partnerships with Google Live and Trade Desk (TTD).

What Is an Ad Server?

What is an ad server, and why is this important for Netflix? According to Amazon (AMZN) Web Services (AWS), ad servers are “the technology engines that allow advertisers and publishers to optimize, manage, and distribute ads across a multitude of paid channels,” such as Netflix and YouTube. Netflix’s ad server will allow it to sell advertising slots to potential advertisers who want to advertise to viewers watching Netflix content.

Digital ads like these are quite valuable to advertisers because they are more targeted and tailored to the specific viewer than traditional broadcast ads. Netflix is very close to the end user and their data, so based on the user’s viewing habits and other data, Netflix’s server may know that they like golf and can serve them ads for new golf clubs or golf apparel, which are more relevant to them than a broader ad for something they are not interested in.

As you can imagine, these narrowly-targeted, data-driven ads are also more valuable to the advertisers themselves.

“Episodic” Ads that Tell a Story

Netflix has also talked about the idea of serving customers “episodic” ads that tell a story within themselves, which could help to attract attention and maintain interest from viewers. Co-CEO and President Ted Sarandos says that the ad server is a “key server in unlocking value” in the ad-supported market and that “while we’ve got lots of work to do, we are very confident in our ability to execute and grow our ad business much like we did with the paid sharing initiative.”

Ultimately, the proprietary ad server will empower Netflix to deliver more targeted, more valuable ads to its growing number of ad-tier subscribers around the world, powering the next leg up in the company’s growth.

Netflix’s Valuation

As discussed above, Netflix trades at a premium valuation of 38.1 times earnings, but with analysts projecting earnings per share to grow to $23.79 for Fiscal 2025, the company trades at a slightly more inviting valuation of 31.8 times forward earnings, getting a bit closer to the S&P 500’s (SPX) average valuation of 25 times earnings.

As the company continues to grow its ad-supported tier and better monetize this segment thanks to its in-house ad server, earnings should continue to grow over time and make this valuation more palatable.

Is NFLX Stock a Buy, According to Analysts?

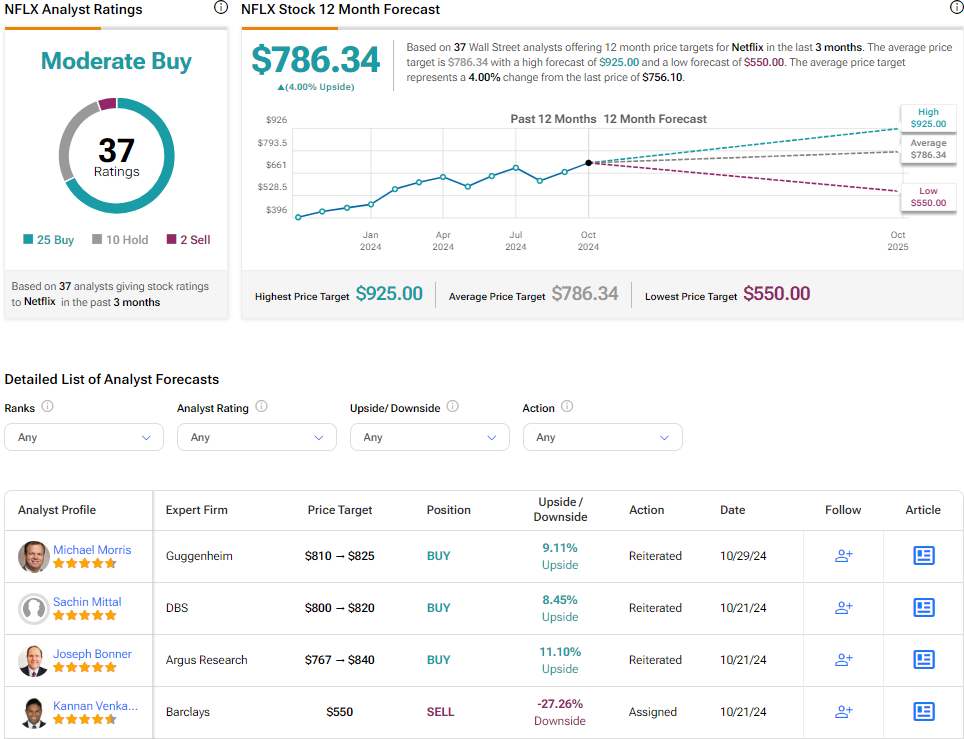

Turning to Wall Street, NFLX earns a Moderate Buy consensus rating based on 25 Buys, 10 Holds, and two Sells assigned in the past three months. The average NFLX stock price target of $786.34 implies 4% upside potential from current levels.

Smart Score

While Wall Street analysts view Netflix as a Moderate Buy, TipRanks’ proprietary Smart Score system is decidedly bullish. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of eight, nine, or 10 are considered equivalent to an Outperform rating. Netflix boasts an impressive Outperform-equivalent Smart Score of 9 out of 10.

Looking Ahead

Netflix has been a great growth story for a long time and has gained nearly 80% over the past 12 months. However, the company could still have ample room for growth ahead as it debuts its new ad server in Canada this month and then rolls it out to a larger number of markets in 2025. I’m bullish on Netflix based on the development and rollout of this valuable tool that Sarandos called the “key to unlocking value” in the ad market.