Kenishirotie/iStock via Getty Images

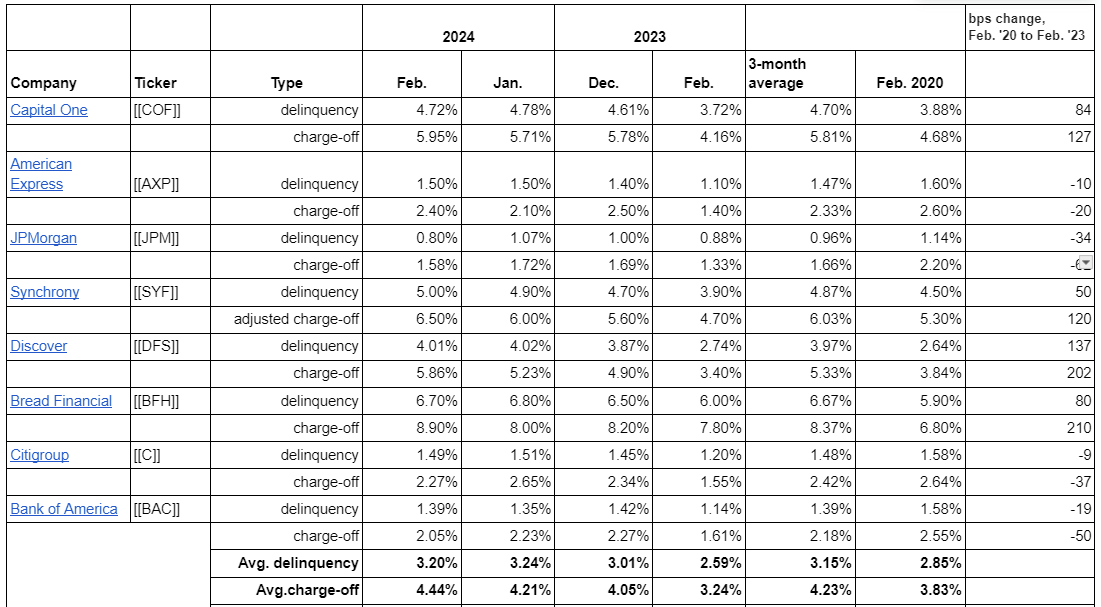

Credit card lenders experienced a slight decline in delinquency rates in February, while witnessing a continued uptick in net charge-offs. Data from eight companies compiled by Seeking Alpha revealed this pattern.

Delinquency Rates and Historical Context

The average delinquency rate of 3.20% in February showed a modest increase from 3.24% in January and a significant rise from 2.59% in February 2023.

Comparing to the period before the pandemic’s economic fallout, the current average figure has shown a notable increase from the 2.85% level observed in February 2020. Noteworthy is that delinquency rates at American Express (NYSE: AXP), JPMorgan Chase (NYSE: JPM), Citigroup (NYSE: C), and Bank of America (NYSE: BAC) remained below their pre-pandemic levels from February 2020.

Net Charge-Offs and Analysis

Meanwhile, the average net charge-off rate of 4.44% witnessed an increase from 4.21% in January and 3.24% in February 2023. This rise is notably higher compared to the 3.83% recorded in February 2020 before the pandemic took its toll on the economy.

Industry analyst John Hecht of Jefferies highlighted that the usual seasonal drop in February credit card delinquencies was weaker than expected, with net charge-offs rising higher than anticipated.

“The year-over-year percentage change in delinquencies improved by 9 basis points compared to the prior month, a crucial trend requiring sustained momentum over the upcoming months to materialize the peak net charge-off cycle in the latter half of 2024 – a key consideration for many stakeholders currently,” noted John Hecht in a communication to clients.

Loan Balances and Future Projections

Loan balances for the companies covered by Hecht decreased by 1.4% month-over-month to reach $480 billion. This decline aligns with historical trends for February and reflects a 10% year-over-year increase.

Commenting on this trend, Hecht mentioned, “Issuers have tightened credit standards in response to the current economic climate, and they should anticipate much slower loan growth in 2024.”

Furthermore, the payment rates observed during the month suggest a slower loan growth trajectory in the future.

“Payment rates serve as an early indicator of loan growth, and hence, we will closely track this metric. We anticipate that prepayment rates will remain high in 2024, resulting in decelerated loan growth,” added Hecht.

Further Exploration of Industry Trends