CrowdStrike Holdings (CRWD), the cybersecurity solutions company, has shown resilience in its recent financial results, bouncing back from an initial dip post the first quarter FY 2025 earnings release. Despite the temporary setback, CRWD stock closed at $349.12 on June 7, indicating strong potential for growth according to its high free cash flow (FCF) margins.

Robust Revenue and FCF Projections

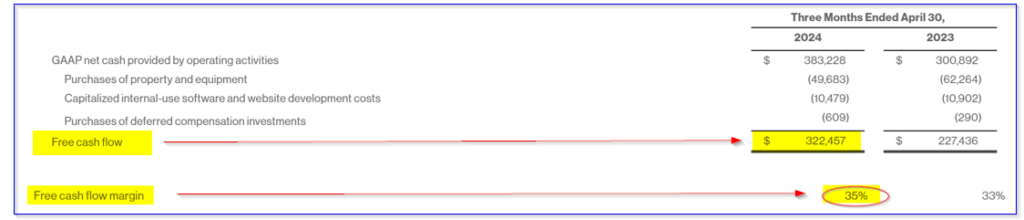

Management at CrowdStrike is optimistic about the company’s future, with a 33% increase in revenue year over year during the last quarter, along with revised revenue guidance for the fiscal year ending January 31, 2025. Impressively, the company achieved its highest FCF of $322.5 million during the quarter, marking a significant 41.8% YoY increase.

The FCF margin saw an uptick to 35%, signifying a promising trend toward enhanced profitability and operational efficiency for CrowdStrike.

Analysts project a substantial rise in sales for the upcoming year, estimating a revenue increase to $5.06 billion compared to the current $4 billion. With a predicted FCF margin of 33.5% to 35%, CRWD’s FCF may surge to a staggering $1.5075 billion to $1.575 billion, reflecting a substantial growth trajectory.

Unlocking CRWD Stock Value Through FCF

By applying a 1.5% FCF yield metric, CrowdStrike’s market capitalization could potentially soar to over $100 billion from the current $85 billion, translating to an 18.2% increase in stock value. Analysts echo this sentiment, with an average price target hovering around $395.07 to $435, indicating a bullish outlook for CRWD.

Investors can capitalize on the undervalued nature of CRWD stock by engaging in shorting out-of-the-money (OTM) put options. This strategy not only generates income through elevated put option premiums but also provides an opportunity to buy into the stock at a reduced price if the put option is exercised.

Shorting OTM Puts as an Investment Play

For instance, selling OTM put options on CRWD stock can yield substantial returns, with premiums offering immediate income while potentially enabling investors to buy shares at a lower price point. By strategically employing this approach, investors can enhance their portfolio’s performance and bolster their potential gains.

With CRWD stock presenting a compelling investment opportunity driven by robust FCF margins and growth prospects, investors can leverage short-put strategies to maximize returns and capitalize on the stock’s latent value.