Riding the Waves of Financial Markets

U.S. stocks found themselves in a tempest of mixed trading midweek, splashing around the Nasdaq Composite, which surged approximately 100 points on Thursday.

As the Dow dipped by 0.16% to 38,884.96, the NASDAQ rode a positive wave, rising by 0.38% to 16,008.19. The S&P 500 also caught the bullish current, edging up by 0.16% to 5,077.83.

Exploring Market Trends: Leading and Lagging Sectors

Real estate shares sailed smoothly, rising by 0.6% on Thursday. However, in this vast sea of trading, health care shares encountered some rough waters, falling by 0.5%.

The Highlight Reel: Best Buy Co., Inc. Shines Bright

Best Buy Co., Inc. BBY displayed its prowess by surpassing fourth-quarter earnings expectations with an adjusted EPS of $2.72, beating estimates of $2.51. Quarterly sales of $14.646 billion also outpaced analyst projections of $14.533 billion.

Additionally, the company announced a 2% increase in the regular quarterly dividend to $0.94 per share. Looking ahead, Best Buy envisions adjusted earnings per share of $5.75-$6.20 for FY25, contrasting the estimated $6.13 figure. Revenue expectations for the same period range from $41.3 billion to $42.6 billion, slightly below the $42.37 billion estimate.

Market Powerhouses: Equities Trading UP

Societal CDMO, Inc. SCTL saw a stellar surge of 132% to $1.0650, following its acquisition by CoreRx Inc. Meanwhile, Enveric Biosciences, Inc. ENVB climbed 155% to $2.12 after signing non-binding term sheets for out-licensing compounds. Vertex, Inc. VERX joined the winners, gaining 32% to $33.46 after an impressive fourth-quarter performance and strong FY24 guidance.

In the Depths: Equities Trading DOWN

LivePerson, Inc. LPSN faced a 40% decline, landing at $1.4450 following fourth-quarter results. Endava plc DAVA also hit a bump, dropping 39% to $38.99 post second-quarter earnings. Kineta, Inc. KA experienced a 44% decline to $1.29 as strategic alternatives were explored.

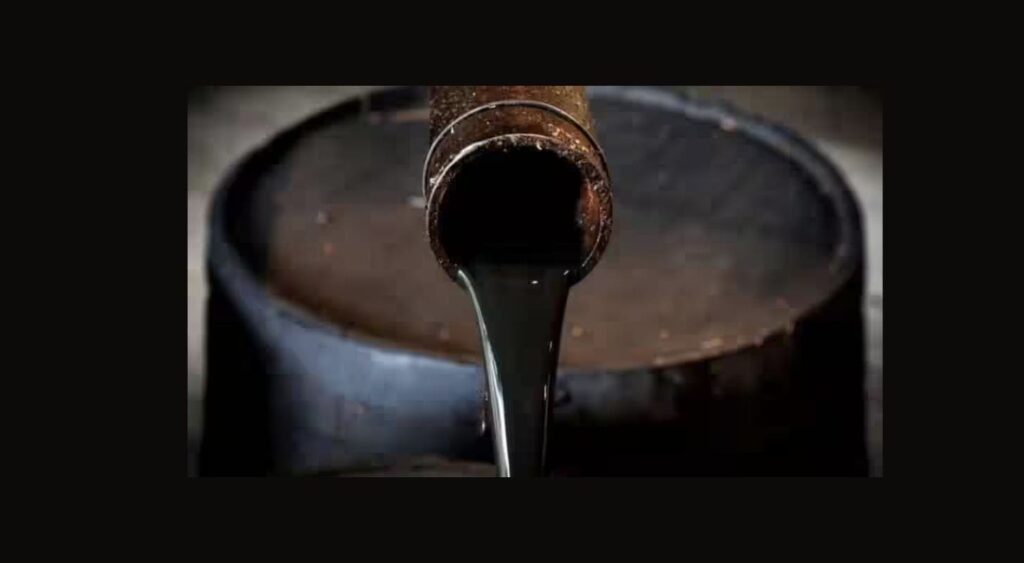

Exploring the Depths: Commodities Scene

In the realm of commodities, crude oil surged by 0.9% to $79.26, while gold shone brightly, trading up by 0.5% at $2,053.80. Silver followed suit, rising by 0.8% to $22.82, while copper made a 0.3% climb to $3.8510.

Charting the Course in the Eurozone

Across the European landscape, markets painted a mixed picture today. The STOXX 600 in the eurozone nudged up by 0.01%, London’s FTSE 100 rose by 0.07%, and Spain’s IBEX 35 Index took a tumble of 0.67%. The German DAX lifted by 0.44%, yet the French CAC 40 experienced a 0.34% fall, and Italy’s FTSE MIB Index sagged by 0.11%.

In Germany, the jobless rate anchored at 5.9% in February. Retail sales took a slight dip of 0.4% on a monthly basis in January. Meanwhile, in Spain, the annual consumer price inflation dipped to a low of 2.8% in February.

The French economy carved out a path of growth, expanding by 0.1% in the fourth quarter, although the annual inflation rate eased to 2.9% in February. Producer prices took a hit, dropping 1.3% on a monthly basis in January.

Setting Sail in Asia Pacific Markets

Asian markets navigated choppy waters on Thursday. Japan’s Nikkei 225 saw a descent of 0.11%, Hong Kong’s Hang Seng Index dipped by 0.15%, China’s Shanghai Composite Index charted a growth of 1.94%, and India’s S&P BSE Sensex trekked up by 0.27%.

In India, the fiscal deficit narrowed to INR 11.03 trillion in April-January from INR 11.91 trillion in the corresponding period of the previous year. Japanese housing starts took a dive by 7.5% year-over-year in January, following a 4.0% decline in the prior month. Retail sales in Japan saw a 2.3% climb year-over-year in January.

Insight into Economic Currents

The annual PCE inflation rate had a slight easing, ticking down from 2.6% in December 2023 to 2.4% in January 2024. Excluding the volatile energy and food sectors, the core PCE index saw a year-on-year uptick of 2.8%, aligning with the expected decrease to 2.8% from the 2.9% rate noted in December.

Personal spending nudged up by 0.2% from the previous month, while personal income enjoyed a 1% rise. Initial jobless claims in the U.S. climbed by 13,000 to 215,000 in the week ending Feb. 24. The Chicago PMI retreated to 44 in February from 46 in the previous month, while pending home sales in the U.S. took a 4.9% dip from the prior month in January.

U.S. natural gas supplies saw a drain of 96 billion cubic feet in the week ended Feb. 23, 2024.