In a bold move, Disney (DIS) is set to clamp down on password sharing for its streaming service. The company will initiate stringent measures to tackle this issue starting in June in select countries, with broader enforcement slated for September. This strategic decision forms part of Disney’s drive to bolster subscriptions and enhance revenue streams.

Following the path blazed by Netflix (NFLX), which observed a surge in signups post its crackdown on password sharing in May 2023, Disney’s move aligns with industry trends. Last month, Warner Bros. Discovery (WBD) announced a similar stance against password sharing on its Max streaming service, echoing competitive moves by rivals such as Netflix and Hulu, also owned by Disney.

The recent limitation on password sharing implemented by Hulu is poised to fuel subscriber growth on the platform. The first quarter of 2023 saw Hulu conclude with 49.7 million paid subscribers, marking an increase from the previous quarter’s 48.5 million.

This move is forecasted to catalyze subscriber expansion for Disney’s streaming services in the forthcoming quarters. Analysts project a surge in fiscal 2024 paid Disney+ subscribers, with estimates pegged at 157.13 million, showcasing a 4.61% year-over-year growth. Furthermore, earnings are anticipated to climb to $4.62 per share, reflecting a robust 22.87% year-over-year growth.

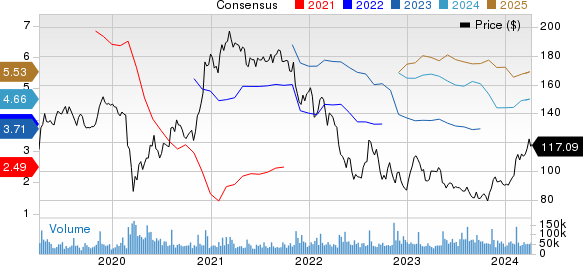

The Walt Disney Company Price and Consensus

Zacks predicts a positive trajectory for The Walt Disney Company, offering insights into the company’s price outlook and consensus estimates.

Disney+ Content Lineup Drives Growth Trajectory

Disney+ has curated an enticing array of shows in its lineup, poised to captivate audiences and boost platform engagement. Notable titles like Doctor Who, The Acolyte, and Ironheart are anticipated to usher in fierce competition against industry stalwarts like Warner Bros. Discovery, Netflix, and Amazon Prime.

Disney’s stock, ranked at #3 (Hold) on Zacks, has surged by 29.7% year-to-date, eclipsing the modest 3.9% growth in the Consumer Discretionary sector. This performance surge is largely attributed to the introduction of advertisements on its platform, set to sustain momentum with a content-rich lineup in the approaching quarters.

The collaboration between Disney Branded Television and BBC has birthed a new season of Doctor Who, premiering on May 10 on Disney+. Encompassing the Fifteenth Doctor’s escapades and Ruby Sunday’s exploits across time and space, the season promises gripping narratives amid battles and alliances.

The Acolyte, an upcoming sci-fi series on Disney+ by Leslye Headland, unfolds in the Star Wars universe during the High Republic era. Depicting Jedi investigators unraveling a chain of crimes preceding the main films, the series is slated for release on June 4.

Furthermore, Ironheart, a mini-series by Chinaka Hodge on Disney+, draws inspiration from the Marvel Comics realm, harmonizing within the Marvel Cinematic Universe. Boasting collaborations with Marvel Studios and Proximity Media, Hodge will spearhead the series as a head writer.

With Netflix dominating the streaming domain through its expansive original content library, the platform is poised to release a slew of new titles like SCOOP, City Hunter, and What Jennifer Did, fortifying its stronghold and allure to subscribers.

Not to be outdone, Warner Bros. Discovery unveiled a lineup of blockbuster entertainment to rival Disney. Upcoming releases like Venom 3 and Red One are poised to attract massive audiences, contributing significantly to revenue streams.

Meanwhile, Amazon Prime continues to assert its dominance, gearing up to introduce compelling projects like Música, Fallout, and How to Date Billy Walsh, expected to resonate with viewers and fortify its position in the streaming market.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook, highlights 5 meticulously selected stocks showcasing exponential growth potential in the Artificial Intelligence domain. By 2030, the AI industry is forecasted to yield an economic impact akin to the internet and iPhone, estimated at $15.7 Trillion.

Today, investors can ride the wave of the future, embracing automation that elucidates queries, rectifies errors, challenges fallacies, and dismisses inappropriate requests. In the words of one of the chosen companies, “Automation liberates individuals from the mundane, enabling them to achieve the extraordinary.”