The Walt Disney Company DIS is set to report its first-quarter fiscal 2024 results on Feb 7.

The Zacks Consensus Estimate for earnings has decreased by 4% to 97 cents per share over the past 30 days, indicating a decline of 2.02% year over year.

The consensus mark for revenues is projected at $23.47 billion, signifying a decline of 0.16% from the year-ago quarter’s reported figure.

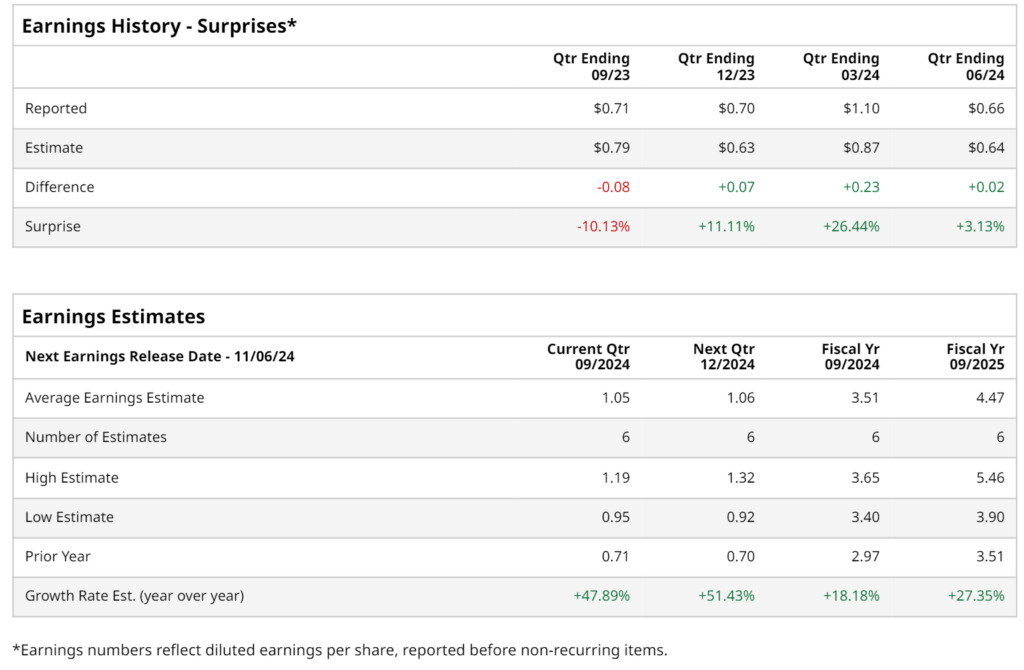

Disney’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 18.6%.

Now, let’s delve into the factors at play.

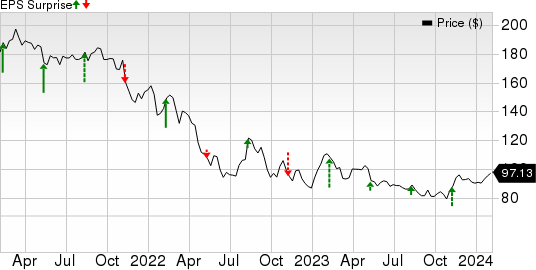

The Walt Disney Company Price and EPS Surprise

The Walt Disney Company price-eps-surprise | The Walt Disney Company Quote

Factors to Consider

Disney’s first-quarter fiscal 2024 results are expected to reflect sluggish Disney+ subscriber growth. By the end of September 2023, Disney+ had 150 million paid subscribers, compared with 146.7 million as of July 1, 2023.

Intense competition from Amazon Prime Video, Netflix NFLX, Apple AAPL, Comcast CMCSA-owned Peacock, and HBO Max is anticipated to have impacted Disney+’s growth rate in the to-be-reported quarter.

The Zacks Consensus Estimate for Disney+ paid subscribers is placed at 148 million, indicating an 8.6% year-over-year and 1.3% sequential decline.

As of the fourth quarter, Netflix had 260.28 million paid subscribers globally, swelling by 12.8% year over year. Peacock’s paid subscribers surged by almost 50% year over year to 31 million, including three million net additions in the fourth quarter.

According to Kantar data, Apple TV+ overtook Disney+ in new SVOD subscriptions during the fourth quarter of 2023, claiming an impressive 18% share, followed by Amazon Prime Video (16%) and Disney+ (14%).

Moreover, Disney is anticipated to have suffered from reduced advertising revenues in the to-be-reported quarter. In fiscal 2023, revenues declined by 15% from the year-ago period, primarily due to decreased impressions, mainly attributed to declines at Hulu and Disney+.

The Zacks Consensus Estimate for Media and Entertainment Distribution revenues is slated at $10.26 billion, indicating a 30.6% year-over-year decline.

Disney is benefiting from a robust resurgence in the domestic and international theme park businesses. Recent attractions like the Frozen theme land at Hong Kong Disneyland and Walt Disney Park in Paris, as well as the Zootopia theme land at Shanghai Disney, are expected to have bolstered the prospects of this Zacks Rank #3 (Hold) company’s theme park business in the to-be-reported quarter. Moreover, the Zacks Consensus Estimate for Parks, Experiences & Consumer Products revenues is placed at $8.93 billion, illustrating a 2.3% year-over-year growth.

Keep yourself updated on upcoming earnings announcements with the Zacks Earnings Calendar.