Some days, even the mighty Disney finds itself on the sharp end of the stick. Recent revelations indicate that the media giant is gearing up for layoffs within its television arm, a move that has sent shockwaves through the company. On the flip side, as if dancing to a discordant tune, reports also herald an upsurge in advertising commitments. The juxtaposition of these developments has left investors more than a little jittery, with Disney shares spiraling down by over 4% in the waning moments of Friday’s trading session.

The axe has fallen on 140 workers in Disney’s television division, a relatively modest cull that accounts for just 2% of the overall workforce. Though no departments faced the guillotine directly, the swath of cuts, particularly hitting National Geographic, local stations, and marketing and publicity sectors, spells tough times ahead for those affected.

Among the casualties, National Geographic bears the brunt, facing a workforce reduction of 13%, with 60 positions lost out of the 140. This move stands in alignment with earlier decisions spearheaded by Iger to rein in expenses on traditional pay-TV ventures due to ballooning investments in streaming services.

The More, The Merrier?

Oddly enough, in a twist that may leave the axed employees seeing crimson, reports disclose that Disney is basking in increased attention from advertisers. The company flaunts a 5% surge in “upfront” ad sales, where advertising spots are pre-sold. While mum’s still the word on precise dollar figures, the news that Disney bagged significant pre-sale ad space can only be music to their ears.

This rings particularly sweet for Disney at a time when the battle for advertising eyeballs is intensifying. Wading through a sea of competitors like Amazon, Netflix, and a spate of ad-supported TV platforms, Disney’s brand value still carries heft with advertisers.

Market Analysis: Buy, Sell, or Hold?

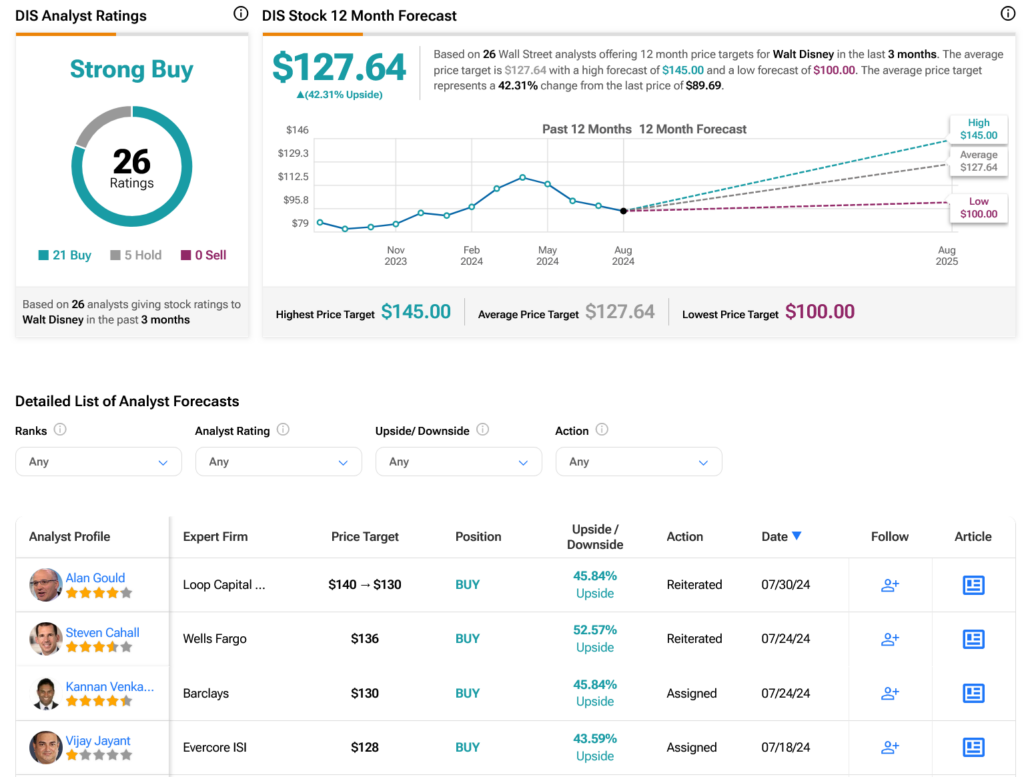

Peer into Wall Street’s crystal ball, and 21 Buy ratings, along with five Holds shower Disney’s stock with a gleaming Strong Buy consensus. Sporting a 5.13% climb in share price over the previous year, the average price target stands at $127.64 per share, suggesting a tantalizing 42.31% upside potential.

Explore more DIS analyst ratings here