The Walt Disney Company DIS is slated to report fourth-quarter fiscal 2024 results on Nov. 14.

The Zacks Consensus Estimate for revenues is pegged at $22.59 billion, suggesting modest growth of 6.37% from the year-ago quarter’s reported figure.

The consensus mark for earnings has moved south by a penny to $1.09 per share over the past 30 days, indicating growth of 32.93% year over year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

In the last reported quarter, Disney delivered an earnings surprise of 15.83%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 18.01%.

The Walt Disney Company Price and EPS Surprise

The Walt Disney Company price-eps-surprise | The Walt Disney Company Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Disney this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

DIS has an Earnings ESP of -1.63% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Shaping Upcoming Results

As the media landscape shifts from traditional linear TV to streaming, Disney finds itself in an enviable position. With two robust U.S. streaming services, Disney+ and Hulu, complemented by ESPN+, the entertainment giant is well-equipped to navigate this transition seamlessly.

One of Disney’s key advantages is its bundling strategy, which combines these streaming services into a compelling package. This approach is not only expected to have boosted average revenue per account in the to-be-reported quarter but is also likely to have helped reduce customer churn.

In the fiscal fourth quarter, Disney expects Disney+ Core subscribers to grow modestly. The company remains optimistic projecting profitability of the combined streaming businesses to improve in the fourth quarter of fiscal 2024, with both Entertainment DTC and ESPN+ expected to be profitable in the quarter.

However, DIS is likely to have suffered from a persistent decline in Linear TV revenues, which is expected to have negatively impacted Media and Entertainment Distribution revenues in the to-be-reported quarter.

Our model estimates for Entertainment revenues (which include Linear Networks, Direct-to-Consumer and Content Sales/Licensing and Other Revenue) are pegged at $9.44 billion, indicating a decrease of 0.8% year over year.

DIS’ true strength lies in its unparalleled portfolio of Intellectual Property (IP). From the iconic Marvel and Star Wars franchises to the beloved Disney princesses, Mickey Mouse and Pixar’s timeless classics, the company owns the most powerful collection of IPs in the media industry. This wealth of IP is a significant asset, as it gives audiences an immediate connection to the content, reducing the risk associated with content investments.

The company’s extensive library of IP not only fuels its studio operations but also underpins its entire business ecosystem, including streaming, linear networks and the profitable Parks, Experiences & Consumer Products segment.

In the Experiences segment, DIS expects that the demand moderation it saw in domestic businesses in the fiscal third quarter could impact the next few quarters. While the company is actively monitoring attendance and guest spending and aggressively managing the cost base, Disney expects the Experiences segment’s operating income to decline by mid-single digits compared with the prior year, reflecting these underlying dynamics as well as impacts at Disneyland Paris from a reduction in normal consumer travel due to the Olympics and some cyclical softening in China.

As we discuss the quarter under review, investors should pay close attention to key metrics, such as park attendance, per-capita spending and any announcements regarding expansion plans, particularly in international markets. The performance of this segment might have provided a strong foundation for Disney’s overall growth trajectory.

Our model estimate for the Experiences segment (renamed from Disney Parks, Experiences and Products) revenues is $9.13 billion, indicating 12% growth year over year.

Despite experiencing strong demand at Disney Cruise Line in the quarter under review, results in the fiscal fourth quarter are likely to reflect pre-launch expenses for Disney Adventure and Disney Treasure.

Price Performance & Valuation

Shares of DIS have returned 11.7% year to date compared with the broader Zacks Consumer Discretionary sector’s growth of 10%. Disney operates in a fiercely competitive streaming market dominated by the likes of Amazon AMZN-owned Amazon Prime Video and Netflix NFLX, as well as the growing prominence of services from Apple, Comcast CMCSA-owned Peacock and HBO Max.

Year-to-Date Performance

Image Source: Zacks Investment Research

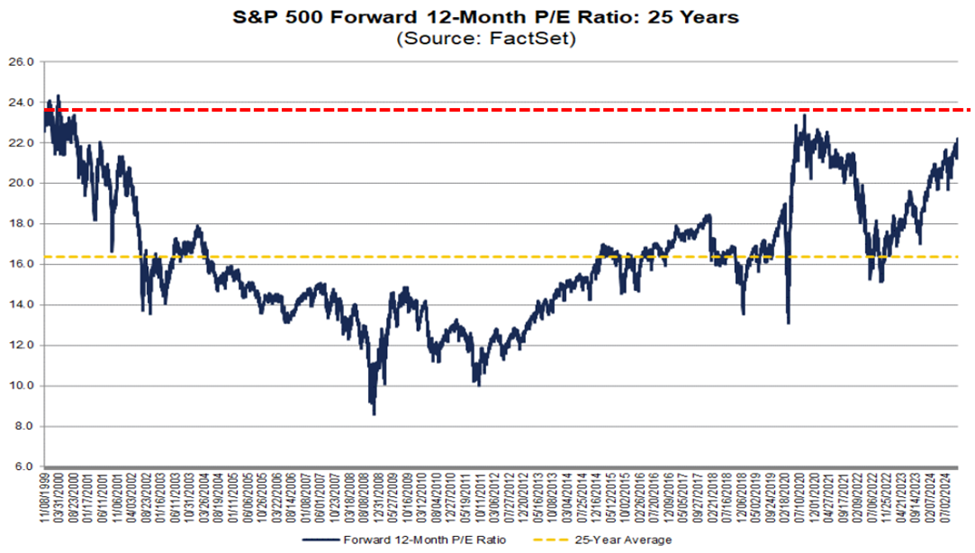

Valuation-wise, Disney is trading at a premium with a forward 12-month P/E of 19.53X compared with the Zacks Media Conglomerates industry’s 19.11X, reflecting a stretched valuation. The company’s debt balance of $47.5 billion compares unfavorably with cash, cash equivalents and its current marketable investment securities balance of $5.95 billion.

DIS’s P/E F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investment Considerations: Balancing Risk and Reward

Disney remains a prominent name in the investment world, long revered as a blue-chip stock and a staple in many portfolios. DIS’ strength lies in its globally recognized brand and diverse intellectual properties spanning movies, TV shows, theme parks and merchandise. This diverse portfolio has historically given Disney a unique edge in captivating audiences worldwide and generating consistent revenue streams. However, recent years have brought significant challenges, including disruptions in traditional media, pandemic impacts on theme parks and evolving consumer behaviors. These headwinds have prompted investors to reevaluate Disney’s appeal, questioning whether the Magic Kingdom can maintain its former allure in an increasingly competitive and rapidly changing entertainment landscape.

Final Thought

Disney remains a diversified media and entertainment powerhouse with a strong brand and valuable intellectual property. Its theme parks and resorts continue to be a significant revenue driver, and the potential for growth in emerging markets of Asia remains promising. However, the accelerating trend of cord-cutting continues to put pressure on this segment, potentially offsetting gains in other areas.

For those considering how to play Disney stock in the fourth quarter of fiscal 2024, a nuanced approach may be warranted. Investors with a shorter investment horizon may want to exercise caution and wait for a better entry point, given the uncertainties surrounding the company’s growth prospects and the competitive pressure it faces despite the enduring power of the Disney brand.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report